Curve DAO Token (CRV) has experienced a 10% increase in the past 24 hours following a reduction in its inflation rate to 6.35% on Monday.

This adjustment has spurred renewed investor interest, positioning CRV for a potential continued rally.

Curve Spikes as DAO Reduces Token Supply

A lower inflation rate typically means fewer new CRV tokens will enter the market. This reduction in supply is expected to positively affect the token’s price, which has dropped more than 95% since its launch. When supply decreases and demand increases, it often drives an asset’s price higher.

The buzz surrounding Monday’s reduction in CRV’s inflation rate has sparked a surge in trading activity. In the past 24 hours, the token’s daily trading volume has risen by 103%. At $244 million at press time, CRV’s daily trading volume currently sits at a two-month high.

The uptick in CRV’s trading volume in the past 24 hours indicates that its double-digit price hike during the same period is backed by a strong market interest in the DeFi token.

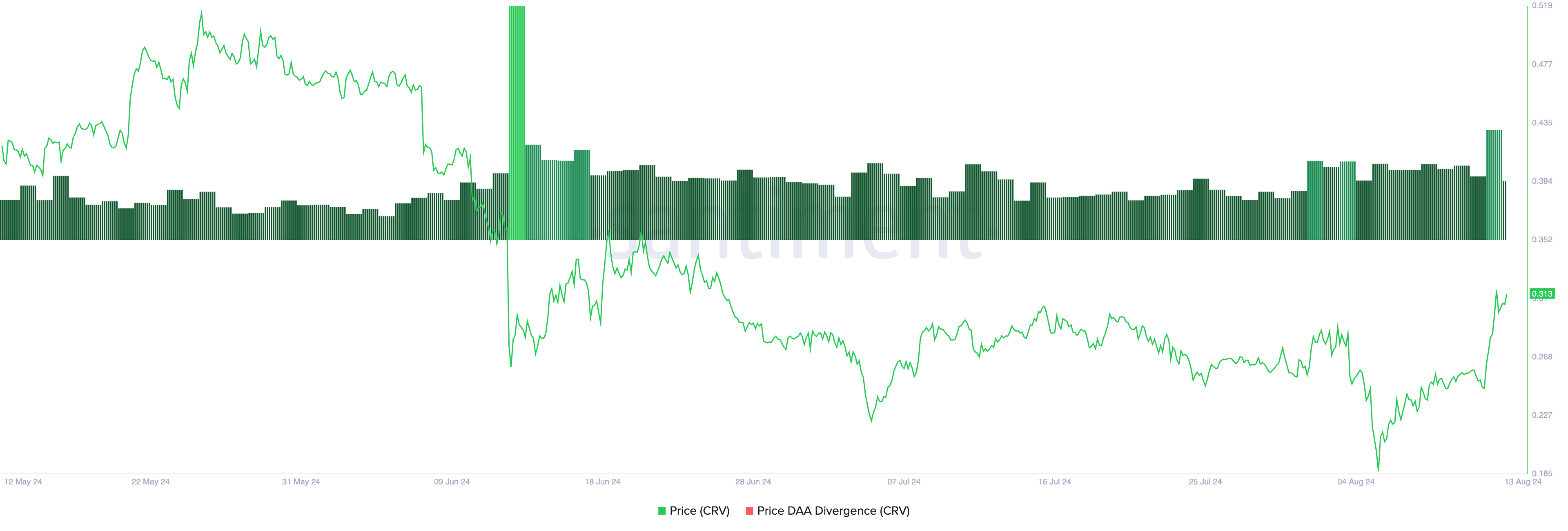

Further, CRV’s positive price daily active Address (DAA) divergence at press time hints at the possibility of a sustained rally as the demand for the altcoin continues to increase.

Read more: DeFi Community Building: A Step-by-Step Guide

This metric compares an asset’s price movements with the changes in its number of daily active addresses. Investors use it to track whether the price movements are supported by corresponding network activity.

When an asset’s price DAA divergence is positive during a rally, it is a bullish signal indicating that the price surge is supported by a demand enough to sustain the uptrend. As of this writing, CRV’s price DAA divergence is 58.11%.

CRV Price Prediction: Pay Attention to the “Cloud“

At its current value, CRV lies above the Leading Span A of its Ichimoku Cloud when assessed on a one-day chart. This suggests that the market is in a bullish phase. As of this writing, the token is making its way toward the Leading Span B.

Leading Span A and Leading Span B are key components of the Ichimoku Cloud, an indicator that identifies trends, support, and resistance levels, as well as potential market reversals. While it rests above the Leading Span A, CRV’s break above the Leading Span B will signal a continuation of the bullish trend.

If this happens, the token’s price will touch $0.34 and may even rally above it to trade at $0.44.

Read more: Top 11 DeFi Protocols To Keep an Eye on in 2024

However, if market sentiment shifts from bullish to bearish, it will cause a price drop below the Ichimoku Cloud. CRV will exchange hands at $0.18 if this happens.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/crv-climbs-as-inflation-rate-drops/

2024-08-13 15:00:00