Uniswap (UNI) trading volume has increased by 150% within the last 24 hours, surpassing $400 million for the first time in almost 10 days. This development happened after the South Korean exchange Upbit listed new trading pairs for the altcoin.

In addition to the volume, UNI’s price also reacted to the development and rose above $8. Here is how it all happened and what could be next for the token.

Uniswap Sees Massive Growth in Volume and Network Activity

Upbit had previously listed Uniswap (UNI) with only a Bitcoin (BTC) trading pair on the spot market. However, earlier today, the exchange revealed that UNI has been added with additional trading pairs, including the Korean Won (KRW) and the USDT stablecoin.

Before this announcement, Uniswap’s trading volume was under $200 million, and its price hovered around $7.40. After the news broke, the price surged to $8.33, and the trading volume skyrocketed to $470 million.

This sharp rise highlights the growing interest in UNI from the Asian market, though it might not be entirely unexpected. Similar Upbit listings have triggered comparable reactions in the past. For example, MEW hit a new high after its listing, while Injective (INJ) climbed 10% following its own Upbit listing just last week.

Read more: How to Buy Uniswap (UNI) and Everything You Need To Know

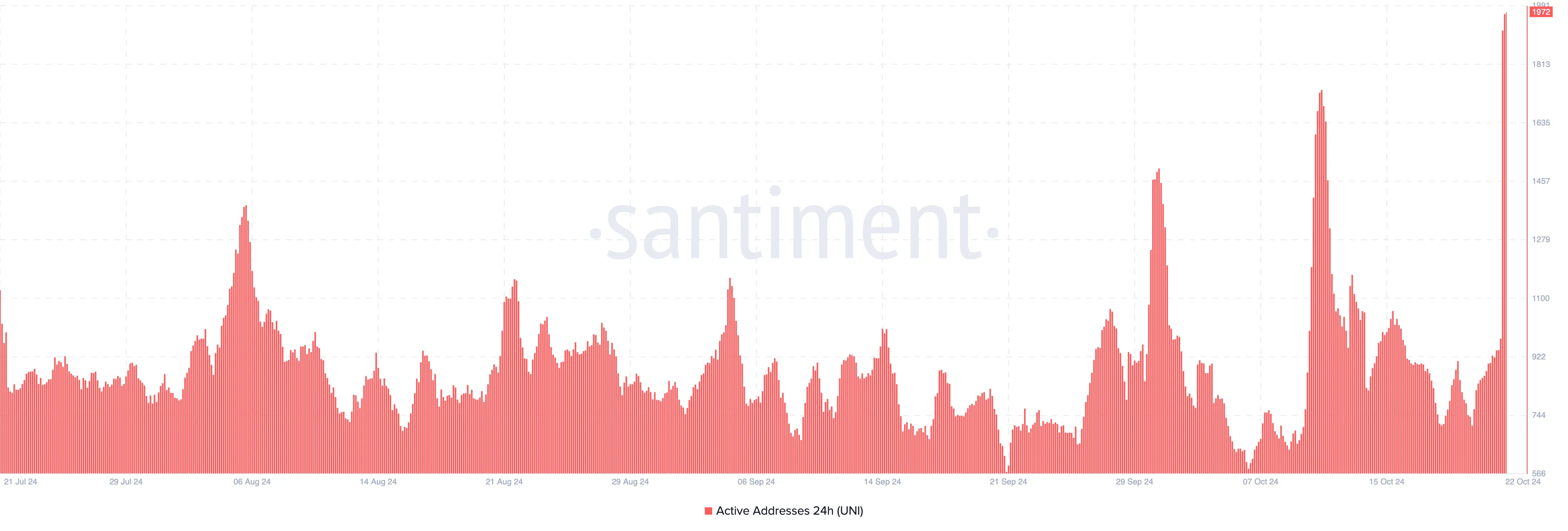

Along with the surge in volume, the number of active addresses on the Uniswap protocol also climbed. Active addresses measure the number of users completing successful transactions on the blockchain. An increase in this metric signals growing user engagement, which can potentially drive prices higher.

Conversely, a drop in active addresses indicates low user interaction, which, if sustained, might lead to a notable price decline. Given the current uptick in network activity, there is a possibility that UNI’s price could continue to rise if this trend holds.

UNI Price Prediction: Token Aims Higher

Based on the daily chart, UNI’s surge above $8 ensured that it broke out of a descending triangle. For context, a descending triangle appears when a cryptocurrency’s price hits lower highs, helping to form the falling trendline with horizontal support.

When it drops below the support, the price might continue to fall. But since UNI’s price broke out of the pattern, it suggests that the altcoin could go higher. Should the token remain above the technical pattern, then the price could rise to $9.04. In a highly bearish case, it could rally toward $11.51.

Read more: Uniswap (UNI) Price Prediction 2023/2025/2030

However, if Uniswap’s trading volume drops, this prediction might be invalidated. In that scenario, the altcoin’s value might sink to $5.62.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/uniswap-trading-volume-soars/

2024-10-22 17:00:00