Bitcoin’s price has been in an upward trend for most of the past two months, maintaining strong support levels amid market volatility.

As the United States elections approach, many analysts believe the results could significantly affect Bitcoin’s price, particularly as it may prompt large holders, or “whales,” to react based on investor sentiment.

Bitcoin Whales Hold the Key

The actions of Bitcoin whales are expected to be a key factor in determining the asset’s price trajectory in the coming weeks. According to data from Santiment, major Bitcoin holders are showing signs of waiting to see how the market reacts to the US election results.

“…crypto traders are ‘expecting the unexpected’. This is particularly true with Bitcoin’s whales, which have been showing declining amounts of transfers since last week’s sudden spike near the top. Look for these spikes in whale BTC transactions as generally reliable signs of potential price reversals for all of cryptocurrency,” Santiment stated.

The US election outcome may either reinforce Bitcoin’s current uptrend or trigger a temporary pullback if whales sense hesitation or panic among smaller holders. These large holders could thus set the tone for Bitcoin’s price action in the short term.

Read more: What Happened at the Last Bitcoin Halving? Predictions for 2024

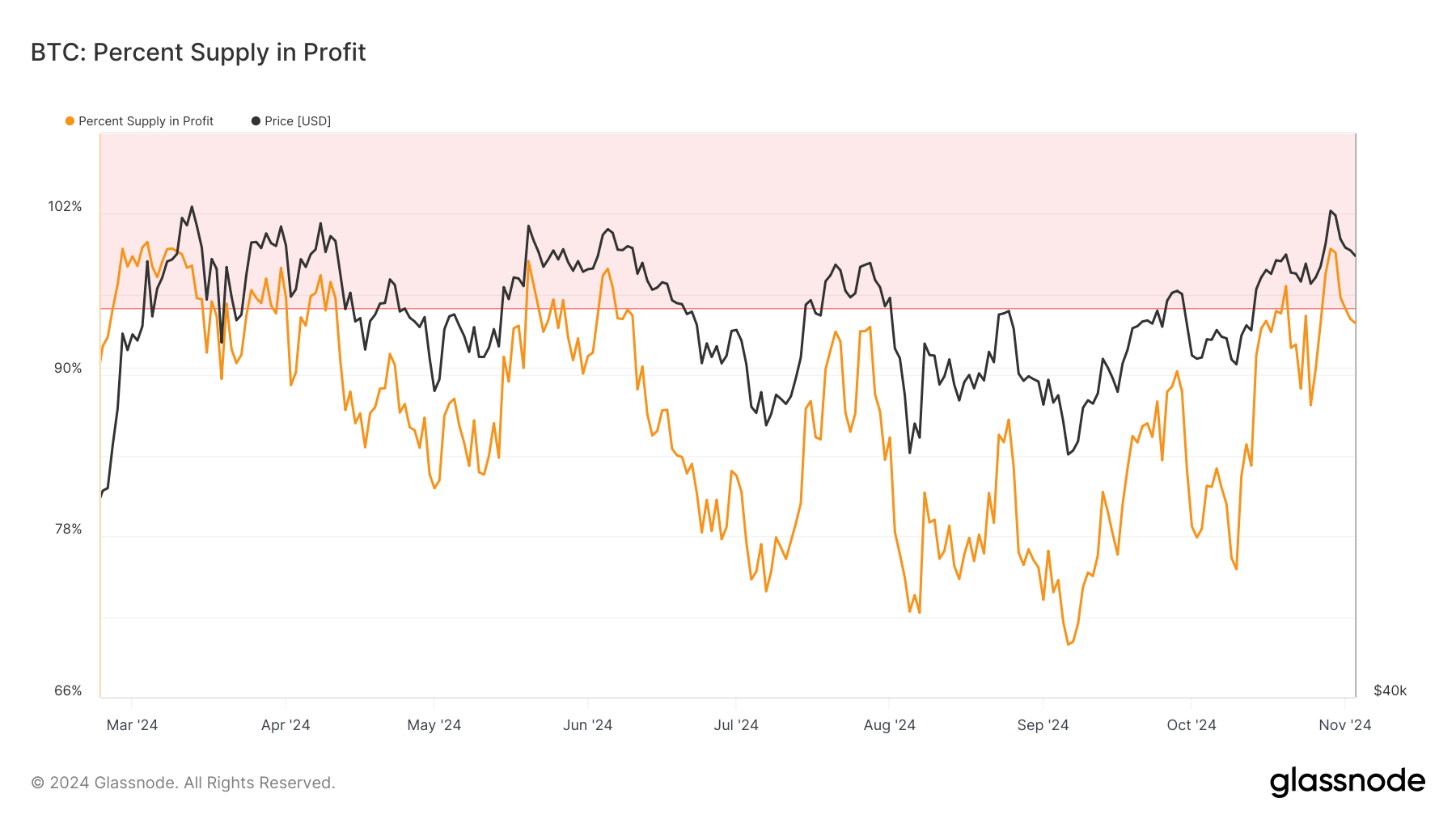

Bitcoin’s macro momentum remains promising, as the total supply of BTC in profit is below the critical 95% threshold that often signals a market top. When this level is reached, it typically marks a peak in prices and may indicate a potential price reversal. Currently, Bitcoin has room to continue its upward movement before reaching this threshold, suggesting that the asset could see further gains.

As long as Bitcoin stays below this level, it maintains space for upward movement. The ongoing demand, paired with the restrained whale activity ahead of the election results, supports this view. However, Bitcoin will need sustained buying interest and favorable macroeconomic conditions to continue this trend, making the upcoming election a critical influence on investor sentiment.

BTC Price Prediction: Keeping the Uptrend Intact

Bitcoin is trading at $68,833 after failing to breach the $71,367 barrier. The cryptocurrency needs to stay above the support level of $68,248 to attempt another move upward. Maintaining this support will be crucial for Bitcoin to retain bullish momentum.

If volatility spikes around the election and Bitcoin experiences a pullback, it could dip to $65,292. This drop would delay hopes for a new all-time high and potentially impact short-term profitability.

Read more: Bitcoin Halving History: Everything You Need To Know

On the other hand, if Bitcoin successfully flips $71,367 into support, it could set the stage for a new all-time high. Achieving this would validate the ongoing uptrend, positioning Bitcoin for its next significant rally, with investors eyeing substantial gains.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/bitcoin-price-rally-stalled-by-whales/

2024-11-04 20:00:00