On November 13, Dogwifhat (WIF) active addresses rose to 17,000. However, as of this writing, that number has dropped almost fivefold, indicating that interest in the meme coin has decreased.

This decline also coincided with WIF’s price decrease from $4.20. Here is a thorough analysis of how the decrease in active addresses could affect the meme coin’s value in the short term.

Dogwifhat Network Activity Drops

WIF’s price rallied above $4 on the same day that active addresses climbed to the highest level since March 14. This hike implies that user engagement was vital to the meme coin’s bullish performance.

As of now, daily WIF active addresses for the Solana meme coin have plummeted to 3,692, signaling a sharp decline in wallet activity compared to just a week ago. This drop suggests a waning interest in transactions involving the coin.

Historically, such a decline in active addresses has been a bearish indicator, often signaling reduced momentum and potential price weakness ahead. So, it is not surprising that WIF’s price could not hold the $4 support and is now trading at $3.27.

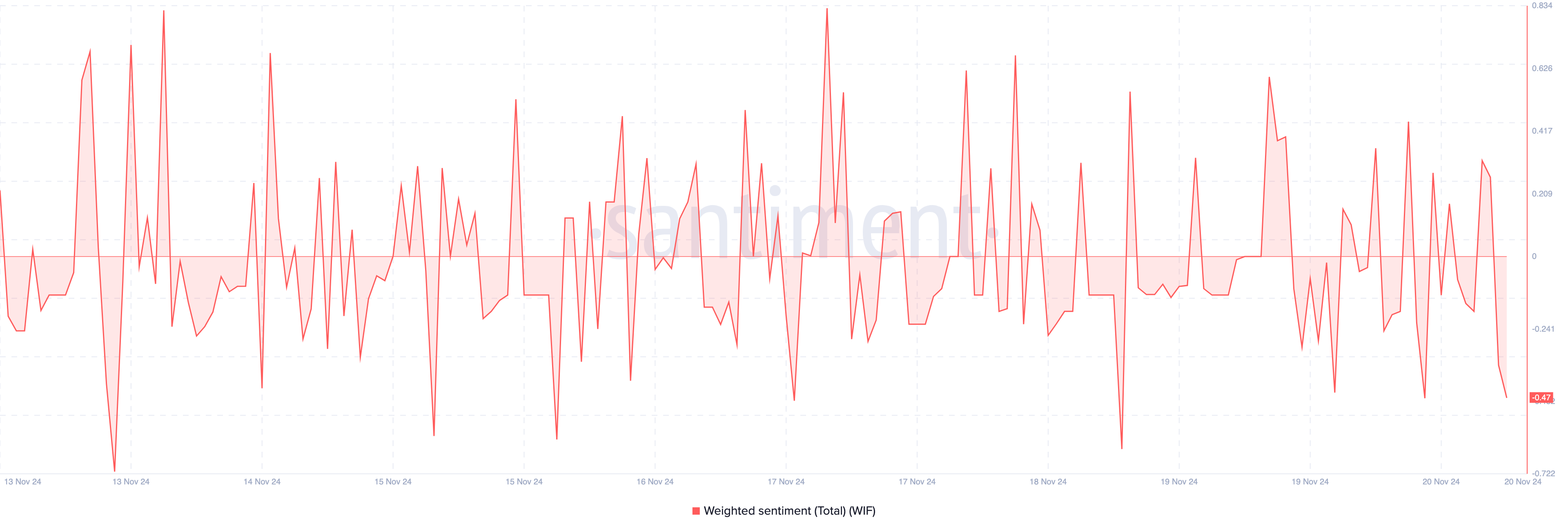

Another metric suggesting that WIF might fail to rebound to $4 quickly is the weighted sentiment. This metric measures the perception market participants have about a token.

When the reading is positive, the Weighted Sentiment implies that most comments online about a project are bullish. On the other hand, if the metric’s reading is negative, it means that the average remark about the asset is bearish.

In WIF’s case, it is the latter. If this remains the same, then the Solana meme coin’s value could drop lower than $3.27 in the short term.

WIF Price Prediction: Lower Than $3

From a technical point of view, the daily chart shows that the Awesome Oscillator (AO) has flashed red histogram bars. The AO is a technical oscillator that compares historical price movements with recent ones to measure momentum.

When the reading is positive, momentum is bullish. But when it is negative, it is bearish. In this case, the reading is positive, but since the histogram is red, it indicates that bullish momentum is fading.

Should this remain the case, WIF could decline to $2.69. On the other hand, if momentum becomes bullish again, this prediction might not come to pass. Instead, WIF could rally to $4.79.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/wif-active-addresses-decline/

2024-11-20 20:00:00