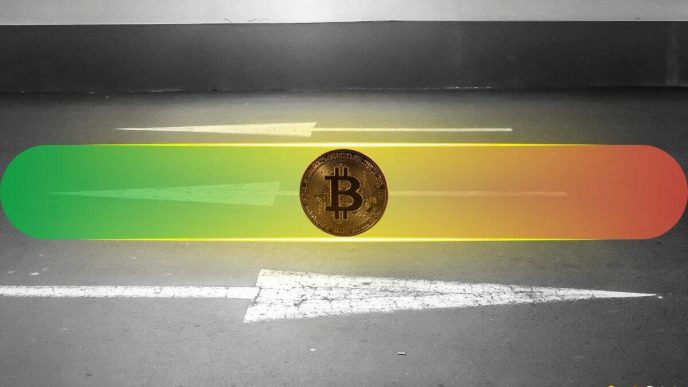

Meanwhile, crypto assets continue to decline in what has been a divergence from tech stock markets, which continue to see growth.

Last week’s economic reports painted a rosy picture of a robust economy, resilient consumer spending, and gradually cooling inflation.

This is the fuel for the Federal Reserve to ease its monetary policy, with investors looking for a rate cut this month.

Economic Events Sept. 2 to 6

This week’s economic calendar will focus on employment reports. “We expect elevated volatility and great trading conditions with a focus on August jobs data,” commented the Kobeissi Letter.

Monday is a holiday in the US but Tuesday will see August’s ISM Manufacturing PMI reports released. This data reflects business conditions in the manufacturing sector and is a measure of overall economic conditions.

Wednesday and Thursday will see Job Openings and Labor Turnover Survey (JOLTS) data, nonfarm employment data, and initial jobless claims data. These reports provide numbers on new jobs created and the percentage of people actively seeking employment in the previous month.

More job data will be released on Friday, which will provide key indicators as the central bank considers labor market changes when making decisions.

Key Events This Week:

1. Markets Closed For Labor Day – Monday

2. August ISM Manufacturing PMI data – Tuesday

3. July JOLTs Job Openings data – Wednesday

4. August ADP Nonfarm Employment data – Thursday

5. Initial Jobless Claims data – Thursday

6. August Jobs Report -…

— The Kobeissi Letter (@KobeissiLetter) September 1, 2024

Fed chair Jerome Powell stressed that the central bank doesn’t want to see further cooling in the labor market. This puts further emphasis on Friday’s payrolls data for August.

Very weak data could make a 50 basis-point rate cut more likely, and on the other hand, strong data could rule out a bigger cut. Investec economist Lottie Gosling commented:

“Even though Powell refused to comment on whether the door could be open to a 50 basis-point [rate] cut in September, we do suspect that a further clear deterioration in the labor market could steer the FOMC into more aggressive easing.”

Crypto Market Outlook

Crypto markets have weakened over the weekend with a decline of around $75 billion. They fell even further during the Monday morning Asian trading session with a 3.7% decline in total capitalization which fell to $2.11 trillion.

Bitcoin continued to fall dropping a further 2% on the day in a fall to $57,500 at the time of writing. Currently, levels are serving as support but if BTC loses this ground, it could quickly retest the next level of $56,000.

A September rate cut would be bullish for crypto in theory, so this week’s jobs data could have an immediate impact on market volatility.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER 2024 at BYDFi Exchange: Up to $2,888 welcome reward, use this link to register and open a 100 USDT-M position for free!

Source link

Martin Young

https://cryptopotato.com/how-will-crypto-markets-react-to-this-weeks-key-jobs-data/

2024-09-02 06:18:50