Layer-1 blockchain Sui (SUI) is set to unlock 64 million tokens on October 1, representing 2.40% of the total circulating supply. As the crypto community eagerly awaits the release of these tokens, SUI is experiencing heightened investor interest.

Although token unlocks usually cause high volatility and sometimes price decline, this analysis highlights why SUI’s price might not experience a massive drawdown and the rationale for predicting a much higher value after the event.

Sui Is Set to Release 64 Million Tokens, Volume Jumps

SUI’s price has increased by 115% in the last 30 days, most of it due to Grayscale’s decision to launch the SUI Trust. Besides this, the project’s Total Value Locked (TVL) has reached a new all-time high, indicating increased confidence in the altcoin’s potential.

Meanwhile, on Tuesday, October 1, the project will unlock 64.19 million tokens, valued at over $100 million. Token unlock is a process by which previously restricted coins are released into circulation.

Most times, this supply shock comes with high volatility. However, on the daily chart, the Bull Bear Power (BBP), which measures the strength of buyers and sellers, reveals that the bulls are in control.

Read more: Everything You Need to Know About the Sui Blockchain

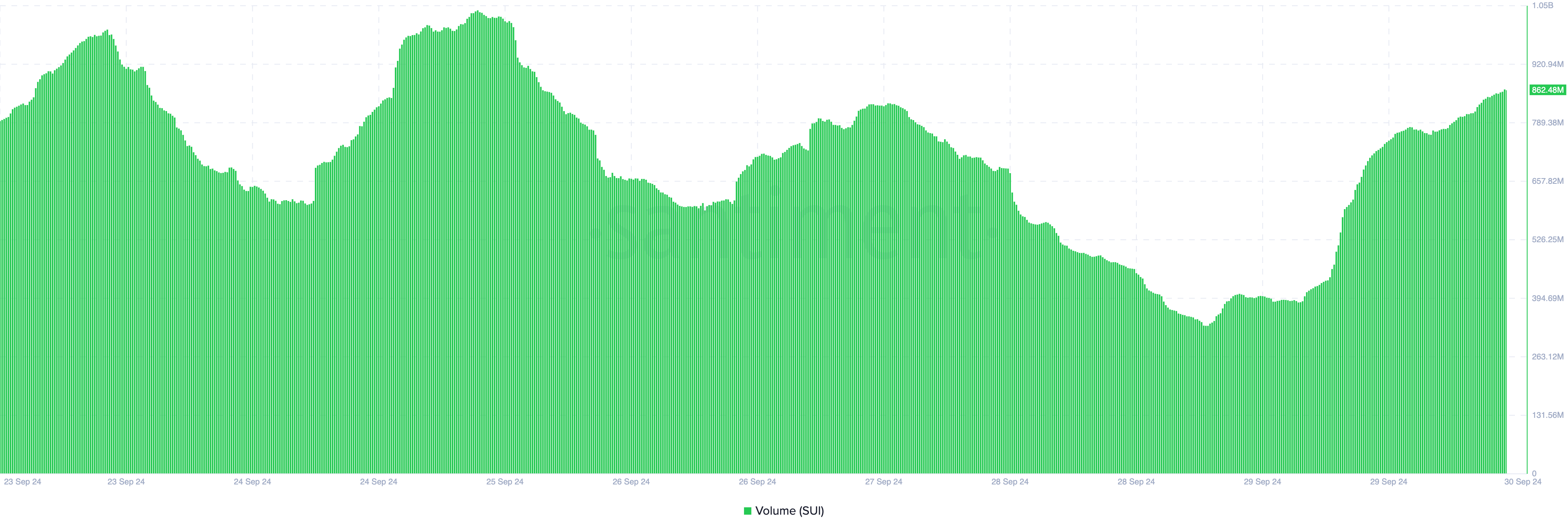

As such, buying pressure is most dominant, suggesting that SUI’s price could jump higher than $1.73. Furthermore, Sui’s volume has also increased to $862.48 million.

Generally, increasing buying volume will push a cryptocurrency’s price higher. But for that to continue, the volume must climb. However, if the volume declines as the price rises, then the uptrend might become weak, and a potential reversal could be next.

In SUI’s case, the price has increased by 5% in the last 24 hours and the volume rose by 122% within the same period. As such, the toke might experience a continued rally.

SUI Price Prediction: Bears Do Not Have a Chance

A further look at the daily SUI/USD chart shows that the altcoin continues to show remarkable strength. However, traders need to watch out for the $1.90 region, which is historically a crucial level for SUI’s price.

For example, when SUI’s price attempted to hit $2 in February, it experienced a push bask as soon as it reached $1.90. Currently, the altcoin is approaching the same zone. But with buying pressure present, it is likely to breach the region.

In addition, the 20-day Exponential Moving Average (EMA) remains above the 50 EMA. This indicates that the bullish setup is still in place, and SUI’s price can continue to appreciate.

Read more: A Guide to the 10 Best Sui (SUI) Wallets in 2024

If buying pressure helps SUI surpass the $1.90 resistance, the token may rise to $2.10. However, a wave of profit-taking could drive its value down to $1.45, invalidating the bullish prediction.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/sui-price-prediction-token-unlock/

2024-09-30 14:00:00