HYPE has been undergoing a slow recovery following a sharp correction, but broader market conditions suggest this could change soon.

While the price shows signs of improvement, a stronger uptrend will depend on increased participation and confidence from investors, which remains a crucial missing factor.

Hyperliquid Investors’ Support Is Missing

HYPE’s Moving Average Convergence Divergence (MACD) has recorded a bullish crossover for the first time in a long while. This shift in the MACD follows a slight price recovery over recent days, indicating that bullish momentum is beginning to revive and could strengthen further with market support.

The bullish crossover in the MACD is a positive indicator, signaling a potential trend reversal. If HYPE maintains its upward trajectory, the renewed momentum may attract more investors, building confidence in the cryptocurrency’s near-term performance.

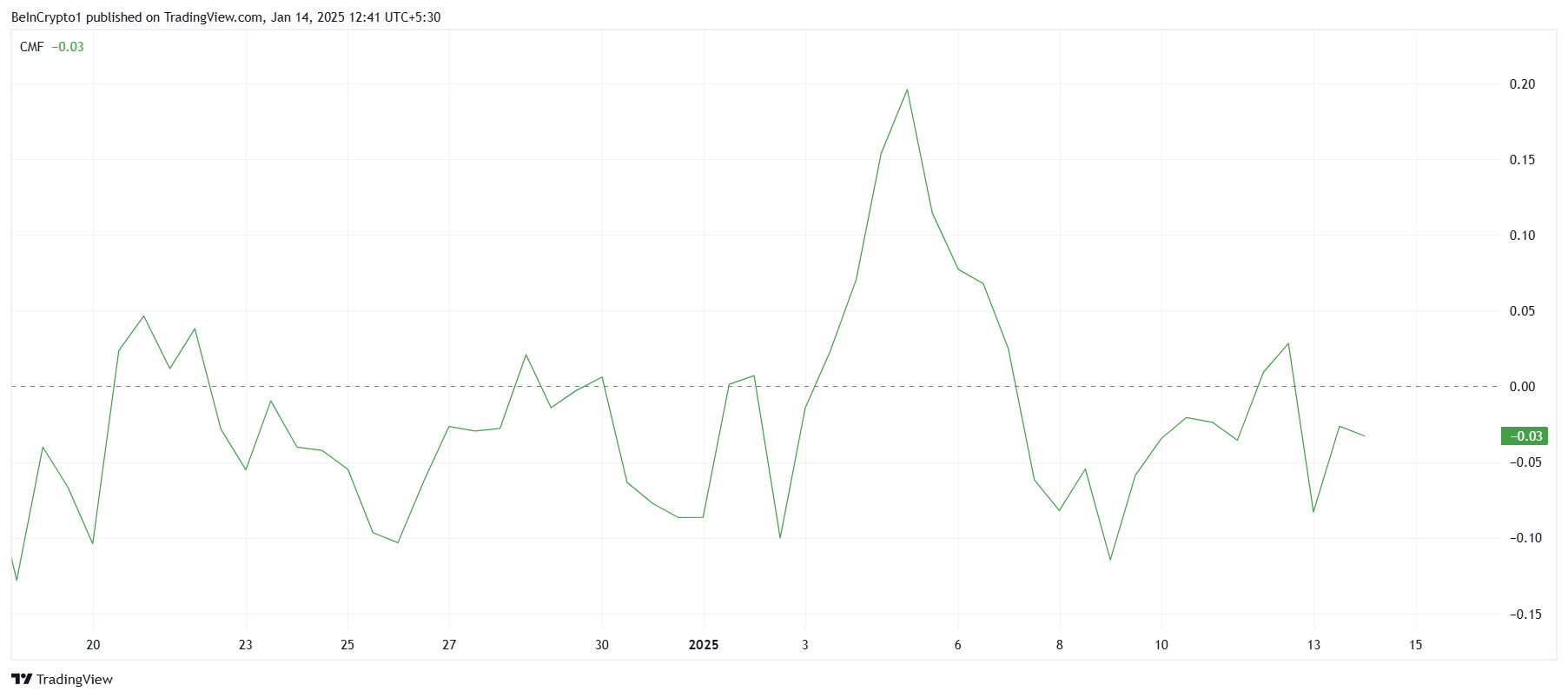

Despite recent price upticks, the Chaikin Money Flow (CMF) indicator for HYPE remains below the zero line. This reflects weak inflows, suggesting that while the market is beginning to stabilize, significant investor participation is still lacking. Stronger inflows are necessary for sustained price growth.

For HYPE to advance its recovery, investors need to inject more capital into the asset. Without sufficient inflows, the current momentum risks stalling, and the cryptocurrency may face difficulty in establishing a solid uptrend.

HYPE Price Prediction: Feuling The Growth

HYPE’s price has risen by 8% over the past few days, signaling early signs of recovery. However, this gain only offsets about half of the nearly 20% correction experienced in the previous week, leaving more ground to cover for a complete rebound.

Currently holding above the $19.47 support level, HYPE is targeting a breach of $23.20. Flipping this resistance into support could pave the way for a rally toward $29.85, enabling the crypto to recover its recent losses and build on its upward momentum.

If HYPE fails to breach the $23.20 resistance due to insufficient inflows, it could fall back to test the $19.47 support. Losing this level would invalidate the bullish outlook, potentially leading to further declines and dampening investor confidence.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/hype-price-gains-bullish-momentum/

2025-01-14 11:30:00