Layer-1 blockchain Hyperliquid, known for its decentralized derivatives exchange, has noted a drop in its Total Value Locked (TVL) since the beginning of the year. This downturn comes despite the slight overall increase in decentralized finance (DeFi) TVL across the market since January 1.

This TVL drop has caused a decline in demand for Hyperliquid’s native token HYPE. With waning buying pressure, the altcoin is poised for a further fall.

Hyperliquid’s TVL Falls 20%

According to DefiLlama, Hyperliquid’s TVL has fallen by 20% since the beginning of the year. As of this writing, it sits at $1.89 billion, its lowest level since January 1.

This decline has occurred despite the general uptick in DeFi TVL in the broader market. According to the on-chain data provider, the crypto market’s DeFi TVL currently stands at $120 billion, noting a 1% rise over the past seven days.

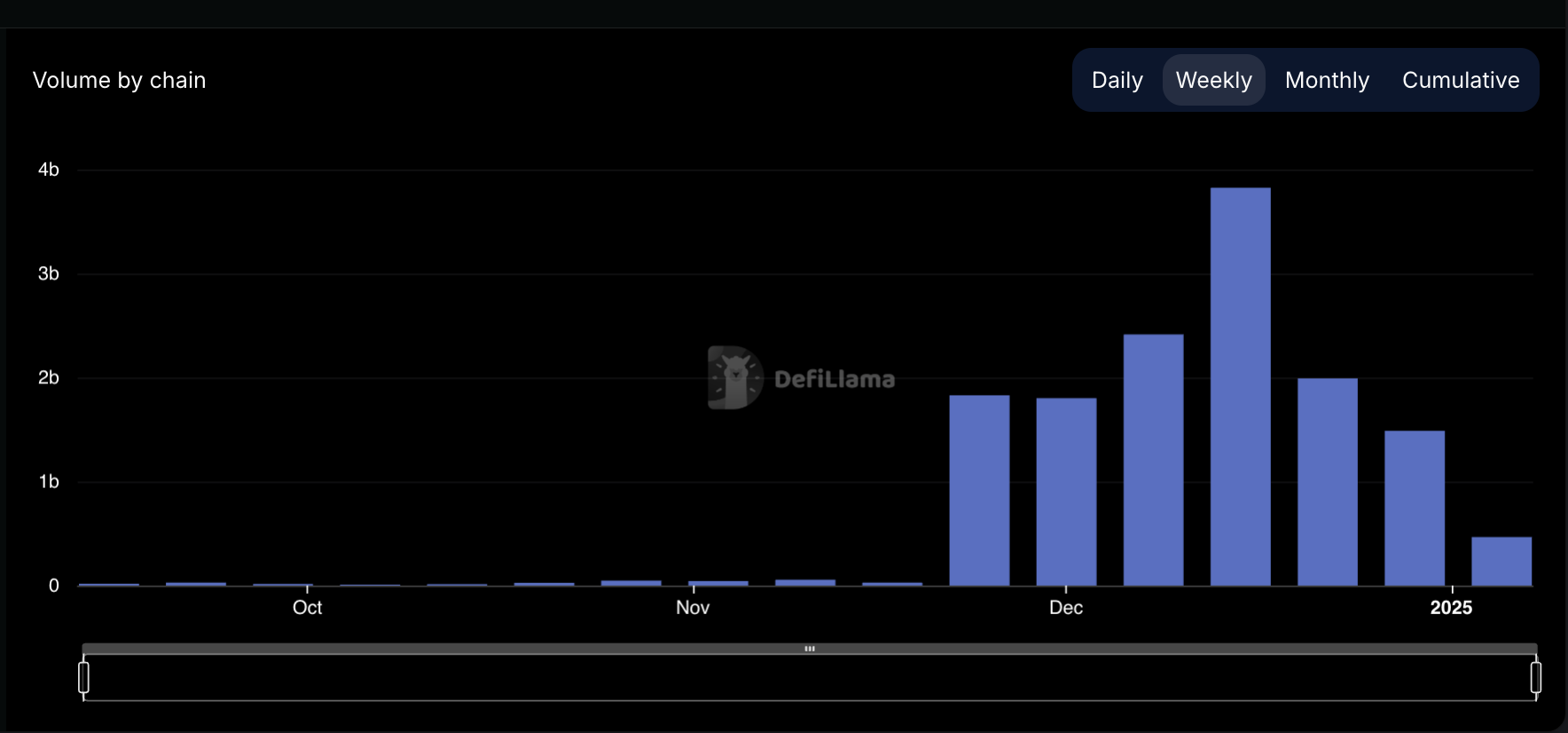

When a protocol’s TVL drops, it often indicates lower user participation. This is reflected in the steady drop in Hyperliquid’s trading volume. Per DefiLlama, this has plummeted by 19% over the past week.

The HYPE Token Reacts

A decline in a protocol’s TVL reflects reduced capital invested or staked within the platform, indicating lower user participation. This often leads to a decrease in the value of its native token, as diminished capital reduces demand for the token.

This is evident with HYPE, which has seen its value drop by 10% over the past seven days. Its Relative Strength Index (RSI), measured on a four-hour chart, supports this trend, currently standing at 35.72. The RSI, an indicator of overbought or oversold market conditions, shows significant selling pressure at this level.

Also, the HYPE token price continues to trade below the red line of its Super Trend indicator, which tracks the direction and strength of its trend. The indicator is displayed as a line on the price chart and changes color to signify the trend: green for an uptrend and red for a downtrend.

If an asset’s price is below the Super Trend line, it signals bearish momentum in the market and hints at a potential price drop.

HYPE Price Prediction: What To Expect?

HYPE currently trades at $22.18. If selling pressure persists, the token’s price could plunge below $20 to exchange hands at $17.34.

On the other hand, a positive shift in market sentiment could propel the HYPE token price to $31.04.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/hype-token-price-drop-tvl-falls/

2025-01-08 16:00:00