Hyperliquid (HYPE) has been the center of a heated debate over its validator setup. Critics have raised concerns about the platform’s lack of transparency and decentralization, accusing the network of selling validator seats and operating with a limited number of validators.

These allegations have sparked widespread discussions on social media, particularly on X (Twitter), as community members scrutinize the network’s operations and governance. Hyperliquid is a decentralized exchange (DEX) that, unlike most of its competitors, runs on its own blockchain

Validator Transparency Issues Around Hyperliquid

Community members have expressed frustration with the network’s closed-source node code and its reliance on a single-binary system. Critics argue that these practices hinder transparency and contribute to centralization. In response, Hyperliquid acknowledged the concerns while defending its current approach.

“Yes, the node code is currently closed source, but open sourcing is important,” the DEX stated in the post.

However, it emphasized plans to make the code publicly available once it reaches a secure and stable state. Addressing the single-binary system, Hyper Foundation pointed out that this method is not uncommon, even among well-established networks.

“There is currently one binary, but even very mature networks like Solana have the vast majority of validators running a single client,” the post clarified.

Further, and to address the criticism, Hyperliquid issued a detailed statement on X, dispelling misconceptions about its validator setup:

- All validators were qualified based on testnet performance, with no option to purchase validator seats.

- A Foundation Delegation Program will soon support high-performing validators and further decentralize the network.

- Anyone can run an API server pointing to any node, ensuring flexibility and accessibility.

- Efforts are underway to enhance testnet onboarding and prevent the creation of black markets for testnet HYPE tokens.

Hyperliquid emphasized that its validator set will expand as the network matures, ensuring a more decentralized and resilient infrastructure. The foundation reiterated its commitment to its mission of bringing all finance on-chain, with the community playing a vital role in the ecosystem’s growth.

Hyperliquid’s Past Controversies

This is not the first time Hyperliquid has faced scrutiny. Two weeks ago, the network denied allegations of a potential hack by the North Korean Lazarus Group, despite on-chain evidence suggesting otherwise.

Additionally, Hyperliquid has faced criticism over its token price volatility and significant outflows amid hack-related fears. As BeInCrypto reported, $60 million worth of HYPE tokens flowed out of the platform recently, coinciding with a decline in token value.

In hindsight, however, Hyperliquid launched its HYPE token in November 2024 through a token generation event (TGE) and a community airdrop, setting new DeFi standards. The airdrop distributed 31% of the total supply, equivalent to 310 million tokens, to early supporters and active users.

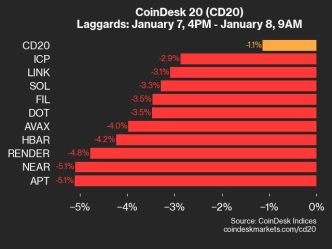

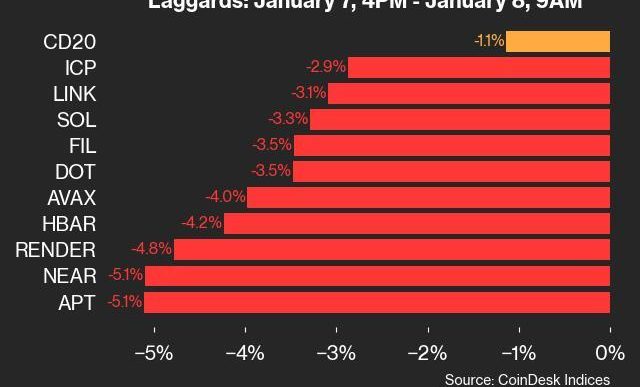

Following the airdrop, the token price surged, reaching an all-time high of $35.73 on December 21, 2024. However, it has since fallen by around 40%.

BeInCrypto data shows HYPE was trading for $21.12 at the time of writing, representing a drop of nearly 20% since the Wednesday session opened.

Currently, HYPE’s market capitalization stands at approximately $7 billion, with a fully diluted valuation exceeding $21 billion. The circulating supply is about 333.93 million tokens, with 5% of HYPE TVL locked for distribution among the community.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Lockridge Okoth

https://beincrypto.com/hyperliquid-addresses-validator-concerns/

2025-01-08 13:30:00