Hyperliquid is one of the most profitable platforms in crypto right now, yet its price has been struggling, dropping over 8% in the last 24 hours and more than 24% in the past seven days. Despite its strong fundamentals, bearish momentum has kept HYPE at its lowest levels since December 2024.

However, the network’s rising revenue has outpaced Solana, Ethereum, and Raydium. This suggests underlying strength that could fuel a rebound if market conditions shift. If HYPE breaks resistance at $14.65, it could trigger a rally toward $20 or even $25.87, but failure to reclaim momentum could send it below $12.

Hyperliquid RSI Has Been Neutral Since March 4

Hyperliquid’s RSI (Relative Strength Index) is currently at 32.59, remaining in neutral territory since March 4. Suspicious high-leverage trades are raising money laundering concerns, leading to the ongoing correction.

The RSI is a momentum oscillator that measures the speed and change of price movements on a scale from 0 to 100, with values above 70 indicating overbought conditions and below 30 signaling oversold conditions.

An RSI between 30 and 50 suggests weak momentum, often aligning with a downtrend or consolidation phase.

HYPE’s RSI has now stayed below 50 for nine consecutive days, reinforcing the lack of bullish momentum. With the current reading at 32.59, the asset is approaching oversold territory but hasn’t yet reached extreme levels.

This suggests that selling pressure remains dominant, but if RSI turns upward and crosses 50, it could signal the start of a stronger recovery.

Until then, Hyperliquid remains in a weak position, with price action struggling to gain upward traction.

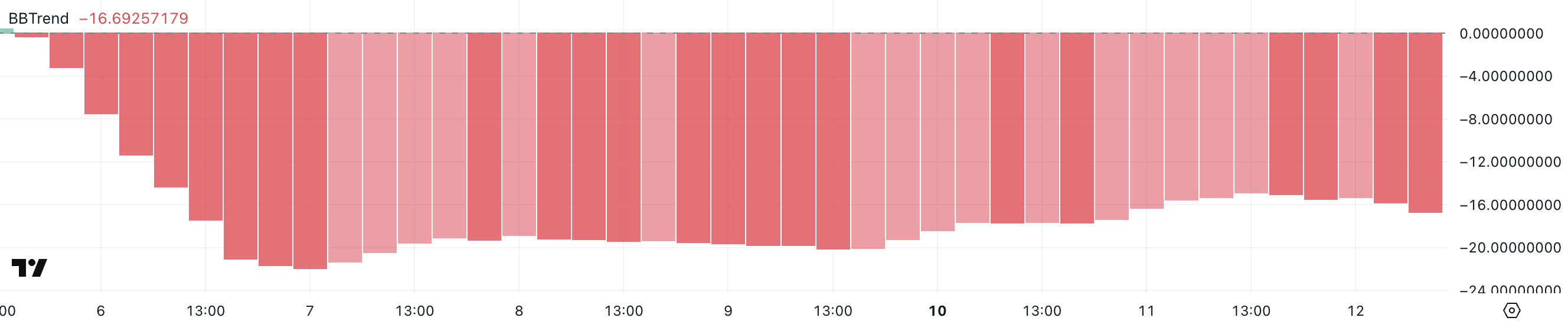

HYPE BBTrend Has Been Negative For One Week

Hyperliquid’s BBTrend is currently at -16.69, remaining negative since March 5 and staying below -10 for the past six days.

BBTrend (Bollinger Band Trend) is an indicator that measures price momentum relative to Bollinger Bands, helping identify bullish or bearish trends.

Values above 10 indicate strong upward momentum, while values below -10 suggest strong downward pressure.

With HYPE BBTrend at -16.69, the bearish trend remains dominant, reinforcing the recent selling pressure.

Staying below -10 for several days suggests that downside momentum has been persistent, limiting any significant recovery attempts.

If the BBTrend starts moving toward 0, it could indicate a weakening downtrend, but for now, Hyperliquid remains in a clearly bearish phase.

Can HYPE Reclaim $20 In March?

Hyperliquid is currently trading at its lowest levels since December 2024, with its EMA lines signaling a strong bearish sentiment.

Short-term EMAs remain well below long-term ones, with large gaps between them indicating strong downside momentum. If the correction continues, HYPE could drop below $12, marking its lowest price in over three months.

However, Hyperliquid revenue has surged past $11 million in the last seven days, outperforming major players like Pump, Solana, Ethereum, and Raydium.

If momentum returns, HYPE could test the $14.65 resistance, with a potential rally toward $17 if broken. A stronger uptrend could push the price above $20, potentially testing $21 and even $25.87 in the coming days.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Tiago Amaral

https://beincrypto.com/hyperliquid-struggles-despite-revenue-hitting-millions/

2025-03-12 23:00:00