Hyperliquid (HYPE) price surged by 60% after its billion-dollar airdrop, which distributed 310 million HYPE tokens to users. This surge was followed by a brief period of overbought conditions, as indicated by its RSI rising above 70.

However, the momentum quickly waned, and the RSI has since declined to 44.8, signaling a neutral or slightly bearish sentiment. Despite fluctuating net flows, which reached an all-time high of $181 million on November 29, HYPE’s price remains under pressure, with recent drops in both net flows and price levels.

HYPE RSI Is Currently Neutral

After its airdrop, HYPE RSI briefly surged above 70, indicating that the asset was overbought.

However, this momentum didn’t last, and the RSI started to decline. It is currently sitting at 44.8, suggesting a neutral or slightly bearish sentiment.

RSI, or Relative Strength Index, is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100.

An RSI above 70 is considered overbought, while an RSI below 30 indicates oversold conditions. An RSI of 44.8 suggests that HYPE is neither overbought nor oversold. In the short term, this could imply that HYPE’s price may remain stable or see slight downward pressure if momentum continues to weaken.

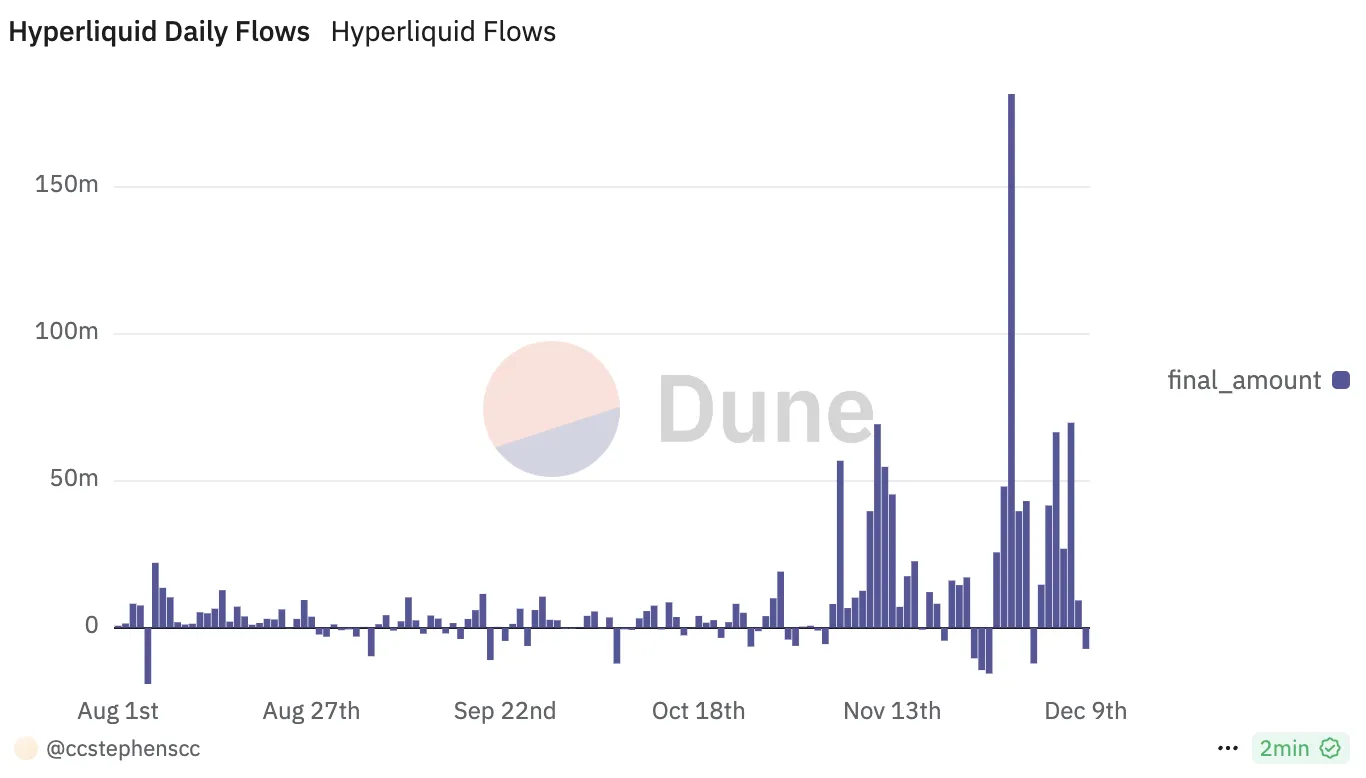

Hyperliquid Flows Reached An All-Time High On November 29

Hyperliquid net flows chart shows a significant increase, reaching an all-time high of over $181 million on November 29. Afterward, it dropped to $66 million on December 5, then rose slightly to $69 million on December 7.

However, on December 8, the net flows dropped dramatically to $9 million, and currently, it stands at approximately -7 million dollars.

Net flows refer to the difference between the total inflows and outflows of an asset or investment within a given period. Positive net flows indicate more funds are entering than leaving, while negative net flows show the opposite.

Despite still having more inflows than outflows overall, the sharp decline in net flows to negative levels could signal a loss of investor confidence or a shift in market sentiment. This drop could indicate potential price instability or downward pressure in the short term, as outflows surpass inflows, signaling a potential reversal in market sentiment.

HYPE Price Prediction: Can HYPE Go Below $10 In December?

After its airdrop, HYPE price experienced a significant surge, reaching a high of $14.99 on December 7. This increase was followed by a period of consolidation, where the price stabilized, before it began to decline gradually.

The market seems to be in a state of uncertainty, with a slight downward momentum taking hold.

If HYPE manages to recover its earlier bullish momentum, it could potentially rise again and challenge resistance levels near $15. This could set the stage for a further upward move, with the next target being $16, as perpetual DEX platforms continue to attract attention.

On the other hand, if the current downtrend continues to gain strength, HYPE price could test its first major support level at $11.29. If this support proves weak, the price may continue to drop, potentially reaching $10.44, signaling a deeper bearish trend.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Tiago Amaral

https://beincrypto.com/hyperliquid-hype-price-drops-after-billion-dollar-airdrop/

2024-12-09 16:00:00