Venture capitalist Chris Burniske is reasserting his stance on one of his main altcoin picks for this crypto market cycle.

Burniske says on the social media platform X that he’s still loading up on Celestia (TIA) tokens, anticipating a massive recovery despite being 77% down from its all-time high.

The investor also says that fear surrounding TIA’s large token unlock next month is likely overblown.

“Still longing TIA while haters spinelessly pile onto the downside momentum. When Celestia recovers, it’s not me that will be haunted by the thought, ‘Instead of jeering, I could have been buying TIA <$5…

Everyone and their mother is fixated on the ‘big $TIA unlock’ in October. Paid groups and momentum bottom trolls are drooling with delight, claiming $TIA will get crushed when the ‘evil VCs’ are given liquidity, hence piling onto these expensive shorts.

What TIA bottom trolls aren’t grasping:

1)Celestia as an ecosystem is firing on all cylinders, with an ideologically committed & diverse set of builders experimenting with zeal. Reminds me of early Bitcoin, Ethereum and Solana energy.

2) The ‘evil VCs’ that’re given liquidity are unlikely to unload as anticipated in October because they see the ecosystem traction and aspirations of the team. Many of TIA’s biggest backers are less short-term oriented than portrayed.

3) When the unlock happens, it’s likely Mr. Market realizes there’s far less sell pressure than these shorts are anticipating, and the shorts get blown out, if they don’t get blown out before.

4) Buyers that have been sidelined, worried about the overhang of the unlock, will both be reassured by positive price action, as well as the reduction of uncertainty, allowing them to take action.

5) TIA market released from its current semi-paralysis.”

Celestia aims to be a “modular data availability” blockchain that scales along with the number of users it has, and provide users with the ability to launch their own chain.

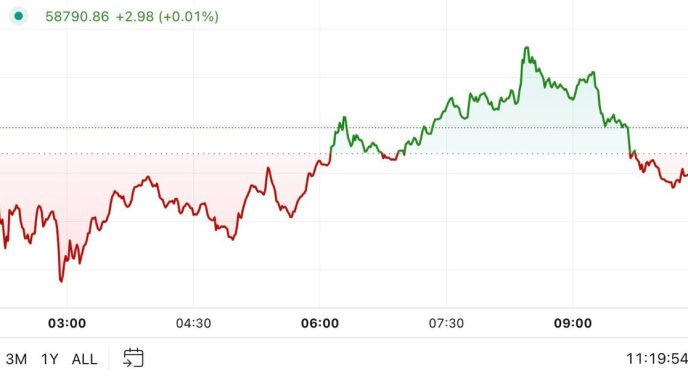

At time of writing, TIA is trading at $4.84 with a market cap of $1.02 billion.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Alex Richardson

https://dailyhodl.com/2024/09/16/investor-chris-burniske-doubles-down-on-one-layer-one-altcoin-play-while-shorts-pile-up-heres-why/

2024-09-16 11:45:22