Bitcoin has struggled to reclaim $100,000 as a support floor, reflecting a lack of momentum in recent price action.

Despite this, investor sentiment remains bullish, with confidence bolstered by Bitcoin’s growing institutional support and its symbolic milestone of turning 16 years old.

Bitcoin Investors Are Bullish

The supply of Bitcoin on exchanges has dropped by 11,000 BTC in the past 48 hours, signaling reduced selling pressure. Since the beginning of the year, accumulation has surged to $1 billion, with investors consistently acquiring BTC even amid stagnant price movements. This trend highlights the confidence of Bitcoin holders in an eventual rally.

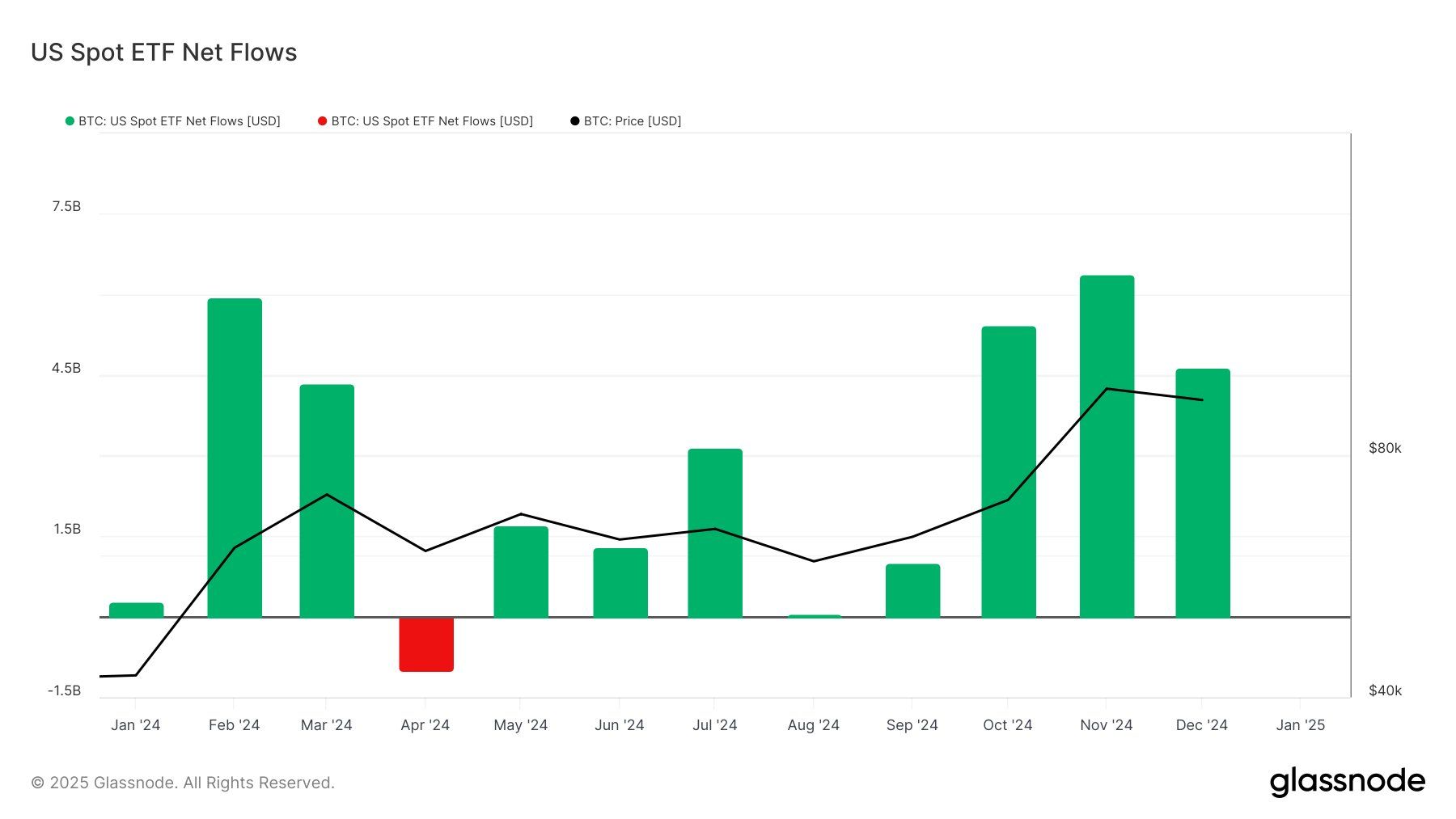

Institutional interest in Bitcoin has reached new highs, with net flows into spot BTC ETFs totaling $4.63 billion in December. This figure is significantly above the 2024 monthly average of $2.77 billion, emphasizing the increasing appetite for Bitcoin among institutional investors.

While most inflows occurred during the first half of December, the bearish conditions in the latter half did not significantly reduce activity. Institutions’ continued support reflects a long-term outlook that could help Bitcoin recover and drive its price higher.

BTC Price Prediction: Finding A Breach

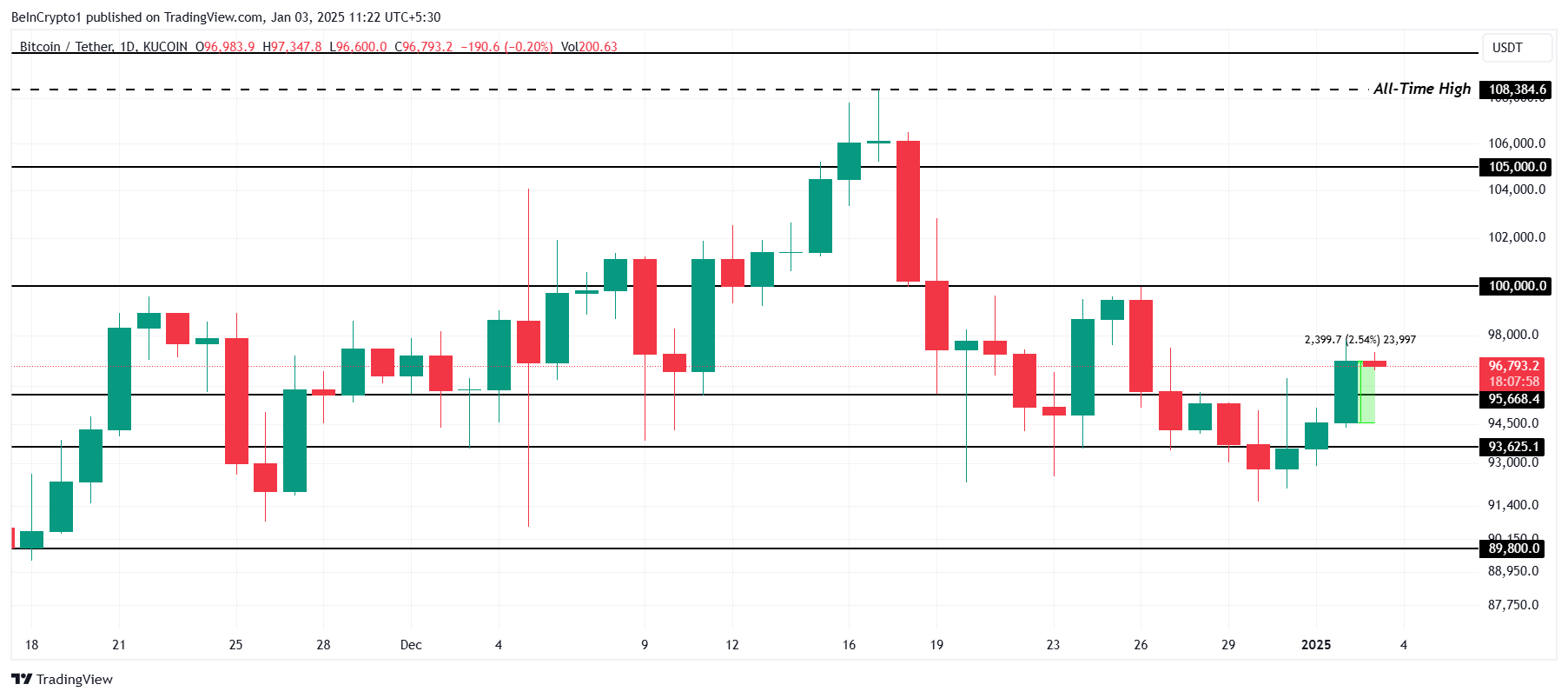

Bitcoin is currently trading at $96,793, holding above the $95,668 support level. To reclaim $100,000, BTC must prevent a decline below this critical threshold. The current market signals suggest the possibility of an upward movement.

The optimistic cues from investor support and institutional inflows indicate that a drop is unlikely. If Bitcoin flips $100,000 into support, it could pave the way for a rise to $105,000, marking a significant step forward in its recovery.

However, losing the $95,668 support level could push BTC to $93,625, raising concerns among investors. A further decline below this level would invalidate the bullish outlook, potentially sending Bitcoin to $89,800. Holding key levels remains vital for sustaining market optimism.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/bitcoin-investors-scoop-up-large-supply-of-btc/

2025-01-03 08:00:00