Story’s IP has maintained its streak as the market’s top gainer for the third consecutive day, bucking the broader downturn.

Despite the crypto market shedding $109 billion in market capitalization over the past 24 hours, IP has continued its uptrend, posting double-digit gains during that period.

IP Token Defies Market Slump

There has been a significant decline in crypto trading activity over the past 24 hours, reflected by the $109 billion capital outflow recorded during that period. At press time, the global crypto market capitalization is at $2.79 trillion, a low it last reached in November.

Despite this, the recently launched Layer-1 (L1) coin IP has defied the broader market decline. It has continued to record new gains, driven by significant demand for the altcoin among market participants.

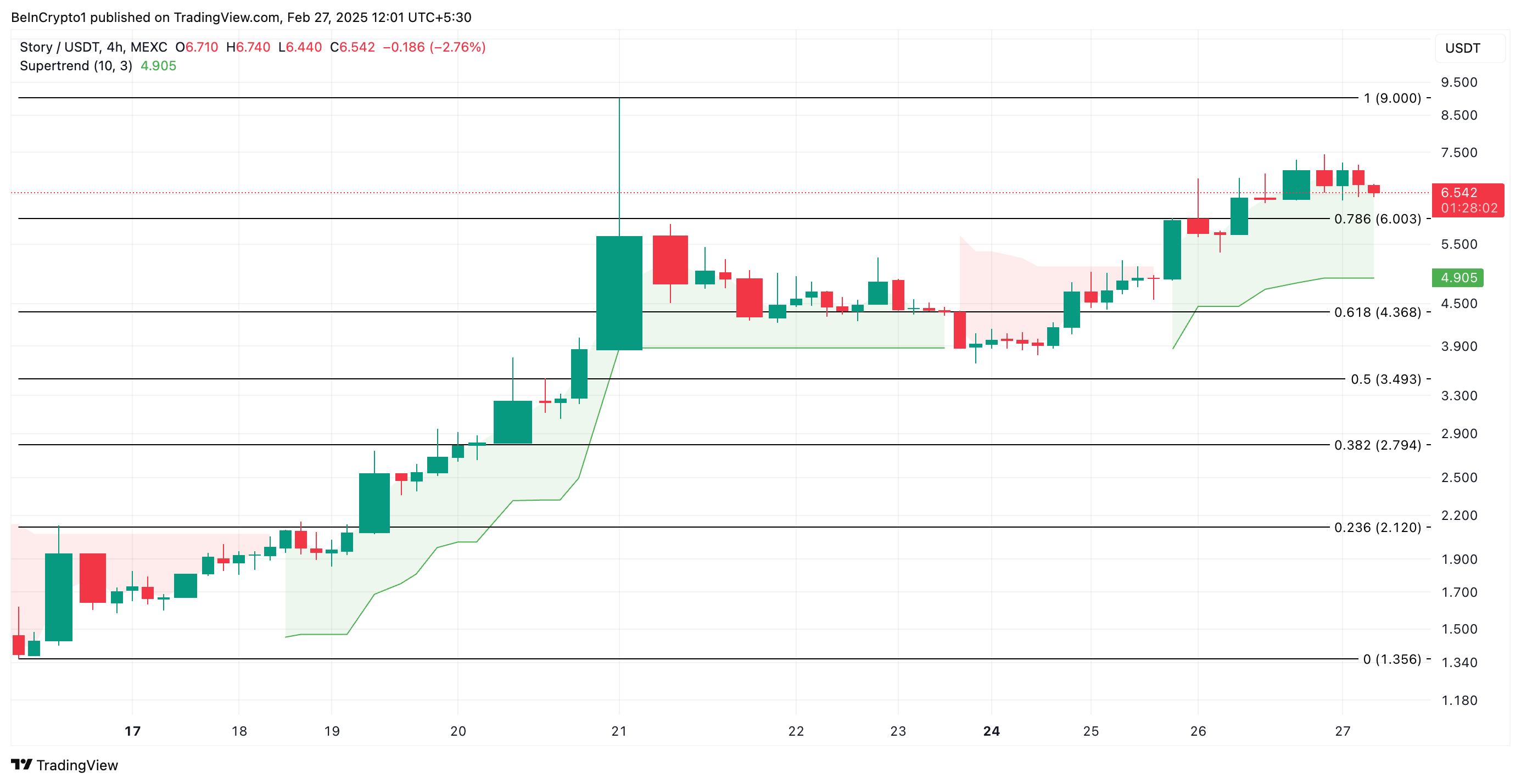

BeInCrypto’s assessment of its Super Trend indicator confirms IP’s bullish bias. At press time, the green line of this indicator forms a dynamic support level below IP’s price at $4.90, highlighting the market’s bullish pressure.

This indicator tracks the direction and strength of an asset’s price trend. It is displayed as a line on the price chart, changing color to signify the current market trend: green for an uptrend and red for a downtrend.

As with IP, when an asset’s price trades above the Super Trend indicator, it is in a bullish trend. This signals that buying activity exceeds selloffs among market participants and hints at a potential sustained rally.

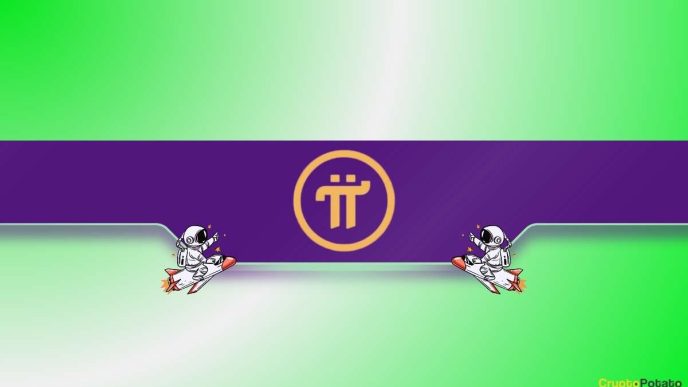

Furthermore, the coin’s rising on-balance volume (OBV) supports this bullish outlook. This momentum indicator has risen with IP’s price over the past few days, indicating the buying activity in its spot markets.

An asset’s OBV measures its buying and selling pressure by tracking cumulative trading volume in relation to its price movements. When it rises like this, it indicates strong buying pressure, suggesting that demand is outpacing supply, and the asset’s value may continue to increase.

IP Holds Above Key Support at $6—Can It Reclaim $9?

IP currently trades at $6.54, just above the support formed at $6. If buying pressure gains more momentum, it could drive IP to its all-time high of $9, which was last reached on February 21.

However, a resurgence in coin selloffs would invalidate this bullish projection. In that case, the coin’s price could fall below the $6 support and trend toward the dynamic support at $4.90.

Nevertheless, IP’s price could slip to $4.38 if this level fails to hold.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/ip-coin-bucks-market-downturn/

2025-02-27 08:33:17