THORChain (RUNE) price has been noting growth over the last 24 hours, but it may not be enough to counter the bearish bigger picture.

The altcoin’s indicators also suggest that the growth may not be sustained as bearish cues remain persistent.

THORChain May Need a Lightning Strike

RUNE price’s rise could be overshadowed by the overtly bearish cues being observed at the moment. The altcoin’s Chaikin Money Flow (CMF) indicator reveals a persistent trend of outflows dominating the market for the past five months.

This consistent pattern has resulted in a downtrend forming on the indicator, highlighting a bearish sentiment among RUNE investors. While the downtrend line has been breached, the question is whether it will stay above it or not.

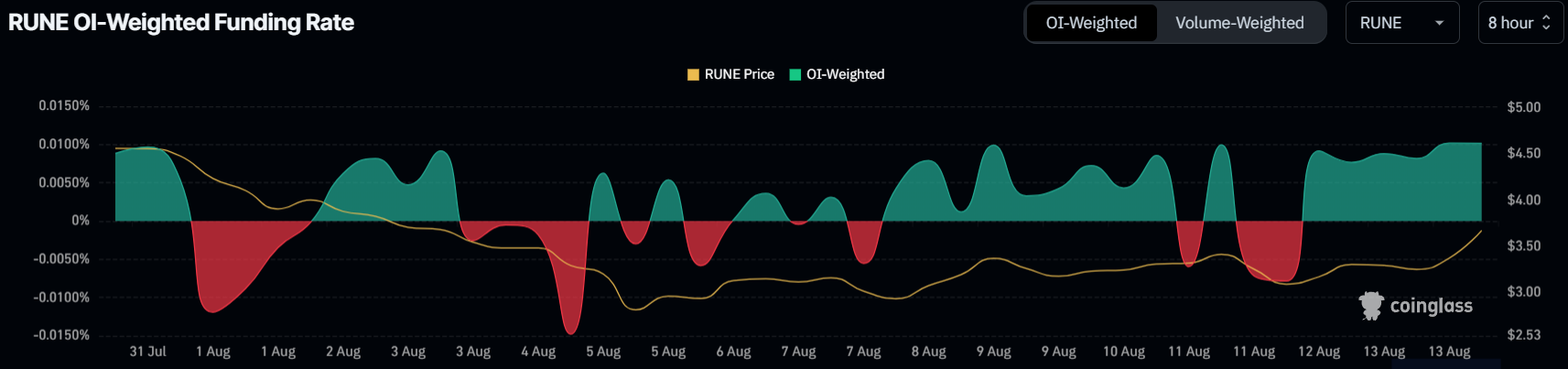

Additionally, the funding rate for RUNE has been reflecting a decrease in optimism over the last two weeks. Since the beginning of the month, altcoin has noted a negative funding rate at times, which suggests short contracts are dominating the market at that moment.

The funding rate frequently turning negative indicates a weakening in market confidence and enthusiasm, which could further contribute to the challenges facing RUNE’s recovery.

Read More: What Is an Automated Market Maker (AMM)?

The combination of these two factors paints a challenging picture for RUNE’s short-term prospects. Overall, the current market conditions suggest that RUNE faces considerable headwinds.

RUNE Price Prediction: Marching Head-On

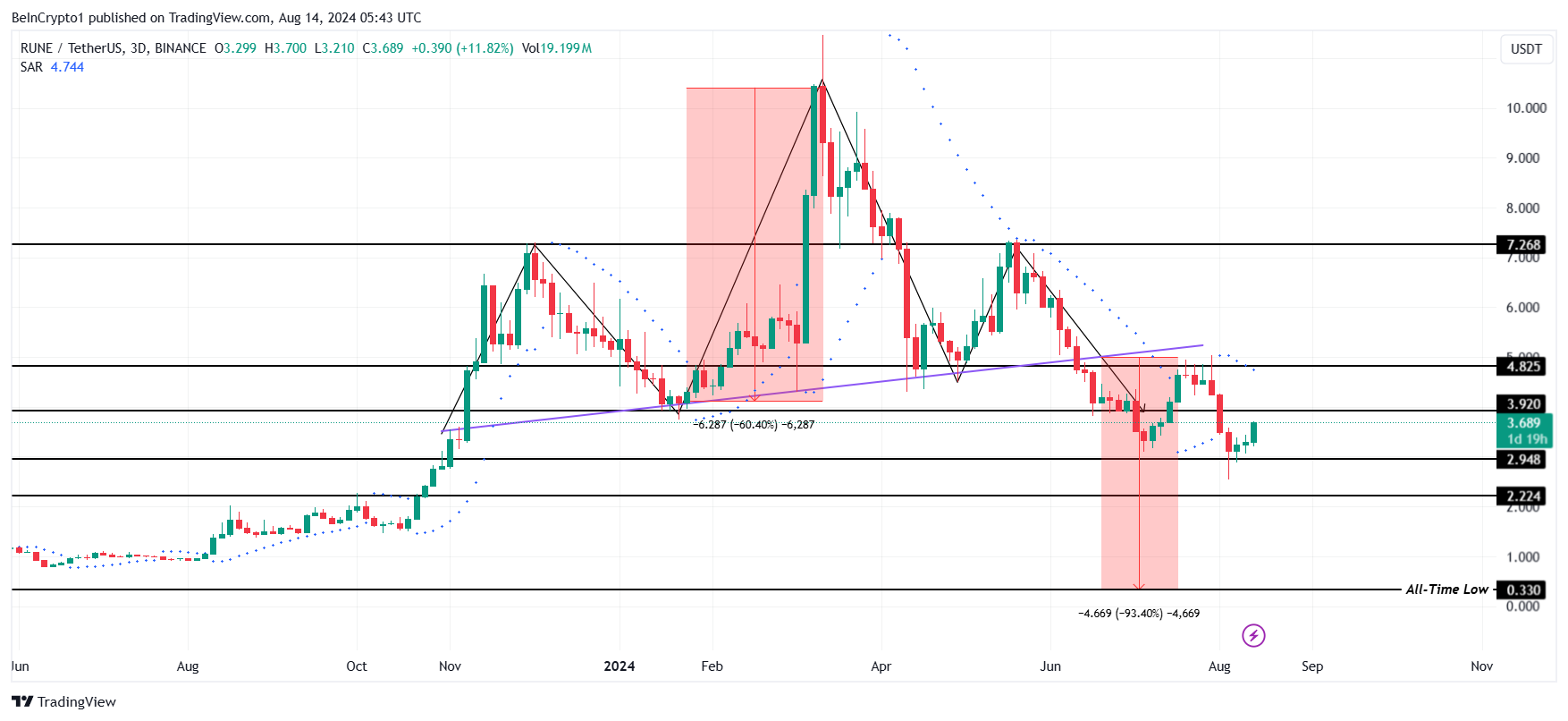

RUNE price has formed a macro head and shoulder pattern over the past nine months. This bearish pattern was validated in early June after the altcoin fell below the breakdown level of $4.82.

At the time of writing, RUNE’s price is trading at $3.68 after bouncing off the support at $2.94. While the broader market’s bullishness is saving the crypto asset from a sharp drawdown, it still has not escaped the pattern.

The head and shoulders pattern suggests a 93% drawdown to the all-time lows of $0.33 is possible.

Read More: Best Upcoming Airdrops in 2024

However, the pattern and the bearish thesis will be completely invalidated once the RUNE price crosses the $4.82 resistance level, leading to further gains for the altcoin.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/thorchain-rune-price-could-reach-all-time-low/

2024-08-14 08:15:00