Cardano (ADA) has been on a downward trajectory over the past few days, with its price slipping by 7%. While this decline reflects broader market pressures, it has also created an opportunity for ADA holders.

The cryptocurrency’s current position offers potential for a bullish reversal, sparking optimism among investors.

Cardano Has a Chance

Cardano’s 30-day Market Value to Realized Value (MVRV) ratio reveals that investors who purchased ADA in the last month are facing average losses of 15%. However, this downturn has pushed the MVRV ratio into the opportunity zone, a range between -13% and -26%. Historically, this range has marked a turning point for recoveries.

This is the first time in four months that ADA’s MVRV ratio has dipped into this critical zone, signaling a potential bottom. Previous instances of the indicator entering this territory have been followed by significant price rebounds. As ADA enters this phase, investors are closely monitoring the altcoin for signs of upward momentum.

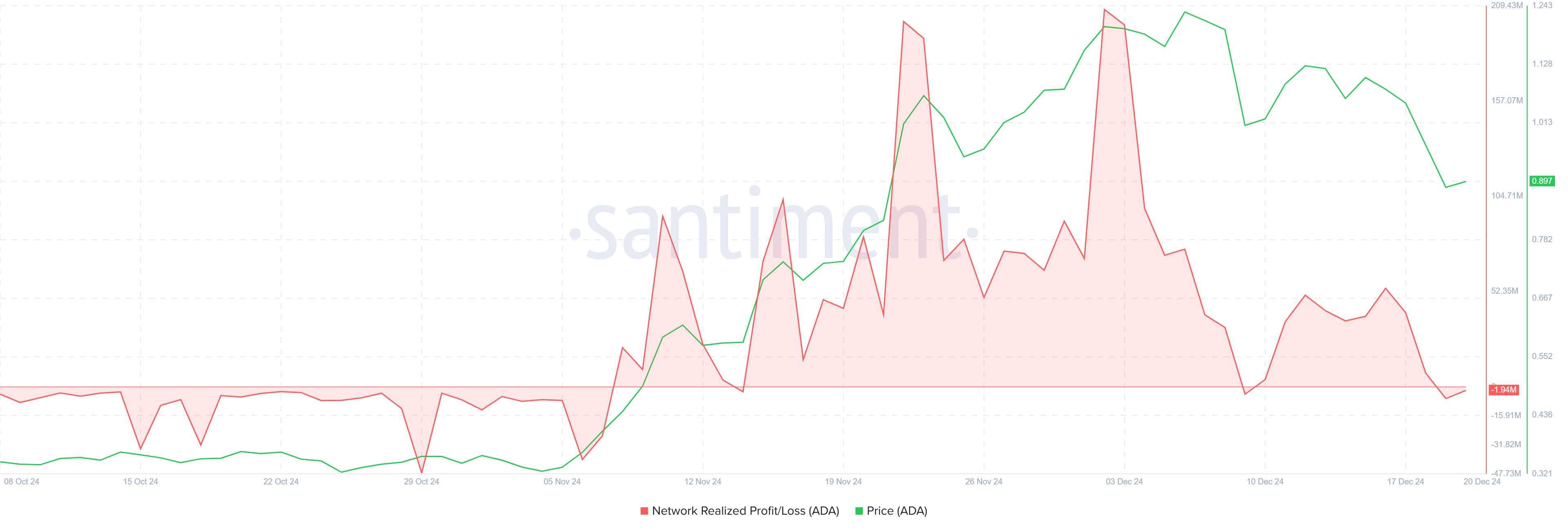

The realized profits indicator for Cardano currently shows no noticeable spikes, suggesting that investors are holding back from profit-taking. This behavior is crucial as it helps reduce market volatility and eliminates the immediate threat of sharp corrections due to excessive selling activity.

With profit-taking minimized, the market has a chance to stabilize, allowing investors more room to accumulate ADA. This phase of reduced volatility strengthens the foundation for a potential price rally. A continued lack of profit spikes could pave the way for sustained upward momentum in the near term.

ADA Price Prediction: Looking For Recovery

At $0.89, Cardano’s price is hovering above its critical support level of $0.87 after experiencing a sharp decline of 7% over the last 24 hours. The cryptocurrency’s ability to hold above this level is vital for maintaining bullish sentiment in the short term.

If the positive indicators materialize into a rally, ADA could reclaim the $1.00 mark, which it recently fell below. Turning this resistance into support would signal renewed strength for Cardano, enabling further price recovery towards $1.23 and drawing in additional investor interest.

However, failure to hold above $0.87 could lead to a deeper decline. A breach of this level would likely push ADA down to $0.77, invalidating the bullish thesis and potentially triggering a bearish phase.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/cardano-price-drops-into-opportunity-zone/

2024-12-20 07:00:00