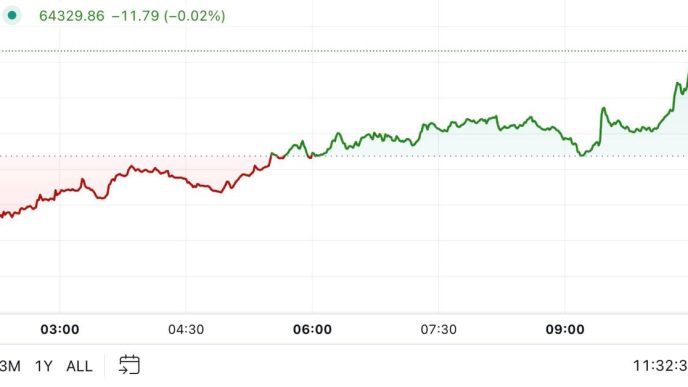

Bitcoin’s price has been on a positive trend for the past week but it has unsuccessfully challenged the $65,000 level a few times.

According to on-chain data, BTC whales have been offloading a lot of their holdings lately, which could suggest more trouble on the horizon if they continue.

#Bitcoin whales sold over 20,000 $BTC in the past 24 hours, worth around $1.28 billion! pic.twitter.com/METXwmIxCn

— Ali (@ali_charts) September 25, 2024

Popular crypto analyst Ali showcased the substantial sell-off that transpired earlier this week, in which, larger entities disposed of more than 20,000 BTC within the span of 24 hours.

This was among the biggest sales that occurred within just a day since the start of the year. In USD terms, the total value was just shy of $1.3 billion.

BTC’s price tumbled yesterday from almost $65,000 to under $63,000 but managed to recover most of the losses almost immediately. After jumping toward $64,000 earlier today, it kept rising and currently sits at $64,400.

If whales’ behavior remains the same and they continue selling, BTC’s price actions could worsen again. Ali outlined $63,300 as the most crucial support level that has to hold, otherwise the cryptocurrency risks dropping to $60,365.

Based on the most recent on-chain activity, $63,300 is the most important support level for #Bitcoin. If it holds, # BTC can rise to $65,500, but if it doesn’t, #BTC will likely dive to $60,365! pic.twitter.com/4RTFQRqClJ

— Ali (@ali_charts) September 25, 2024

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER 2024 at BYDFi Exchange: Up to $2,888 welcome reward, use this link to register and open a 100 USDT-M position for free!

Source link

Jordan Lyanchev

https://cryptopotato.com/is-bitcoins-price-in-trouble-this-important-metric-suggests-short-term-pain-for-btc/

2024-09-26 12:01:35