Cardano (ADA) price has been stuck in a descending channel for the past five months, aiming for a breakout. Despite some volatility, the cryptocurrency remains poised for a potential surge.

However, recent developments, including a substantial selloff by whale investors, have injected uncertainty into the market, sparking questions about the altcoin’s future trajectory.

Bullish Signs for Cardano Emerge

Cardano whale investors have shown increasing skepticism toward ADA’s short-term price movements. In recent days, addresses holding between 10 million and 100 million ADA have sold off approximately 140 million tokens, worth over $50 million, reflecting a wary approach to the cryptocurrency.

Although this move has raised concerns, similar selloffs in the past have led to bullish outcomes. Large-scale whale selloffs often create potential buying opportunities for smaller investors.

Read more: How To Buy Cardano (ADA) and Everything You Need To Know

Despite this, the broader market sentiment remains cautiously optimistic. The selloff has introduced some short-term pressure, but the long-term outlook suggests that whale-driven downturns could have a counter effect on the price.

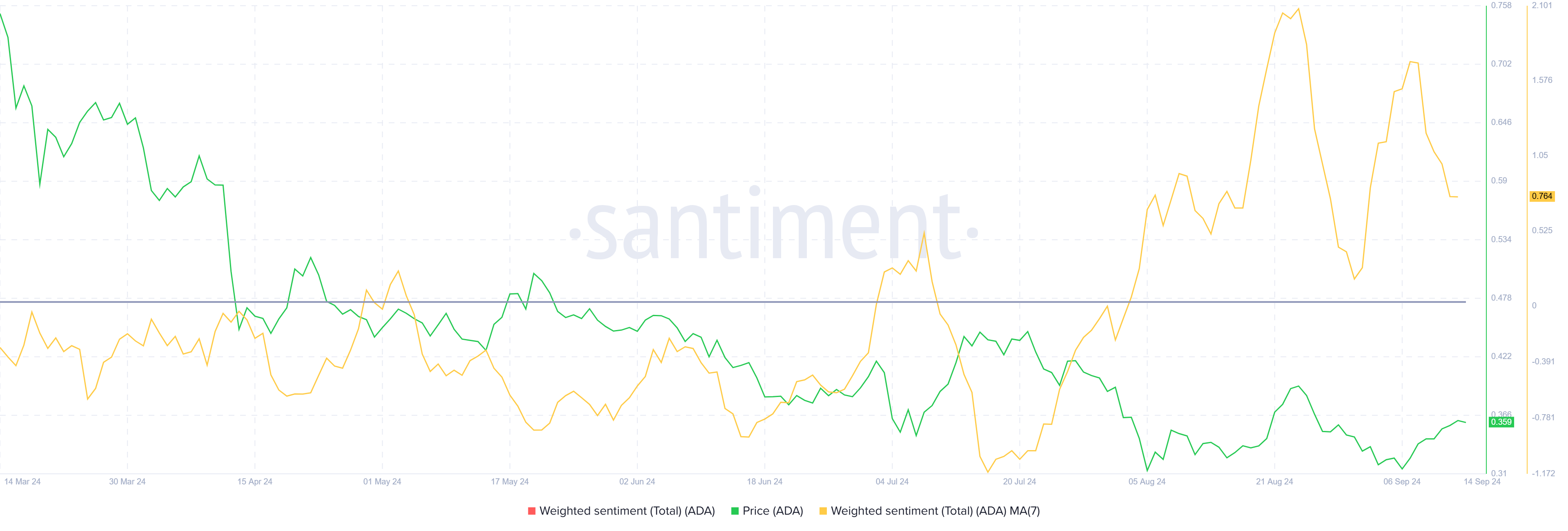

On a macro scale, Cardano continues to display strong momentum regardless of the recent fluctuations. The overall market sentiment surrounding the project remains favorable. This suggests that ADA may still be on the verge of significant gains irrespective of the short-term volatility, supported by positive momentum in the market.

ADA Price Prediction: Aiming High

Cardano’s price is edging closer to a breakout from the descending channel that has restrained its movements for the last five months. While ADA has attempted and failed to break out twice during this period, current market conditions suggest another breakout is on the horizon. Investors are eyeing the key resistance level at $0.37, which could determine whether the cryptocurrency manages to break free from its descending channel.

If ADA successfully flips the $0.37 barrier into a support level, the altcoin could experience a 40% rise, in line with projections based on the current chart pattern. Such move would position ADA at a target of $0.51, marking a notable recovery from its recent lows and boosting investor confidence.

Read more: Cardano (ADA) Price Prediction 2024/2025/2030

However, Cardano may retest the $0.34 support level if the breakout fails. A further drop below this threshold could see the altcoin slipping to $0.31, raising concerns about extended sideways movement and potentially invalidating the bullish thesis.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/cardano-ada-price-eyes-major-rally/

2024-09-14 09:12:34