Dogecoin (DOGE) price has risen by 27% over the past month, leading meme market gains. Interestingly, despite the double-digit price hike, a key on-chain metric signals that the meme coin remains undervalued, presenting a buying opportunity for market participants.

If demand strengthens, Dogecoin’s price may extend its gains in the near term. Here is why.

Dogecoin Flashes Buy Signal

Dogecoin’s market value to realized value (MVRV) ratio, which measures the overall profitability of all its holders, shows that the altcoin is currently undervalued. This is happening despite the 27% spike in its price over the past month.

As of this writing, the coin’s 60-day MVRV ratio is -8.18%. A negative 60-day MVRV ratio indicates that Dogecoin’s current market price is below its average over the past 60 days.

Read more: Dogecoin (DOGE) Price Prediction 2024/2025/2030

Negative MVRV ratios historically represent a buying signal. They suggest that the asset is being traded below its historical acquisition cost, thus creating a buying opportunity for traders looking to “buy low” and “sell high.”

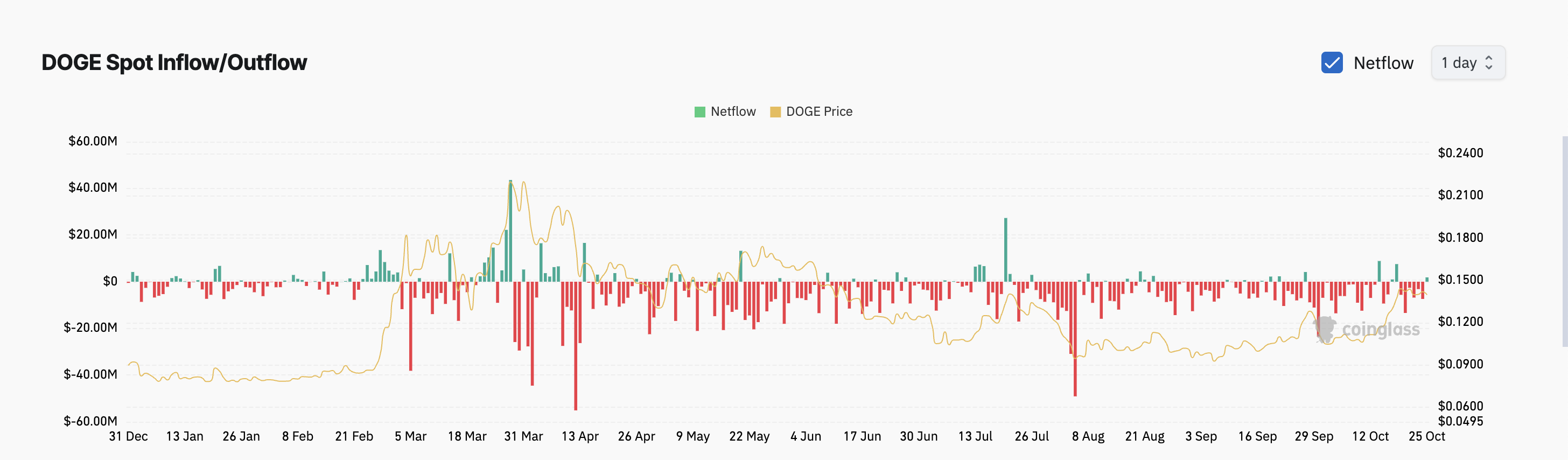

Traders have seized upon this bullish indicator, with DOGE’s spot market recording its first net inflow in seven days. According to Coinglass data, the inflow into the meme coin’s market on Friday totals $2 million. This comes after seven consecutive days of spot market net outflows, which exceeded $35 million.

Spot inflow is a bullish signal. It indicates that investors are confident in Dogecoin’s mid/near-term prospects and are willing to hold it as an asset.

DOGE Price Prediction: This Crucial Support Must Hold

At press time, Dogecoin trades close to the crucial support level of $0.137. With increased inflow into its spot market, bulls are positioned to defend this price point, potentially initiating an uptrend if demand strengthens.

The coin’s bullish sentiment is further supported by its bull-bear power (BBP) indicator, which measures buying and selling pressure in the market. Currently, the BBP sits at 0.0033, suggesting bullish momentum. When this indicator is positive, the bulls control the market.

If bulls maintain their grip, they could drive Dogecoin’s price towards the resistance level at $0.154. A successful breakout above this threshold would allow the meme coin to reach $0.172, a high not seen since May.

Read more: How To Buy Dogecoin (DOGE) and Everything You Need To Know

However, if demand wanes and the $0.137 support level fails to hold, Dogecoin’s price could drop significantly towards $0.112.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/dogecoin-price-first-net-inflow/

2024-10-25 13:30:00