As one of the Telegram coins severely affected by Pavel Durov’s arrest, Notcoin’s (NOT) price plunged from $0.010 to $0.0090 on August 25.

Despite the prevailing downtrend, recent market indicators hint at a potential reversal. If validated, here is how NOT might overcome the intense bearish pressure.

Indicator Hints at Notcoin Recovery

Currently, Notcoin trades at $0.0093, indicating that the cryptocurrency is making moves to erase some of its losses. In addition, on-chain data from IntoTheBlock shows an increase in the project’s network activity.

The seven-day active addresses, for instance, have increased. This rise indicates that, despite the recent downturn, users are interacting with the token. Furthermore, it appears to be a similar situation with the new addresses as it also jumped.

Zero-balance addresses are also not left out, as the number increased by 58%. When these metrics increase alongside a price decrease, market participants see the decline as a discount and are buying NOT.

Read more: Where To Buy Notcoin: Top 5 Platforms In 2024

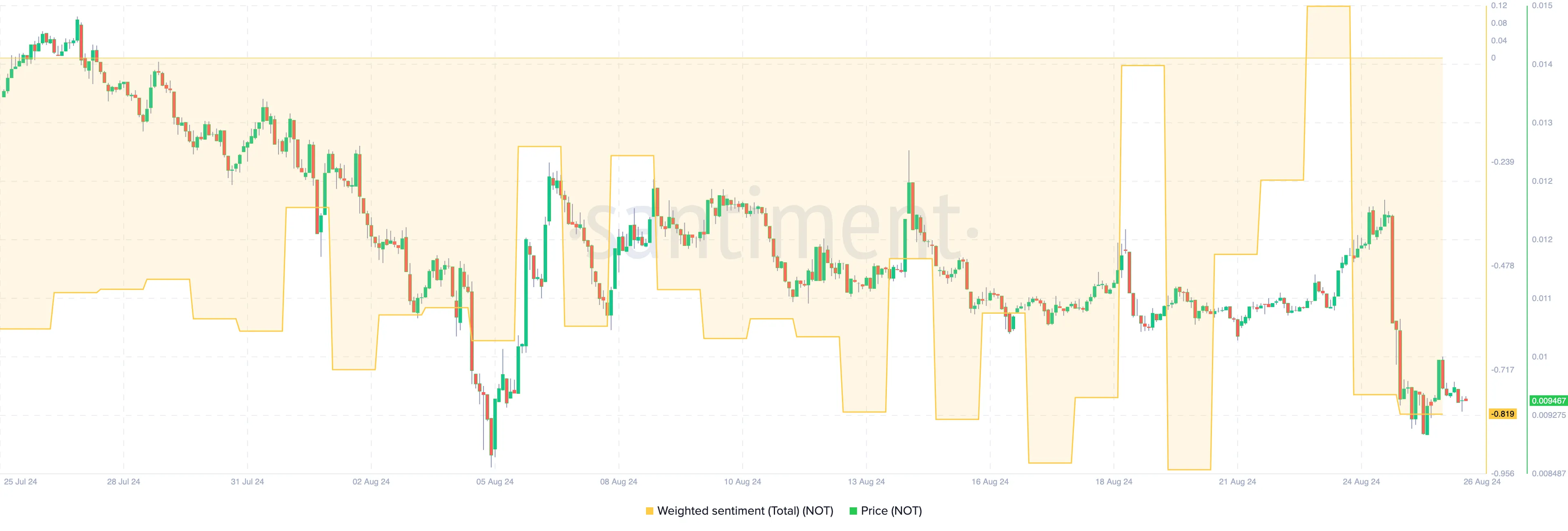

Meanwhile, the Weighted Sentiment around NOT remains in the negative region. Weighted Sentiment gauges the perception the broader market has about a cryptocurrency. If the reading is positive, then most comments online are bullish.

The current reading for NOT, as shown below, indicates that participants are still skeptical about the cryptocurrency’s rebound. However, a closer look at the chart shows that NOT’s price bounces when sentiment is extremely negative.

For example, on August 5, during the crypto market crash, the Weighted Sentiment tumbled to -0.64. Notcoin’s price, at that time, was $0.0088. A few days later, the value increased to $0.013.

On August 16, a similar thing happened: NOT’s price fell to $0.010 alongside sentiment reading but eventually jumped to $0.013 3 days later. If this historical pattern repeats itself, Notcoin might rebound, and it could be time to buy.

NOT Price Prediction: The Telegram Coin Is Oversold

Yesterday, Notcoin’s price dropped to $0.0088, a level last seen during the broader market drawdown earlier this month. A further slide below this point could have spelled trouble for the cryptocurrency associated with Telegram.

However, as seen in the chart below, NOT has rebounded to $0.0093. The daily chart also highlights the Money Flow Index (MFI), showing that NOT is currently oversold. In crypto, an oversold asset often increases the likelihood of a price rebound.

For those unfamiliar, the MFI analyzes price and volume to gauge buying and selling pressure, identifying overbought and oversold conditions. An MFI reading of 80.00 or above signals overbought, while 20.00 or below indicates an oversold state.

Read more: Notcoin (NOT) Price Prediction 2024/2025/2030

With a current MFI reading of 18.30, Notcoin is oversold. If buying pressure builds, the cryptocurrency could aim for a short-term target of $0.012. However, if selling pressure intensifies or more negative news surfaces, like further developments in Durov’s arrest in France, NOT could decline toward $0.0077.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/notcoin-to-break-bearish-trend/

2024-08-26 20:30:00