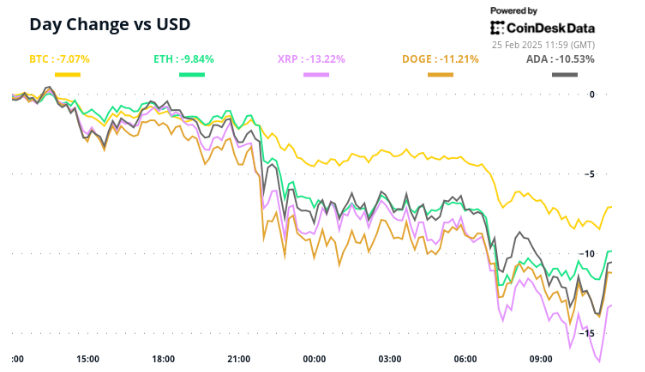

Strategy’s (formerly MicroStrategy) stock (MSTR) has taken a significant hit. The stock fell by double digits following a sharp decline in Bitcoin’s (BTC) price.

As speculation swirls over whether the company could be forced to liquidate its Bitcoin holdings, The Kobeissi Letter weighed in, suggesting that while such a move remains highly unlikely, it’s not entirely off the table.

MSTR Dips Amid Bitcoin Downturn

Over the past 24 hours, Bitcoin’s price dropped more than 3%, triggering a ripple effect that sent MSTR down by 11%. According to Yahoo Finance, the stock closed at $250. This marked a 55% decline from its all-time high (ATH) in November 2024.

Amid this dip, The Kobeissi Letter delved into the prospects of a forced liquidation of the company’s Bitcoin holdings.

“Forced liquidation of MSTR is not necessarily impossible. But, it is highly unlikely. It would need a “mayday” situation to occur,” the post read.

The analysis elaborated that the company’s business model relies on raising capital, rather than selling Bitcoin, to fund its cryptocurrency purchases.

By issuing 0% convertible notes and selling new shares at a premium, Strategy has managed to finance its Bitcoin acquisitions without liquidating assets—even during market downturns.

As of the latest data, Strategy holds approximately $43.4 billion in Bitcoin against $8.2 billion in debt. Thus, its leverage ratio is around 19%.

Notably, most of this debt consists of convertible notes. The conversion prices are below the current share price and maturities extending to 2028 and beyond. This structure provides significant breathing room for the company.

Despite this, the company’s ability to raise fresh capital is not entirely immune to challenges.

“In a situation where their liabilities rise significantly higher than their assets, this ability could deteriorate,” the analysis examined.

While this doesn’t automatically mean “forced liquidation,” it could strain the company’s financial flexibility. Yet, the analysis highlighted that liquidation still remains a possibility but only under a “fundamental change.”

“Effectively, for liquidation to occur, there would first need to be a stockholder vote or a corporate bankruptcy,” The Kobeissi Letter noted.

Nonetheless, the scenario was deemed unlikely given Michael Saylor’s 46.8% voting power. This effectively shields the company from such moves without his consent.

Saylor has been a vocal supporter of Bitcoin, emphasizing its long-term growth. In fact, last week, the firm increased its holdings with a 20,356 BTC addition.

However, The Kobeissi Letter stressed that the real concern for Strategy lies in the future, especially when the company’s convertible bonds mature after 2027.

If Bitcoin’s price falls more than 50% and stays low, Strategy might struggle to refinance or repay the debt in cash, potentially testing its reserves and investor confidence.

“Maintaining investor confidence will be crucial for MSTR in the wake of downswings,” the publication added.

Therefore, while liquidation remains unlikely in the short term, the long-term risks associated with Bitcoin’s volatility and the company’s debt obligations remain an area of concern.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Kamina Bashir

https://beincrypto.com/strategy-mstr-bitcoin-liquidation/

2025-02-26 12:01:54