Both total value locked (TVL) and technical indicators are sending mixed signals for SUI price. After reaching a milestone TVL above $1 billion, SUI’s market support has shown signs of hesitation, leading to a period of stagnation.

Additionally, its ADX suggests that while SUI is in a downtrend, the trend lacks strong momentum, which could allow for a reversal. Investors are watching key support and resistance levels closely, as these will likely shape the next direction in SUI’s price movement.

SUI TVL: Can It Go Back To $1 Billion?

SUI’s total value locked (TVL) currently stands at $979 million, having surged impressively from $313 million on August 4. On September 30, SUI’s TVL crossed the $1 billion mark for the first time, a milestone that coincided with a notable price increase.

During this period, SUI’s price climbed from $0.57 to $1.83, showing strong market enthusiasm and confidence in the coin’s potential.

Read more: Everything You Need to Know About the Sui Blockchain

However, since the end of October, SUI’s TVL has shown signs of stagnation, repeatedly dipping slightly below $1 billion and then recovering. This back-and-forth movement reflects a cautious market sentiment, suggesting that investors may be hesitant to commit long-term capital in SUI tokens.

This stagnation signals potential volatility or downward pressure for SUI’s price, as a sustained lack of confidence in TVL could limit further price growth. Without consistent inflows, SUI might struggle to maintain its previous momentum.

SUI ADX Shows the Current Downtrend Isn’t Strong

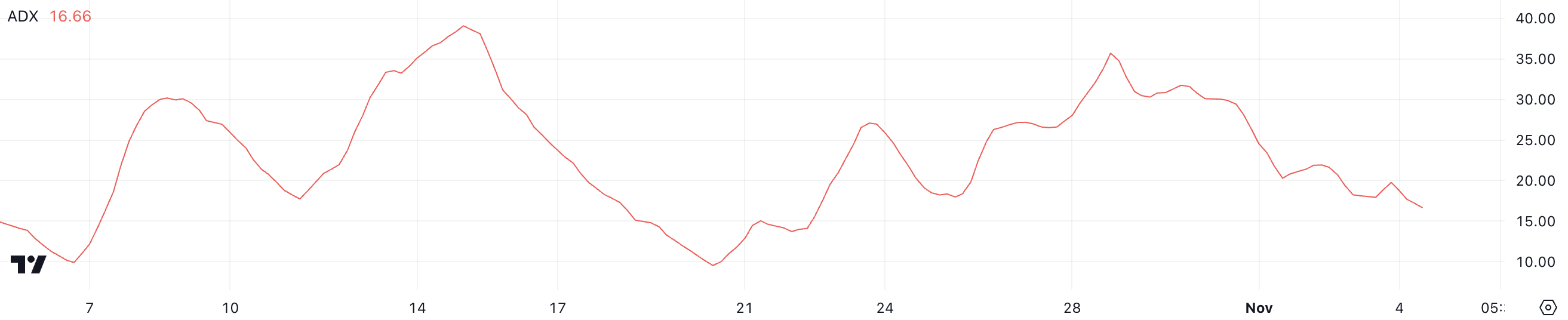

SUI’s ADX (Average Directional Index) currently sits at 16.66, reflecting a consistent decline over the past few weeks. A falling ADX indicates weakening momentum in SUI’s price trend, suggesting that the current downtrend lacks significant strength.

ADX helps measure the strength of a trend rather than its direction, so this low reading implies that the market is not fully committed to a sustained bearish movement.

ADX values are critical for gauging trend strength, with readings below 20 indicating a weak or non-trending market, while values above 25 signal a strong trend, either up or down. The low ADX confirms that SUI’s current downtrend is not particularly strong.

With the ADX at 16.66, the price movement could remain subdued or lack clear direction until momentum picks up. This means SUI may continue to drift without significant volatility unless a stronger trend begins to develop.

SUI Price Prediction: More Corrections Ahead?

SUI’s EMA lines are currently in a bearish alignment, with short-term averages crossing below the longer-term ones, a classic signal of downward momentum. However, the short-term lines have yet to cross the oldest long-term EMA, which would create a “death cross.”

This formation is often seen as a strong bearish indicator, signaling that further declines could be ahead if it materializes. A death cross suggests an intensifying downtrend that could put additional pressure on SUI’s price.

Read more: A Guide to the 10 Best Sui (SUI) Wallets in 2024

If the downtrend continues, SUI’s price may first test support around $1.74. Should this level fail to hold, it could drop further to $1.60, marking a potential 13.9% correction.

On the other hand, the ADX indicates that the current downtrend lacks strong momentum, leaving room for a potential reversal. If an uptrend takes shape, SUI could test resistance at $2.16. Breaking this level would open the door for further gains, with the price possibly reaching $2.36, a potential 26.8% increase.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Tiago Amaral

https://beincrypto.com/sui-price-stalls-tvl-wavers-near-billion/

2024-11-04 14:00:00