After closing at a two-year high of 58.41% on September 19, Bitcoin’s dominance (BTC.D) has initiated its downward trend, noting a 2% decline. Meanwhile, the combined market capitalization of all altcoins (TOTAL2) has surged, indicating a shift in investor sentiment.

However, this is not without a catch. TOTAL 2 has experienced a steady decline, signaling a slowdown in market activity as traders hold back, waiting for the catalyst to spark the anticipated bull run in the year’s final quarter.

Altcoin Season May Be Underway, But With Weak Momentum

TOTAL2 is currently at $927 billion at press time, climbing by 5% since BTC.D started to fall. This reflects the surge in demand for altcoins over Bitcoin in the past ten days.

However, TOTAL2’s momentum indicators signal that buying pressure has weakened over the past few days. This is driven by a slowdown in broader market activity as traders wait for a trigger to ignite the highly anticipated “Uptober.”

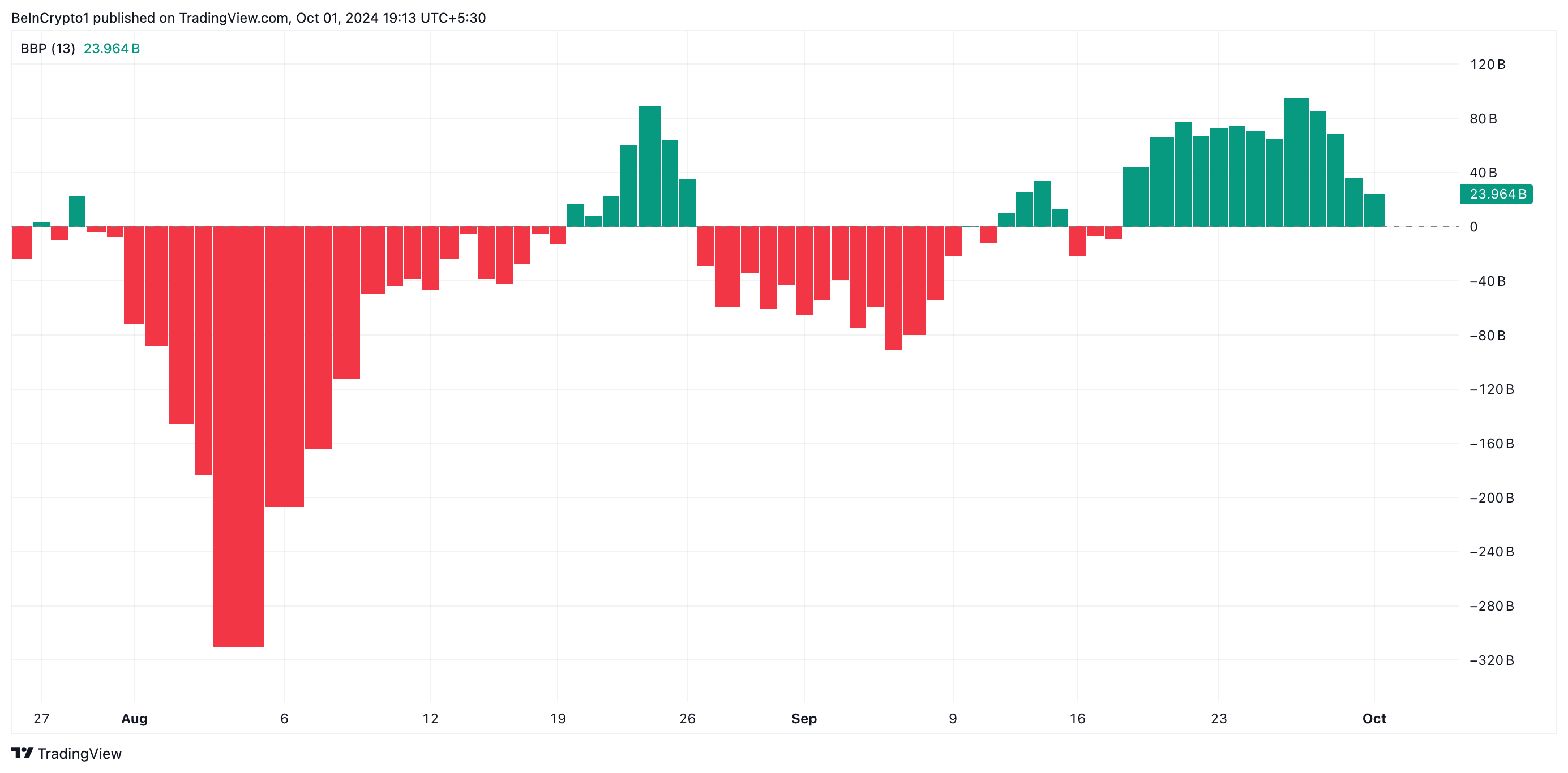

For instance, the size of the histogram bars in TOTAL2’s Moving Average Convergence/Divergence (MACD) indicator has gradually decreased over the past few days.

Read More: 11 Cryptos To Add To Your Portfolio Before Altcoin Season

While the MACD line (blue) remains above the signal line (orange), indicating that buying activity is outpacing selling pressure in the altcoin market, the shrinking size of the histogram bars typically signifies a weakening momentum in bullish trends.

Furthermore, the declining bars of TOTAL2’s Elder-Ray Index, which measures the strength of the bulls and bears in the market, support this position. Although this indicator has shown green bars, indicating that bulls are currently in control, the diminishing size of these bars suggests that buying pressure is weakening and that bulls are gradually losing their grip on the market.

Altseason May Arrive Much Later

After spending 20 days below TOTAL2, the dots of its Parabolic Stop and Reverse (SAR) indicator flipped to the top during Monday’s trading session, signaling a shift in market sentiment. This reversal often indicates that the prevailing uptrend is losing momentum and that a downtrend could begin.

Moreover, according to data from Blockchain Center, the altcoin season commences when at least 75% of the top 50 altcoins outperform Bitcoin over a 3-month period. Currently, only 49 of these assets have surpassed Bitcoin’s performance in the last 90 days. Hence, the altcoin season has not yet arrived.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/altcoins-season-may-arrive-later/

2024-10-01 15:40:07