Ripple’s XRP hit a year-to-date high of $1.63 on November 23. However, fading bullish momentum has made future traders doubtful about the rally’s sustainability. An increasing number are opening short positions, expecting a near-term price correction.

Currently trading at $1.44, XRP has declined by 6% in the past 24 hours. This analysis explores the recent activity in the token’s futures market and assesses the likelihood of a continued XRP price decline.

Ripple Traders Bet on a Price Drop

A drop in its open interest has accompanied XRP’s price decline over the past 24 hours. Per Coinglass data, this sits at $2.52 billion, falling by 9% during that period.

Open interest refers to the total number of active contracts in a derivatives market, such as futures or options, that have not been settled. When open interest drops as an asset’s price falls, traders are closing their positions to lock in profits or minimize losses, indicating reduced market participation.

In XRP’s case, this suggests waning confidence in the continuation of the uptrend and hints at a sustained reversal in the asset’s price movement.

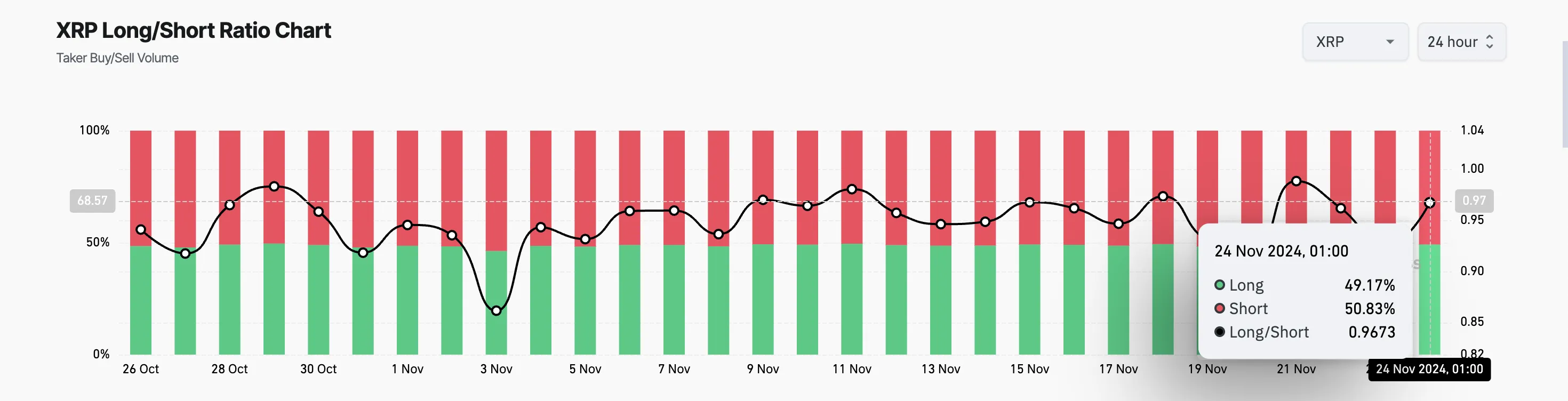

Moreover, XRP’s Long/Short ratio confirms this bearish outlook. As of this writing, this sits at 0.96%, with 51% of all positions opened shorting the altcoin.

The Long/Short ratio measures the proportion of long positions (bets on price increases) to short positions (bets on price decreases) in a market. When the ratio is below 1, it indicates that there are more short positions than long positions, suggesting a bearish sentiment among traders.

This imbalance in the XRP market reflects growing pessimism about the asset’s near-term prospects and may contribute to continued downward pressure on its price.

XRP Price Prediction: More Declines Imminent

XRP is currently trading at $1.44, holding above the $1.33 support level. If bearish sentiment intensifies, the price could drop to this support. A further decrease in buying pressure at that level may push XRP down to $1.15.

On the other hand, a shift in market sentiment from negative to positive will invalidate this bearish outlook. Should this happen, the altcoin will reclaim its year-to-date high of $1.63 and attempt to surpass it.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/xrp-price-decline-after-year-to-date-high/

2024-11-24 13:00:00