Dogecoin (DOGE) price is up 10% in the last 24 hours, catching the eye of traders with increased activity. The recent surge in trading volume and trend indicators like ADX reflect growing interest in the market. This bullish momentum is further supported by the positioning of DOGE’s EMA lines, pointing to a potential continuation of the uptrend.

If this strength holds, DOGE could soon test key resistance levels, with room for further gains. However, a reversal could lead to a retest of support zones, making it an important time to watch for trend changes.

DOGE Daily Volume Recently Crossed $ 2 Billion

DOGE’s daily trading volume recently spiked to $2.27 billion, the highest since August 5. It has since settled slightly, now sitting at $2.12 billion. Such a surge in volume indicates heightened activity, drawing the attention of traders and investors alike.

This uptick in volume can signal potential shifts in the market trend, making it a key metric for assessing buying or selling pressure.

Tracking trading volume is crucial because it provides insight into the strength behind price movements. The recent surge in DOGE’s volume appears to correlate with its price increase, from $0.10 to $0.134 between October 10 and October 18.

Higher trading volumes often indicate a stronger market conviction, and in this case, it suggests that the price rise has significant backing. The increase in activity supports the notion that investors have confidence in the current trend, potentially pushing DOGE towards further gains.

Read more: How To Buy Dogecoin (DOGE) and Everything You Need To Know

Dogecoin’s Current Uptrend Is Strong

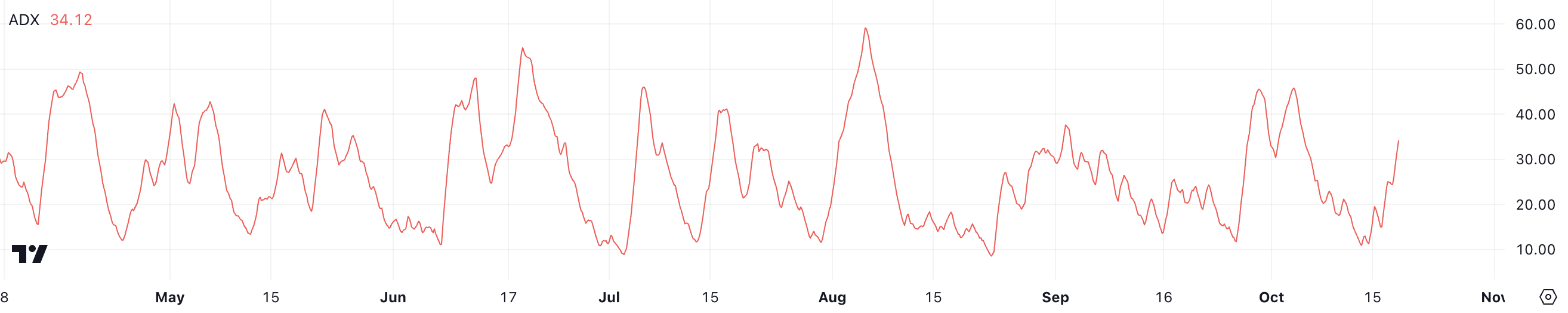

DOGE’s ADX currently sits at 34.12, climbing from just 13 just four days ago. This substantial increase indicates that DOGE’s market trend is gaining significant strength. The ADX, or Average Directional Index, helps measure the intensity of a trend, whether bullish or bearish, without considering its direction.

The sharp rise in DOGE’s ADX suggests that the market is experiencing a period of strong conviction, with the trend picking up substantial momentum. Such a rapid shift implies that investor sentiment has shifted notably, creating an environment ripe for further price action.

The ADX is a powerful tool for identifying the strength of trends. It ranges from 0 to 100, with values below 20 typically signaling a weak or non-existent trend, while values above 25 indicate a well-defined and strengthening trend.

DOGE’s current ADX value of 34 places it comfortably in the “strong trend” territory, signaling that recent price action is not just a brief spike but part of a sustained movement. Considering that DOGE’s price has already surged by 10% in the last 24 hours, the growing ADX adds credibility to the rally, suggesting that there is considerable momentum supporting the price action.

Although the current ADX is strong, it remains well below the levels seen during recent price spikes, such as between September 26 and September 28, when DOGE’s price surged by 30% and ADX reached almost 45. This suggests that there is still room for further strengthening and that the ADX could continue to rise if the uptrend persists.

If the current momentum continues, the ADX could easily climb higher, further validating the strength of the current trend and opening the door for more potential gains.

DOGE Price Prediction: Back To $0.17 In October?

DOGE’s EMA lines are currently in an uptrend, with the short-term EMAs positioned above the long-term EMAs and a considerable gap between them. This setup indicates a strong and healthy upward momentum.

Exponential Moving Averages (EMAs) are a type of moving average that gives more weight to recent price data, making them highly responsive to the latest market conditions.

They are used to identify trends, with shorter-term EMAs reacting quickly to price changes while longer-term EMAs move more gradually. When short-term EMAs are above the long-term ones, it typically signals an uptrend, suggesting that buyers have the upper hand and that momentum is building.

Read more: Dogecoin (DOGE) Price Prediction 2024/2025/2030

If DOGE’s current uptrend continues and strengthens, DOGE price could potentially test the $0.14 level and even challenge the resistance at $0.175—its highest price since May. This movement would represent a roughly 30% increase from current levels, showing the strength of the upward trend indicated by the EMA lines.

The significant distance between the short-term and long-term EMAs suggests that the bullish momentum has been building steadily, supporting the case for a continued push higher.

However, if the uptrend were to falter and reverse, DOGE would likely revisit key support zones at $0.12 and possibly even dip to $0.098, representing a potential 26% correction. The gap between the EMA lines would begin to narrow, signaling a weakening trend, and such a scenario could indicate a shift in market sentiment towards the bearish side.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Tiago Amaral

https://beincrypto.com/dogecoin-doge-price-climbs/

2024-10-18 20:00:00