In his latest video analysis titled “BITCOIN’S One Indicator Signaling LAST Major Dip,” Dan Gambardello, a noted crypto analyst with 370,000 subscribers on YouTube, delves into the latest price action of Bitcoin to forecast what could potentially be the final major dip. After dropping as low as $60,000 on Wednesday, the fear of another deeper price crash has grabbed the Bitcoin market.

Why This Could Be The Final Leg Down For Bitcoin

Gambardello emphasizes the significance of the daily and six-hour charts. On the daily chart, Bitcoin is currently testing the 50-day moving average, a level that often serves as a litmus test for short-term market sentiment.

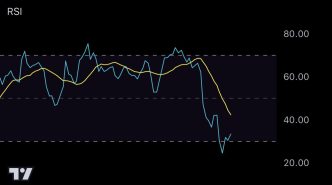

However, the analyst’s main focus is on the six-hour chart’s Relative Strength Index (RSI), a momentum oscillator used to measure the speed and change of price movements, which has hit oversold levels. According to Gambardello, the RSI reaching oversold territory is traditionally viewed as a bullish signal, potentially indicating an approaching end to the current price dip.

Related Reading

“The bottom is actually, I think, close. There could be some type of capitulation in the very short term, but I think there could be a very strong bounce after that happens,” Gambardello noted, suggesting that despite the immediate market turmoil following the Israel-Iran conflict news, the fundamentals point towards an eventual robust recovery.

Via X, Gambardello added, “Nothing like a 6 hour oversold RSI at the beginning of bull season. Also great during bull season.”

This assertion is grounded in his analysis of past market behaviors during similar conditions, reinforcing the cyclical nature of Bitcoin’s market dynamics. Drawing parallels to historical data, Gambardello highlights the behavioral trends of Bitcoin in previous Octobers, noting a pattern of initial declines followed by strong recoveries by the end of the month.

“October will close green. It’s always [like this] with the dip. People are just freaking out. I guess that’s it, but this gives us a little time. We’re getting all these red candles going into October, give us another week, maybe even two and we could get a pump, a breakout to the upside to end October,” Gambardello claims.

Related Reading

Further deepening the analysis, Gambardello discusses the potential scenarios around Bitcoin’s lower trend line, a recurrent support level over the past six months. He speculates that if Bitcoin approaches this trend line again, it could effectively serve as a robust support level, potentially marking the last significant downturn before a sustained upward trend.

Notably, one final touch of the trendline could bring down the BTC price as low as $50,000. However, Gambardello thinks that this is a less likely scenario as the 6-hour RSI has already hit oversold territory while BTC is currently bouncing off the 50-day moving average.

Moreover, Gambardello refers to Bitcoin’s performance in past halving years, which are typically followed by bull markets, as seen in 2016 and 2020. Gambardello suggests that the current year could follow a similar trajectory. “This is a Halving year. We’ve seen what’s happened in Halving years in 2020 and 2016 in October. Is it going to repeat?”

At press time, Bitcoin traded at $60,899.

Featured image created with DALL.E, chart from TradingView.com

Source link

Jake Simmons

https://www.newsbtc.com/news/bitcoin/bitcoin-last-big-drop-expert-key-indicator/

2024-10-03 12:30:26