Jupiter, a DEX Aggregator platform on Solana, has unveiled the criteria for its second airdrop scheduled for January 2025.

The allocation plan for this airdrop includes 700 million JUP, which is equivalent to $581 million at the current market price.

2.3 Million Wallets Eligible for Jupiter’s Second Airdrop

According to Jupiter, the 700 million JUP for this airdrop will be distributed across two groups. Specifically, Jupiter will allocate 500 million JUP to Users and Stakers and the remaining 200 million JUP to Carrots and Good Cats:

- Users: Individuals who perform transactions on the platform, such as swaps.

- Stakers: Those participating in staking.

- Carrots: Users who continue holding their airdrop rewards, purchase/increase their JUP holdings, or are compensated after being mistakenly flagged as bots.

- Good Cats: Contributors who make quality contributions to the community.

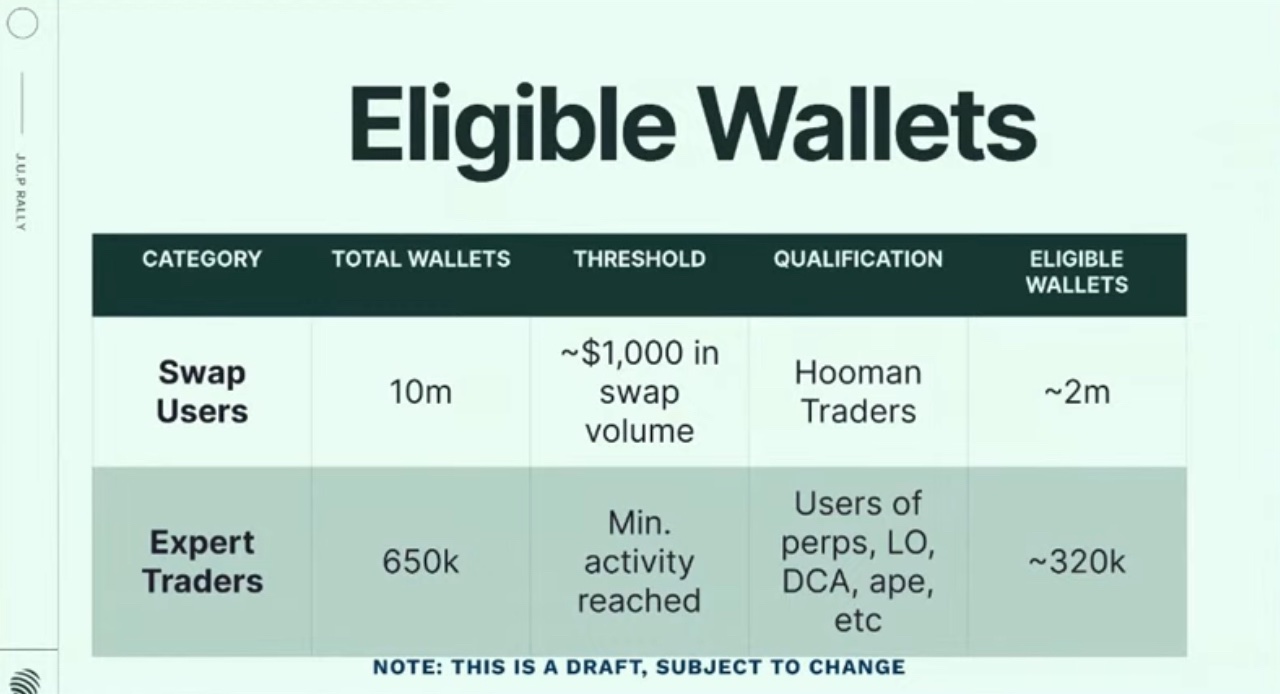

Additionally, Jupiter revealed that 2.32 million wallets out of a total of 10.65 million wallets are eligible, accounting for approximately 22%. Among these, 2 million wallets meet the criteria of having a swap volume of around $1,000. In comparison, 320,000 wallets belong to Expert Traders who utilize advanced features like limit orders, perpetual swaps, DCA, and Ape Pro.

Jupiter also noted that these conditions are drafts. They are subject to possible changes.

Earlier this year, Jupiter conducted its first airdrop, which became one of the largest in Solana’s history. The platform distributed 1 billion JUP to nearly 1 million wallets. Following the airdrop, the JUP price surged 300%, rising from $0.45 to an all-time high of $1.85.

However, JUP is currently trading at around $0.85, with no significant price changes since the second airdrop criteria were announced.

Data shows that JUP currently has a circulating supply of 1.35 billion, with a maximum supply of 10 billion. In August, the platform proposed and gained 95% approval to burn 3 billion JUP—30% of the total supply—over six months

Additionally, data from DefiLlama shows Jupiter’s total value locked reached over $2.4 billion in December. Daily Perps volume on the platform averaged $1.5 billion in the past two months.

This is double the average volume of other months this year. The data reflects the growing demand for trading on Jupiter

The post Jupiter Announces $580 Million Airdrop Criteria: Everything You Need to Know appeared first on BeInCrypto.

Source link

Nhat Hoang

https://beincrypto.com/jupiter-announces-580-million-airdrop-criteria/

2024-12-27 13:19:27