The cryptocurrency markets are closely watching several key US macroeconomic events this month, which could significantly impact portfolios. Fed interest rates announcements in particular will be a key print in September.

Positive economic data often influences investor sentiment in the crypto space. As traditional markets strengthen, investors become more confident in the overall economy, and vice versa. This could influence risk appetite and, ultimately interest in alternative assets like cryptocurrencies

US Economic Events to Watch in September

Bitcoin (BTC) has slipped further from the $60,000 psychological level, continuing its sluggish performance despite positive catalysts. Factors like growing institutional adoption, a potentially more favorable regulatory environment, and expected Federal Reserve (Fed) rate cuts have done little to boost BTC’s price.

Currently, Bitcoin is over 20% below its recent all-time high of nearly $73,500, recorded more than five months ago. As the new month begins, crypto market participants are closely watching key events, particularly because historical data indicates that September has traditionally been Bitcoin’s worst-performing period.

Read more: How To Buy Bitcoin (BTC) and Everything You Need To Know

Non-Farm Payrolls, Unemployment Rates

Investors will keep a close eye on the upcoming US Non-Farm Payrolls (NFP) report, which includes key data on job creation and the unemployment rate. The July report showed weaker-than-expected job growth with 114,000 jobs added, leading to a median forecast of 162,000 for August.

If August’s NFP figures are strong and the unemployment rate declines, it could indicate a robust economy, which might positively influence investor sentiment toward cryptocurrencies. Employment-related reports like these can significantly affect market sentiment, risk appetite, and the overall economic outlook, indirectly impacting Bitcoin and the broader crypto market.

Before the NFP report, the Job Openings and Labor Turnover Survey (JOLTS) data, set to be released on Wednesday, will offer insights into the labor market’s health. A median forecast of 8.1 million job openings in July, slightly down from 8.18 million, could indicate a growing economy, increased consumer spending, and potential wage growth.

Additionally, the ADP National Employment Report, due on Thursday, will provide a snapshot of private sector employment. If July’s ADP report exceeds the previous 122,000 jobs added, it would signal strong job creation and economic growth

Donald Trump Debate Against Kamala Harris

On September 10, the Republican and Democrat presidential candidates for the upcoming November elections, Donald Trump and Kamala Harris, will participate in a debate. With cryptocurrencies and digital assets becoming key issues in the campaign, this event could trigger volatility in the Bitcoin and broader cryptocurrency markets.

Both parties have shown an interest in crypto, with Harris reportedly warming up to pro-crypto policies.

“They’ve expressed that one of the things that they need are stable rules, rules of the road…focus on cutting needless bureaucracy and unnecessary regulatory red tape… innovative technologies while protecting consumers and creating a stable business environment with consistent and transparent rules of the road,” Bloomberg reported, citing Brian Nelson, a senior advisor on Vice President Harris’ campaign.

On the Republican side, Trump’s team is working to position the US as the world crypto capital. As both candidates seek to connect with the crypto community, the debate is expected to be intense, especially given Trump’s combative style and Harris’s background as a prosecutor.

US CPI

The US Consumer Price Index (CPI) data for August, scheduled for release on September 11, will be one of the key economic indicators for the month. This data measures the rate of inflation by tracking price changes in consumer goods and services. In July, the CPI inflation rate came in at 2.9%, slightly lower than the 3% recorded in June, according to the US Bureau of Labor Statistics (BLS).

The August CPI data will be crucial for determining whether inflation is continuing to slow, as the Federal Reserve targets a 2% inflation rate. If the CPI falls below 2.9%, it would suggest that inflation is moving in the right direction, potentially reducing the pressure on the Fed to maintain high-interest rates.

Ahead of the CPI release, speeches by New York Fed President John C. Williams on September 6 and Fed Governor Christopher Waller will be closely watched. Both have previously indicated a possible shift towards looser monetary policy as inflation shows signs of easing and the labor market stabilizes. If their upcoming speeches express confidence that the disinflationary trend is holding steady, it could be bullish for the cryptocurrency market.

Currently, price pressures are easing across the economy, with declines in goods prices, slower increases in housing costs, and more moderate wage growth contributing to a broader reduction in inflation, especially in the services sector. This trend, if sustained, could positively influence investor sentiment, particularly in riskier assets like cryptocurrencies.

US PPI

The day after the CPI data is released, the US Bureau of Labor Statistics will publish the US Producer Price Index (PPI) inflation data. In July, the PPI showed more significant easing than expected, providing relief for both stocks and Bitcoin.

Specifically, the US PPI inflation rate decreased to 2.2% year-on-year (YoY) in July, below the expected 2.3% and down from the previous period’s revised 2.7%. Similarly, Core PPI inflation, which excludes food and energy prices, dropped to 2.4% YoY in July, also below the forecast of 2.7% and significantly lower than the previous 3.0%.

If the August PPI data, set to be released on September 12, shows continued declines in inflationary pressure, it could boost risk appetite among investors, favoring assets like Bitcoin and other cryptocurrencies.

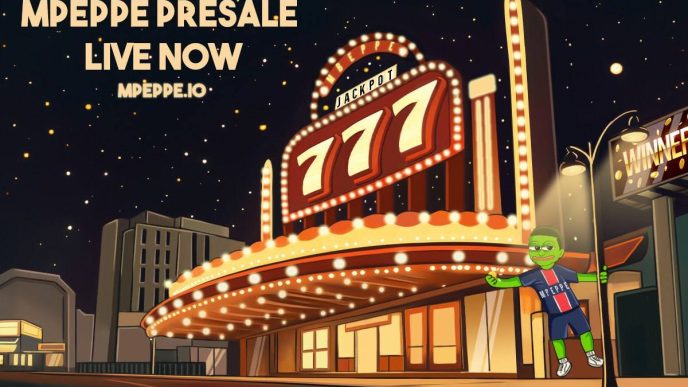

Fed Interest Rate

Another key event this month will be the Federal Reserve’s interest rate decision on September 18. In its previous meeting, the Federal Open Market Committee (FOMC) decided to keep interest rates unchanged, with policymakers unanimously voting to maintain the benchmark overnight borrowing rate between 5.25% and 5.50%.

However, during a recent meeting, Fed Chair Jerome Powell expressed increased confidence that inflation is on a sustainable path toward the Fed’s 2% target.

“The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks,” Powell stated.

Read more: How to Protect Yourself From Inflation Using Cryptocurrency

This signals that the Fed may be nearing the end of its rate-hiking cycle, depending on the latest economic data. Markets participants will closely watch the upcoming decision, as it could widely impact financial markets, including cryptocurrencies.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Lockridge Okoth

https://beincrypto.com/us-economic-events-to-watch-in-september/

2024-09-02 09:40:04