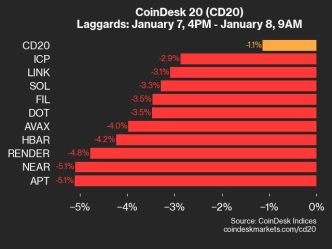

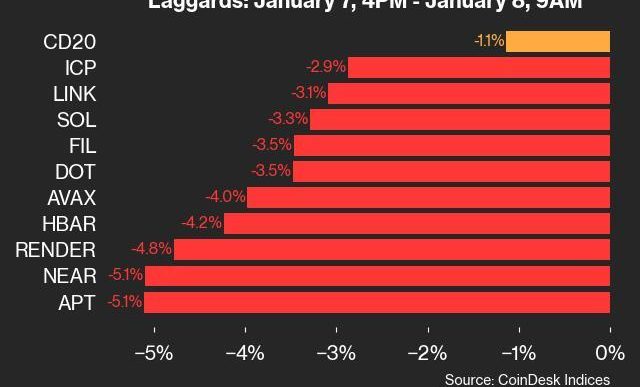

Bitcoin plunged below $95,000 on Wednesday after shedding almost 8% over the past day. Amidst heightened volatility, investors appear to have positioned themselves cautiously.

But prominent entrepreneur and investor Robert Kiyosaki believes the latest “crash” is great. Here’s why:

Opportunity in Crisis

Kiyosaki took to X to express his optimism about Bitcoin despite its recent price decline. Best known as the author of the best-selling personal finance book Rich Dad Poor Dad, Kiyosaki referred to the cryptocurrency’s downturn as “great news,” describing it as an opportunity to purchase it at a lower price and portraying it as being “on sale.”

He reiterated his belief in the investment strategy of “buying low and holding” long-term. Highlighting Bitcoin’s limited supply, Kiyosaki noted that fewer than two million BTC remain to be mined.

Kiyosaki has been a vocal proponent of Bitcoin and frequently advises investors to consider it an effective inflation hedge. In a recent New Year forecast, the financial guru predicted that Bitcoin could soar to $175,000-$350,000 by 2025. This optimistic outlook isn’t out of place, as it closely matches the range forecasted by several other financial experts.

Bernstein analysts, for one, set a price target of $200,000 for Bitcoin by late 2025, restating a previous statement. Their projection is part of a larger perspective on the crypto industry, which they believe is transitioning into an “Infinity Age” defined by mainstream acceptance and integration with the global financial system.

“Temporary Pause”

Weighing on the latest price action, QCP Capital stated that Bitcoin has retreated towards the $95,000 support level following unexpectedly strong US labor market data. The JOLTS job openings report revealed 8.1 million vacancies, which exceeded the forecast of 7.74 million.

This labor market resilience triggered risk-off sentiment, which, in turn, drove a sell-off in risky assets as long-term bond yields surged. The sharp decline in Bitcoin’s price led to liquidations totaling $206 million in just one hour.

The ripple effects of the sell-off extended to equities, with the Nasdaq and S&P 500 reflecting broader market weakness, trading near 21,200 and 5,900, respectively. Meanwhile, Bitcoin ETF inflows have dwindled by 94%, falling to $52.9 million from a previous $987 million.

As markets await the Federal Open Market Committee (FOMC) and Non-Farm Payroll (NFP) reports later this week, these developments are expected to shape Bitcoin’s next moves. Despite the pullback, QCP Capital added that it anticipates this dip to be a temporary pause, with optimism building for a bullish rally ahead.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Source link

Chayanika Deka

https://cryptopotato.com/kiyosaki-urges-investors-to-buy-low-and-hodl-as-bitcoin-plunges-below-95000/

2025-01-08 13:09:04