Chainlink (LINK) price has surged over 8% in the last 24 hours, with trading volume soaring by 106% to reach $1.04 billion.

Despite this strong price movement, whale activity has stabilized, as the number of addresses holding between 100,000 and 1,000,000 LINK has remained steady at 527 after a previous peak of 534.

LINK Whales Keep the Neutral Stance

The number of addresses holding between 100,000 and 1,000,000 LINK increased significantly from 510 on December 18 to a monthly high of 534 on December 27. This surge in whale activity highlights a period of strong accumulation, reflecting heightened interest from large investors during that time.

Tracking such whale behavior is crucial, as their buying or selling patterns can heavily influence price trends. Whales’ accumulation often signals confidence in the asset and can drive further price growth, as their substantial trades create upward momentum.

However, after reaching the peak of 534 addresses, the number began to decline slightly and has since stabilized at 527. This recent stabilization indicates that large investors are currently neither significantly accumulating nor offloading their LINK holdings, suggesting a neutral sentiment.

Despite the 8% price surge in the last 24 hours, the lack of continued whale accumulation could signal caution regarding the sustainability of the recent rally. For LINK price to maintain its upward trajectory, renewed interest and increased activity from these large holders may be necessary to provide additional support.

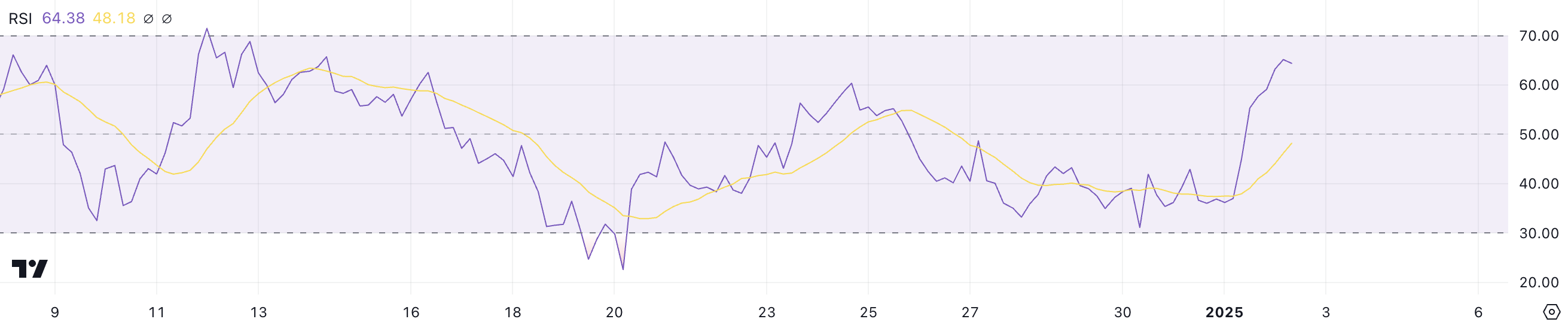

Chainlink RSI Signals Possible Recovery

Chainlink Relative Strength Index (RSI) has experienced a sharp increase, jumping from 36.9 to 64.3 within just a single day. This rapid surge reflects a significant shift in momentum, driven by strong buying pressure following the recent price rally.

The RSI, a widely used momentum indicator, measures the speed and magnitude of price movements on a scale from 0 to 100, providing insights into whether an asset is overbought or oversold. Readings above 70 indicate overbought conditions, often signaling a potential pullback, while readings below 30 suggest oversold conditions and the possibility of a recovery.

At 64.3, Chainlink RSI is nearing the overbought zone, indicating that while buying momentum remains strong, the asset is approaching a critical threshold where upward movement may begin to face resistance. In the short term, this RSI level suggests that LINK still has room for moderate gains, but traders should monitor for signs of exhaustion as it nears 70.

If buying pressure continues, the RSI could move into overbought territory, signaling the potential for a temporary consolidation or correction before further price movement. Conversely, a stabilizing or declining RSI could indicate that momentum is beginning to weaken.

LINK Price Prediction: Can It Reclaim $30 In January?

Chainlink EMA lines are signaling the possibility of a Golden Cross forming soon. A golden cross is a bullish indicator that occurs when a shorter-term EMA crosses above a longer-term EMA.

If this Golden Cross materializes and the current uptrend continues, LINK price could see significant upward momentum. The price might test the resistance at $25.99, and a breakout above this level could pave the way for further gains. Targets at $27.46 and potentially $30.94 could mark substantial growth for the asset.

On the other hand, recent whale activity and the elevated RSI suggest that the current surge may not be entirely sustainable, leaving room for a potential reversal.

If the uptrend falters and selling pressure increases, LINK price could face a correction, testing its immediate support at $21.32. Should this level fail to hold, the price might drop further to $20.02, signaling a deeper retracement.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Tiago Amaral

https://beincrypto.com/link-price-jump-whale-moves-pause/

2025-01-03 01:00:00