ME, the token launched by Magic Eden, a leading NFT marketplace, has seen its volume plunge significantly. This crash could be linked to declining interaction with the token since its airdrop some days back.

However, trading volume is not the only part of the Magic Eden ecosystem affected. This on-chain analysis reveals what else and how the price might fare in the coming days.

Magic Eden Sees Waning Interest in Two Major Areas

Data from Santiment shows that the Magic Eden volume was nearly $5.50 billion on Wednesday, December 11. As of this writing, the same metric has decreased to $1.58 billion, indicating that it declined by approximately $4 billion.

Trading volume represents the total number of buy and sell transactions for a specific cryptocurrency asset within a given time frame, typically measured daily. When the volume increases, it means that there is a lot of interaction with the cryptocurrency.

On the other hand, a decrease in volume indicates reduced buying and selling, which makes it challenging for the price action to increase. Interestingly, this decline in volume coincides with ME’s 54% price decrease since its launch on Tuesday. Should the volume continue to fall, then the altcoin’s value might not experience a quick rebound from $5.15.

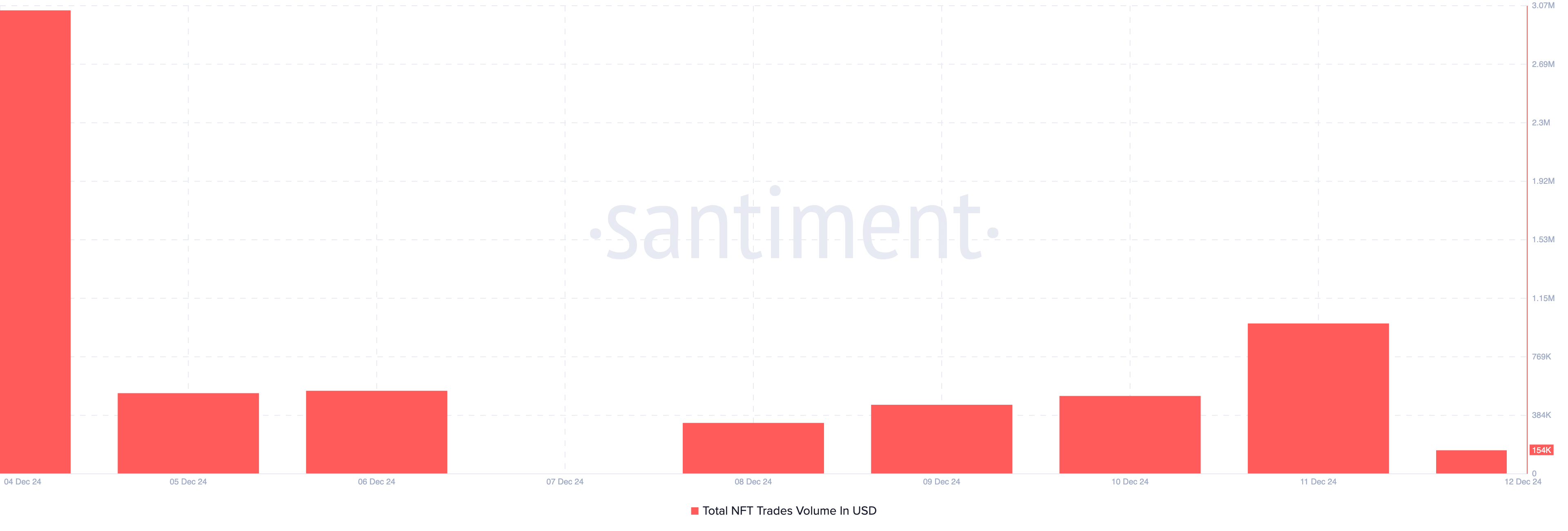

Like the token’s trading volume, the total NFT trade volume has also tanked. NFT trade volume represents the total value of transactions, measured in US dollars, involving non-fungible tokens within a specific marketplace during a given measurement period.

According to on-chain data, the volume was over $3 million on December 4. As of this writing, that value has declined to $154,000, indicating that the number of NFTs bought and sold on the Magic Eden marketplace is no longer at the height it was last week.

Should the platform continue to experience this decline, it might also affect the demand for the ME token, which is also the marketplace’s utility token.

ME Price Prediction: Soon to Lose $5 Support

At first glance, the 1-hour ME/USD chart shows that the altcoin is trading within a descending channel. A descending channel, characterized by lower highs and lower lows, indicates a bearish market trend. This pattern suggests that sellers have the upper hand, consistently driving the price downward.

Considering that this is happening with the Magic Eden token volume declining, then the price might go lower. If this remains the case, then ME’s price could decline to $4.93 in the short term.

On the flip side, if bulls defend the price at the support level of $5.13, this forecast might not happen. In that case, the cryptocurrency’s value might climb to $7.19.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/magic-eden-token-volume-nosedives/

2024-12-12 12:30:00