The Bitcoin market is grappling with mixed predictions, fueled by both technical analysis and external factors like geopolitics. Political turmoil has hurt Bitcoin before. When tensions grow, cryptocurrency prices fall, unlike gold, market analysts say.

Related Reading

Bitcoin shot down to about $59,000 as the Middle East’s crisis worsened, and then recovered somewhat, but continuing volatility is probably in the cards. In spite of this uncertainty, CoinCodex’s latest BTC price prediction offers a huge 40% gain in the price of the crypto asset, which could top out at $86,428 by November 2024.

Market expert Ali Martinez notes that Bitcoin is moving in a descending parallel channel, a pattern generally associated with price drops. Bitcoin’s technical setup says it might drop to $52,000, increasing uncertainty. Though CoinCodex predicts a bullish climb, BTC’s future is uncertain.

#Bitcoin could drop to $52,000 if the governing pattern behind the recent price action is a descending parallel channel! pic.twitter.com/CEAbdWXCrB

— Ali (@ali_charts) October 2, 2024

Impact Of Market Sentiment On Bitcoin

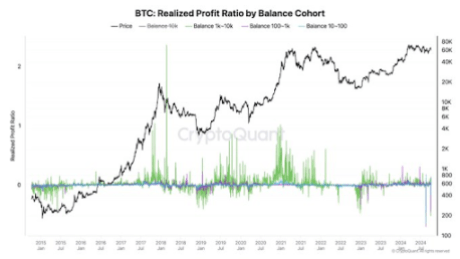

The price momentum of Bitcoin would depend on market sentiment. According to CryptoQuant, Long/Short Volume to Open Interest Ratio is a notable indicator that reflects trader positioning: when this ratio grows, it indicates that long positions are dominant and it is commonly seen as an indication of positive market movement.

A little too much optimism in the markets, however, produces prices to be corrected downwards. On the other hand, too much short position also hints at bearish sentiments, but at the extreme, it can be a precursor to the rebound of prices.

BTCUSD trading at $61,696 on the daily chart: TradingView.com

Currently, Bitcoin’s sentiment remains neutral, with the Fear & Greed Index at 41, reflecting the caution in the market. This suggests that, despite its stable performance with 60% green trading days over the last month, investors are still wary.

Geopolitical Factors

While geopolitical events influenced the price movement of Bitcoin aside from technical analysis, its movements are varied. According to cryptocurrency analyst Jesse Colombo, the coin usually traded downhill during periods of increased global tensions. So far, there is a rebound due to the Middle East crisis, and its traders are expecting more of the same. This has the consequence of making the alpha crypto experience drastic value changes mainly when the tensions in different parts of the world keep rising.

Related Reading

The Road Ahead

Bitcoin’s future is not by any means certain with these mixed signals. Ali Martinez has a bearish forecast, but on this assessment in combination with CryptoQuant’s market sentiment analysis, the price could well fall to $52,000. CoinCodex believes that this will provide more reason for optimism so that BTC can enjoy healthy growth in the coming months or years.

Featured image from Vecteezy, chart from TradingView

Source link

Christian Encila

https://www.newsbtc.com/news/market-signals-hint-at-bitcoins-potential-fall-to-52000-analyst/

2024-10-05 06:30:35