MicroStrategy (MSTR), a leading business intelligence firm turned Bitcoin holder, has made history, achieving an astounding $21.8 billion in trading volume on November 19, 2024.

The milestone surpassed the combined trading volumes of tech heavyweights Apple (AAPL), Amazon (AMZN), and Meta (META), highlighting the market’s growing enthusiasm for MicroStrategy’s BTC-centric strategy.

Unprecedented Momentum

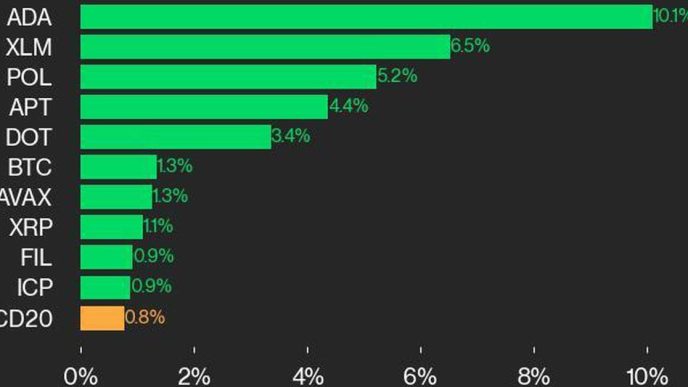

Data shared by investment expert HODL15Capital showed that MicroStrategy had the third-highest 24-hour trading volume after Nvidia (NVDA) and Tesla (TSLA).

However, the figure was almost three times more than fourth-placed Apple, which raked in slightly less than $8 billion. Fellow tech titans Amazon and Meta recorded more modest amounts of $6.32 billion and $5.11 billion, respectively.

Some analysts have partly attributed MSTR’s trading frenzy to the 2x leveraged MicroStrategy exchange-traded funds (ETFs) launched earlier in August. The ETFs collectively manage about $3.8 billion in assets and have provided more than $7.7 billion in leveraged exposure to MSTR stock.

In a recent post on X, investment advisor Will Hershey highlighted these ETFs as critical drivers of MicroStrategy’s outperformance. Since their debut, MSTR’s market capitalization has skyrocketed 237%, vastly outpacing Bitcoin’s 61% rise over the same period. Additionally, the cryptocurrency’s recent rally, including multiple all-time highs, has also fueled the stock’s momentum.

Record Bitcoin Purchases Strengthen MicroStrategy’s Position

MicroStrategy’s pivot to BTC started in 2020 as a hedge against macroeconomic instability. Since then, it has pioneered the corporate Bitcoin treasury model, inspiring other companies, such as Japan’s Metaplanet, to follow suit.

Some of the firm’s largest crypto purchases include $1.026 billion spent on 19,452 BTC on February 24, 2021, and $2.03 billion used to buy 27,200 coins on November 11, 2024. Its latest purchase of 51,780 BTC at a price of $4.6 billion cemented MicroStrategy’s position as the largest corporate Bitcoin holder, with no less than 331,000 coins on its books.

Market observers have noted that the company’s Bitcoin buys often correlate with increased volatility in the coin’s price. For instance, its last haul briefly caused a dip before the asset rebounded to new highs.

In a recent X Space event, the company’s executive chairman, Michael Saylor, revealed that he had been invited to give a short presentation to the Microsoft board of directors to discuss investing in Bitcoin.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Source link

Wayne Jones

https://cryptopotato.com/microstrategys-btc-fueled-trading-volume-surpasses-apple-amazon-meta-combined/

2024-11-20 13:35:22