Business intelligence company MicroStrategy has made big headlines again with its latest acquisition of 18,300 Bitcoin, valued at approximately $1.11 billion.

The purchase, the largest by the company in over three years, was disclosed in a recent filing with the US Securities and Exchange Commission (SEC), which took place between August 6 and September 12, 20241.

MicroStrategy Now Holds 1% Of All BTC Ever Issued

This purchase brings MicroStrategy’s total Bitcoin holdings to around 244,800 BTC, valued at approximately $14 billion. Notably, this represents about 1% of all Bitcoin ever issued. The company acquired its Bitcoin at an aggregate purchase price of about $9.45 billion, with an average purchase price of approximately $38,585.

Related Reading

According to Bloomberg, the company’s latest acquisition was financed through the issuance and sale of common shares, a strategy that has been part of its broader capital allocation plan. In August, MicroStrategy conducted a 10-for-1 stock split to make its shares more accessible to investors and employees.

Based in Tysons Corner, Virginia, MicroStrategy began its Bitcoin acquisition strategy in 2020 as a hedge against inflation. Co-founder and executive chairman Michael Saylor has been a vocal advocate for Bitcoin, viewing it as a superior store of value compared to traditional assets like cash, bonds, or gold.

Despite the volatility in the cryptocurrency market, Saylor remains confident in Bitcoin’s long-term potential and continues to accumulate more digital assets.

Bitcoin Price Analysis

As reported by NewsBTC, Saylor revealed that he owns about $1 billion worth of BTC and has no plans to sell any of his holdings. He believes Bitcoin is a great investment for individuals, families, institutions, and even countries.

However, Saylor’s belief in BTC’s potential is further reflected in his prediction that the cryptocurrency could reach a value of $13 million by 2045, based on the belief that BTC will eventually evolve to reach 7% of the world’s capital.

Moreover, the company’s investments have led to a surge in MicroStrategy’s stock (MSTR), which has more than doubled this year, outperforming the approximately 40% increase in the Bitcoin price over the same period.

Related Reading

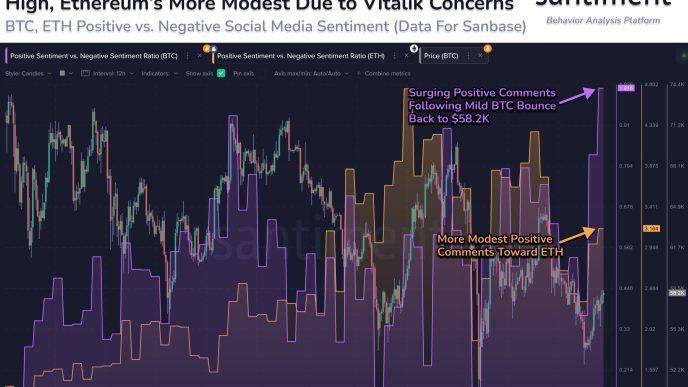

When writing, the BTC is trading at $58,820, up 2.3% in the last 24 hours and over 8% in the last seven days alone. This could potentially signal a continuation of the recovery seen not only in the BTC, but in the broader market, which has managed to endure notable spikes in volatility.

Nevertheless, BTC’s ability to move higher will be determined by its ability or inability to break through its biggest resistance wall to date, which is the 200-day exponential moving average on the daily BTC/USDT chart, marked by the yellow line above, at $59,775.

Featured image from DALL-E, chart from TradingView.com

Source link

Ronaldo Marquez

https://www.newsbtc.com/breaking-news-ticker/microstrategys-largest-bitcoin-order-since-2021-purchases-additional-1-1-billion/

2024-09-13 15:41:02