The meme coin market saw a mixed performance this week, with only a handful of tokens managing to post gains. Most top meme coins ended the week in the red, deepening investor losses.

BeInCrypto has analyzed three meme coins that stood out this week, either for their notable gains or sharp declines.

Mochi (MOCHI)

MOCHI emerged as the top-performing meme coin this week, surging 241% to trade at $0.00004016. The token is holding strong above the critical support level of $0.00003596, maintaining its bullish structure.

If MOCHI sustains support at $0.00003596, the uptrend could continue. The key resistance level stands at $0.00004867, and breaching this barrier could propel the meme coin toward the $0.00006000 mark. This move would reinforce bullish sentiment and drive further investor interest.

However, losing the $0.00003596 support level could trigger a sell-off, sending MOCHI down to $0.00002486. This decline would erase recent gains and invalidate the bullish outlook, potentially leading to increased market volatility for the meme coin.

Toshi (TOSHI)

TOSHI has been closely following MOCHI’s bullish momentum, surging 93% over the past week. Despite the strong rally, the meme coin remains stuck under the $0.00128 resistance, currently trading at $0.00112.

For TOSHI to sustain its uptrend, it must flip $0.00128 into a support level. Successfully doing so could push the token toward its all-time high of $0.00211. Breaching this milestone would reinforce bullish sentiment and signal further price appreciation.

However, if the downtrend resumes, TOSHI could retrace to the $0.00057 support level. Losing this key level would invalidate the bullish outlook, potentially erasing a significant portion of the recent gains and triggering further selling pressure.

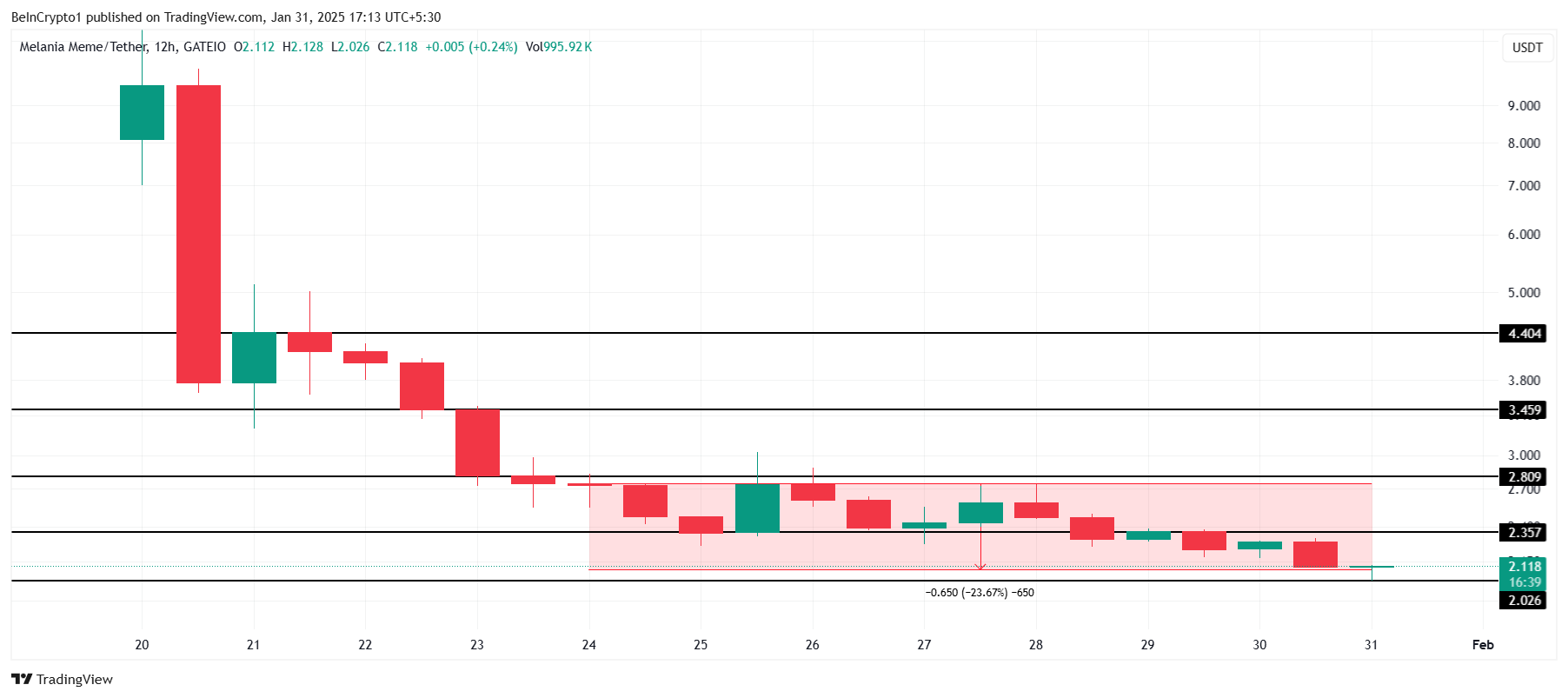

Official Melania Meme (MELANIA)

MELANIA dropped 23% over the past week, currently trading at $2.11. The declining interest in political meme coins has played a major role in the altcoin’s recent drawdown. Without renewed investor enthusiasm, the token may continue struggling to regain momentum.

If MELANIA fails to hold the $2.02 support level, further losses could follow. A drop below $2.00 would expose the altcoin to increased bearish pressure, potentially leading to extended declines.

However, a reversal above $2.35 could invalidate the bearish outlook. If MELANIA breaks past $2.80, bullish momentum may accelerate, pushing the token toward $3.45 and signaling a strong recovery.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/meme-coins-weekly-mochi-toshi-melania/

2025-01-31 15:30:00