This is the first in a series of stories examining the crypto industry’s high-stakes 2024 foray into politics and campaigning.

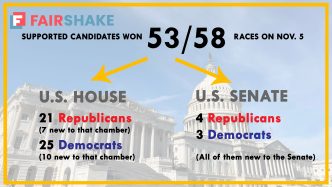

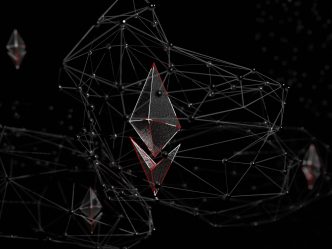

With the last few congressional elections finally called, the score card is in, and the crypto industry’s effort to steer policy with cash has resulted in a 91% success rate in U.S. election battles for the sector’s favored candidates.

Of the 58 races that the industry’s Fairshake political action committee and its affiliates focused on in the elections last month, just five candidates lost. The result: A large segment of the Senate and House of Representatives will have the industry to thank for significant backing — in some cases, money that likely tipped the balance.

In January, they’ll head to Capitol Hill, where a significant block of crypto support has already been digging in — partially thanks to the previous congressional elections in 2022 in which Fairshake’s predecessor, GMI PAC Inc., conducted a similar strategy, though that was significantly smaller.

Congress is famously difficult to wrangle into producing complex legislation, such as the regulation package called for by the U.S. cryptocurrency sector, but the dozens of members potentially closely aligned with the industry could help unstick the crypto bills. President-elect Donald Trump has also promised his executive branch will embrace the financial innovations, putting the two branches into alignment in 2025.

How did the industry get here? Unprecedented campaign contributions and a politically expedient strategy that didn’t wear its crypto enthusiasm openly.

Modern U.S. election laws allow for corporations to spend as much as they’d like to run ads for their chosen candidates, so three of the top names in the industry — Coinbase Inc. (COIN), Ripple Labs and investment firm Andreessen Horowitz (a16z) — piled up the largest mound of cash any single industry devoted to the 2024 elections. It was primarily those three companies putting together the $169 million war chest, with some additional millions added by other firms and individuals.

It marked the boldest corporate incursion into campaign finance since the U.S. Supreme Court’s Citizens United ruling cleared a path for businesses to make unlimited independent ad buys to support or oppose candidates, as long as the activity isn’t directly tied to the campaigns. The Fairshake super PAC and its affiliates — Protect Progress for its Democrat recipients and Defend American Jobs for its Republican spending — focused only on congressional races and not the presidency.

For crypto, the top priority in Washington is the passage of new laws to regulate the space and eliminate questions in the minds of hesitant potential investors. Though that was the case, the industry’s anonymously monikered super PACs refrained from mentioning crypto in the ads they bought to boost or block candidates. The long game wasn’t about winning crypto support in the field, but getting people into Washington who would eventually be on the industry’s side.

“This was an industry — Fairshake, as part of those efforts on the PAC side — that was really running a very smart and strategic and impactful political operation,” said PAC spokesman Josh Vlasto, in an interview with CoinDesk. “That not only paid off on Nov. 5 in terms of what the new Congress is going to look like with, I think, 300 or so pro-crypto members. But now you have an operation that’s really proven its effectiveness going into the next cycle.”

While election night had already made clear last month that the industry had walked away with a substantial number of new congressional friends, it took weeks for all of the races to be ironed out. The final tight battle was in the California 45th Congressional District, where the crypto-favored Republican Michelle Steel lost to Democrat Derek Tran with only several hundred votes separating the two in a district that drew more than 300,000 votes.

Another of its November losses, Representative Lori Chavez-DeRemer, a Republican from Oregon, won Trump’s nod to be the next head of the Department of Labor.

But the two biggest contests occurred at the beginning and end of the election cycle. Fairshake went in guns-blazing in California, spending about $10 million in its Senate primary to smother the campaign of Representative Katie Porter, a Democrat who was allied with the industry’s most hated lawmaker: Senator Elizabeth Warren. The opposition effectively drowned out her campaign.

And more recently, Fairshake declared war in Ohio, pitting more than $40 million against the re-election hopes of Sherrod Brown, the Democratic senator who has been chairman of the Senate Banking Committee as it held the line against crypto legislation. That money — by far the largest block of spending in the state — went to support Bernie Moreno, a blockchain entrepreneur, who took the seat by more than 200,000 votes and helped flip the Senate to a Republican majority.

Those were Fairshake’s most dramatic plays, but its longterm success could come from the dozens of lesser-known races it targeted in the primaries. In many cases, the PAC located a crypto fan from either party in a district in which that candidate’s party was dominant (meaning the primary would really decide the election). Fairshake or its affiliates would often drop more than $1 million into these races to dominate the spending there and smooth the candidate’s path into the general.

In one Arizona district, the PAC put $1.4 million into backing a former vice mayor of Phoenix, Yassamin Ansari, who won her primary by just 42 votes. The crypto campaign-finance effort spent a little more than $70 for each of the votes she won in that primary, but Ansari went on to take the general election with almost 71% support.

Fairshake only funded four losers in the primaries, and the vast majority of its primary winners headed into this month’s general election with low-stress confidence, because they had the right party affiliations to easily win their districts. In some places, though, the PAC spent money pushing crypto-fan incumbents in longer-odds contests, and five of them ended in defeats.

Its success rate neatly illustrated that its tactics were a rapid answer to what had been a deeply tarnished reputation in Washington. Against the odds, the crypto industry emerged from a 2022 disaster in which some of its biggest names foundered and millions of investors lost money.

The effort from Fairshake may have borrowed some lessons from the industry’s previous attempts to woo lawmakers, but it was far more focused. In the previous cycle, when FTX’s Sam Bankman-Fried was at the height of his pre-collapse powers, he and his FTX executives gave money to one in three members of Congress (though in much smaller, direct contributions). This time, the focus was on flexing its unlimited-spend ability in highly targeted matchups where it calculated that the money could make the difference.

Fairshake’s patron companies realized that the overall track record for crypto in the previous election cycles “had been a failure,” Vlasto said. It hadn’t been sufficiently “organized, professional, thoughtful, balanced and focused,” he argued.

He’s the one authorized to speak for the super PAC, because it otherwise shields its strategists from media, and the companies behind it won’t comment on how the organization was given its marching orders or what its ongoing relationship is with donors. At least two of the organizers of GMI returned two years later to help run Fairshake, though the PAC doesn’t disclose its inner workings. Vlasto also splits his duties as spokesman with an even more secretive crypto-pushing organization, the industry’s dark-money Cedar Innovation Foundation, which has gone after the sector’s chief political enemies but won’t identify its backers.

With the election over, crypto lobbying groups in Washington and advocacy organizations such as Stand With Crypto will look to take advantage of the Fairshake momentum and to make sure members of Congress deliver.

“There are other entities and organizations that are there to engage directly with members,” Vlasto said, because that’s not Fairshake’s job. “That constellation of support and network of organizations are going to continue to do what they’ve been doing, and that’s going to be a reality throughout the next Congress.”

Source link

Jesse Hamilton

https://www.coindesk.com/news-analysis/2024/12/02/crypto-cash-fueled-53-members-of-the-next-u-s-congress

2024-12-03 09:00:00