Neiro Coin (NEIRO) has captured the attention of the crypto market, experiencing a whopping 4,608% increase in value within a mere 30 days. The memecoin’s extraordinary 48x return in a single month was a result of its precipitous rise from $0.000039 to $0.002.

Neiro explodes in price in the last month. Source: Coingecko

Despite this dramatic rally, the coin has slowed down its momentum, losing 15% from its peak of $0.0022. Price forecast from CoinCodex still calls for further increases in the future for the cryptocurrency, foreseen to reach 219%, getting up to a price of $0.019284 by November 2024, as traders start wondering if this is only the beginning of a much more massive drop.

In the short term, traders are concerned with whether Neiro’s retracement is temporary or if the memecoin has reached its maximum potential. However, this long-term forecast indicates the possibility of substantial upside.

Retracement Strikes Critical Support

Neiro’s recent drop in price coincided with a daily bullish order block, causing the price to fall to a critical support level—the 23% Fibonacci retracement area—at the time of publication. These levels are essential because they have the potential to provide the necessary support to prevent further declines. The bulls would proceed to the 37% Fib level as their subsequent line of defense if the retracement persists.

Neiro’s stochastic RSI indicates an oversold condition, which suggests a potential rebound. Furthermore, the RSI continues to exceed the neutral 50 level, which serves to bolster the likelihood of a price reversal. If momentum returns, some analysts predict that Neiro could increase to $0.0027, which would be a 20% increase from its current value.

Longs Predominate, But Sentiment Is Neutral

Market sentiment remains neutral, despite the presence of positive technical signals. The Weighed Sentiment is at the median level, which indicates that there is uncertainty regarding whether Neiro will continue to rise or encounter additional selling pressure. The coin’s substantial rally has resulted in a decrease in supply outside of exchanges, which suggests that some investors have taken profits.

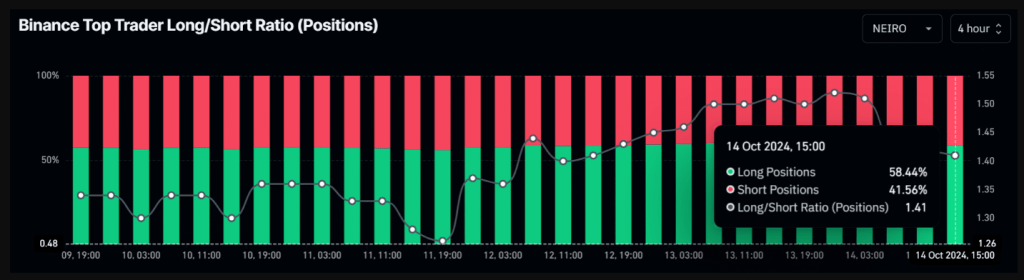

But for the successful traders, there is still a glimmer of hope. Using the Binance Top Trader Long/Short ratio, 58% of traders are still net long on Neiro and thus expect an extended ascent. Traders will be watching above resistance at $0.0027 and support at $0.0017 over the next days to see how the memecoin goes forward.

Over the past month, Neiro has recorded 18 out of 30 green days, or 60%, with a notable price volatility of 26.66%. These factors suggest that now may be an opportune time for potential buyers.

Looking Ahead: Is A Bigger Rally Possible?

As Neiro’s volatility plays out, traders should track important support and resistance levels for now. The next significant movement for this high-flying memecoin might go either way since both technical indicators and market mood give conflicting signals.

Featured image from KuCoin, chart from TradingView

Source link

Christian Encila

https://www.newsbtc.com/news/neiro-coin-blows-up-5540-in-30-days-is-a-crash-imminent/

2024-10-16 03:30:44