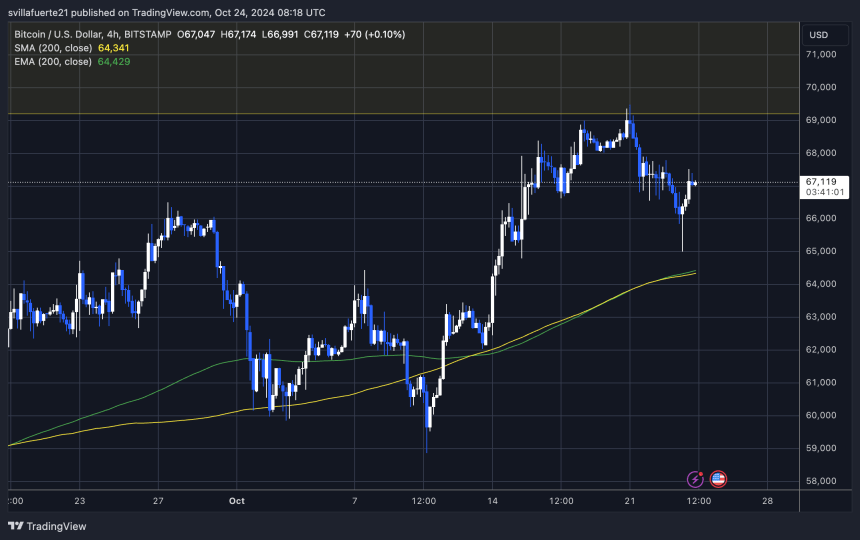

Bitcoin has rebounded strongly from the $65,000 mark after a 6% dip from Monday’s high of around $69,500. Despite the recent pullback, BTC remains in a bullish trend that has been in place since early September. This rebound shows resilience, helping maintain the bullish market structure.

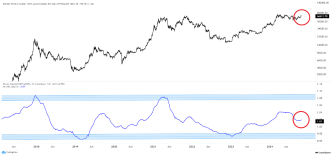

Key data from CryptoQuant reveals that the average funding rate has steadily grown since September, indicating that bullish sentiment is increasing as more traders actively engage in the market.

Related Reading

The coming two weeks will be pivotal for Bitcoin as it approaches March’s all-time high. Investors and analysts closely watch price movements as BTC builds momentum toward breaking key resistance levels.

If the bullish trend continues, Bitcoin could be poised for another significant rally, with the potential to set new highs shortly. However, any failure to hold current levels could bring renewed volatility.

Bitcoin Showing Strength

Despite a recent dip, Bitcoin remains strong above key demand levels, maintaining the overall bullish structure. Analysts and investors are closely monitoring the price action for confirmation that the current phase is simply a bullish consolidation before the next leg up.

CryptoQuant analyst Axel Adler shared data on X, highlighting the BTC futures perpetual funding rate, which has shown steady growth since Bitcoin reached the $60,000 level. This indicates a growing number of bulls entering the market, with optimism rising as the price pushes higher.

Adler suggested that bullish momentum will likely continue as long as this funding rate increases, reinforcing that BTC is in a healthy consolidation phase. However, this doesn’t guarantee an immediate breakout. There is still a significant chance that Bitcoin may trade sideways over the next few days. Sideways price action could be essential for building liquidity, allowing the market to gather strength for a larger move.

Related Reading

While the market sentiment remains optimistic, especially with the ongoing increase in bullish activity, investors should prepare for potential fluctuations. The next major price action could go in either direction, but the steady support above key levels is a positive indicator for those betting on further upside in Bitcoin’s price.

BTC Holding Above Key Demand

Bitcoin is holding strong above the $66,000 level after finding support around $65,000. Currently trading at $67,100, the market seems to be in a consolidation phase, and it may take some time before a breakout above the crucial $70,000 level.

For the bulls to maintain momentum, it’s essential that the price holds above $65,000 or finds support around the $64,300 mark, where both the 4-hour exponential moving average (EMA) and moving average (MA) align.

Related Reading

If Bitcoin fails to maintain these support levels, a deeper correction could be expected, with the price potentially retracing to lower demand zones around $60,000. On the other hand, if BTC manages to break and hold above $70,000 in the coming days, this could trigger a strong rally toward challenging all-time highs.

With investors closely monitoring key support and resistance levels, the next few days will be crucial for determining Bitcoin’s direction.

Featured image from Dall-E, chart from TradingView

Source link

Sebastian Villafuerte

https://www.newsbtc.com/bitcoin-news/number-of-bitcoin-bulls-increases-as-funding-rate-shows-steady-growth-details/

2024-10-24 14:30:44