Bitcoin continues to trade within a tight range, holding above the $94K level while struggling to break past the $100K mark. The long-term outlook remains bullish as BTC maintains key demand levels, but short-term price action remains uncertain. Investors and analysts are closely watching for a breakout, with speculation rising that this period of consolidation is the calm before the storm.

Related Reading

While bulls have defended crucial support levels, they have been unable to push BTC above key resistance, leading to growing frustration in the market. Analysts suggest that an aggressive move in either direction is imminent. Key metrics from Glassnode reveal that the most critical resistance level for Bitcoin is currently at $97,533. This level has acted as a key rejection zone in recent weeks, preventing BTC from reclaiming momentum.

If Bitcoin manages to break and sustain a move above this resistance, it could signal the start of a new uptrend, potentially driving prices toward ATH and beyond. However, failure to do so may lead to continued sideways trading or even another retest of lower demand zones. As market participants await confirmation, Bitcoin remains at a pivotal moment that could define its next major move.

Bitcoin Prepares For An Aggressive Move

Bitcoin has remained in a quiet consolidation below the $100K mark, creating an environment filled with uncertainty and frustration among traders. Price action remains range-bound, fluctuating between $94K and $100K without any clear direction. Analysts continue to speculate about the next move, with most agreeing that an aggressive breakout is inevitable. However, the major question remains—will it be a bullish surge into price discovery or a selloff into lower demand levels?

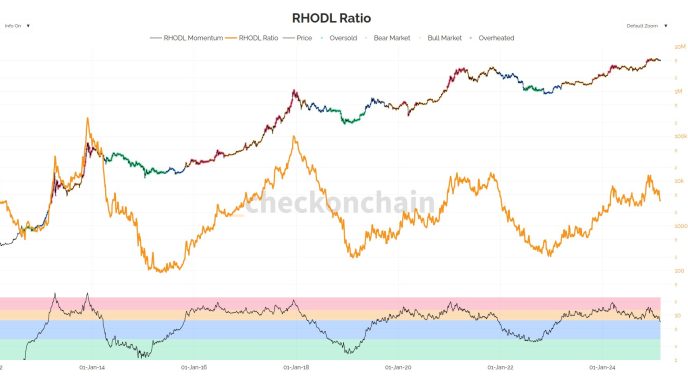

Top analyst Ali Martinez shared Glassnode data on X, revealing that the most critical resistance level for Bitcoin is currently at $97,533. This level has repeatedly acted as a barrier, preventing bulls from regaining control. Martinez suggests that a sustained breakout above this level could signal further upside, potentially paving the way for a move toward the $100K psychological barrier.

Investor sentiment is mixed, with some expecting Bitcoin to reclaim momentum and push past ATH, while others remain cautious due to the prolonged consolidation and weakening volatility. Historically, extended periods of low volatility often precede major price moves, but the market remains divided on which direction BTC will take.

For now, Bitcoin continues to trade within a tight range, and investors eagerly await confirmation of the next major trend.

Related Reading

BTC Price Action Details

Bitcoin is trading at $97,300, attempting to reclaim key moving averages that could define its short-term direction. The 4-hour 200 exponential moving average (EMA) at $98K and the 200 moving average (MA) at $100K serve as critical resistance levels that bulls must overcome to confirm an uptrend. If Bitcoin breaks above these levels and holds them as support, it could ignite a massive rally toward new highs.

However, uncertainty still dominates the market as BTC struggles to sustain bullish momentum. Investors are closely watching whether the price can break through these resistance zones or if another rejection will occur. A failed attempt to push above the $98K-$100K range could result in increased selling pressure, leading BTC into lower demand zones around $91K.

Related Reading

Despite the cautious sentiment, Bitcoin’s long-term structure remains bullish as it continues to hold above key support levels. The coming days will be crucial as traders look for confirmation of either a breakout or a potential retracement. If BTC manages to reclaim these key moving averages, confidence could return to the market, fueling further upside momentum. Until then, Bitcoin remains in a critical consolidation phase, awaiting its next decisive move.

Featured image from Dall-E, chart from TradingView

Source link

Sebastian Villafuerte

https://www.newsbtc.com/bitcoin-news/on-chain-metrics-reveal-the-most-critical-resistance-for-bitcoin-can-btc-break-97-5k/

2025-02-20 17:00:27