Onyxcoin (XCN) is down over 45% in the last 30 days, following a historic surge at the end of January. After being one of the most trending altcoins earlier this year, XCN is now showing signs of cooling off.

Both momentum and trend indicators point to weakening bearish pressure, suggesting that a shift could be forming. Here’s a look at the technical outlook and what could come next for Onyxcoin.

XCN RSI Has Been Neutral For One Week

Onyxcoin’s RSI is currently at 41.7, down from a peak of 55.6 three days ago.

The RSI has remained in a neutral zone for the past week, fluctuating between 41 and 55, without showing a strong bullish or bearish trend.

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements, ranging from 0 to 100.

Readings above 70 typically indicate overbought conditions, while readings below 30 suggest oversold conditions. With XCN’s RSI now at 41.7, it suggests mild bearish pressure but not enough to confirm an oversold market.

This could indicate that XCN is in a consolidation phase, and traders may be waiting for a stronger directional signal before committing to a trend.

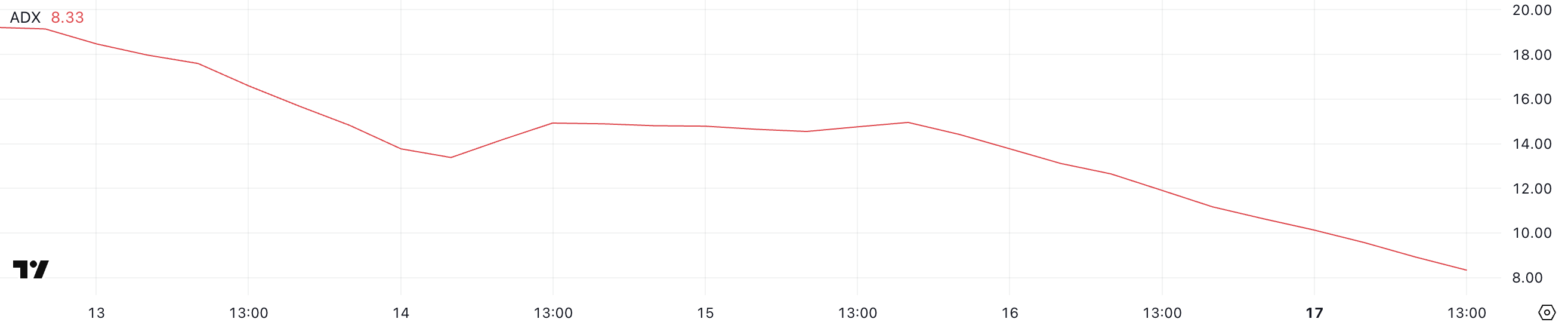

Onyxcoin ADX Shows The Current Downtrend Is Fading Away

Onyxcoin’s ADX is currently at 8.33, dropping from 14.7 just two days ago.

This sharp decline signals a further weakening of trend strength as the token remains in a downtrend but with reduced momentum behind the move.

The Average Directional Index (ADX) measures the strength of a trend, regardless of its direction. Values above 25 indicate a strong trend, and values below 20 point to a weak or non-trending market.

With XCN’s ADX now at 8.33, this suggests that the ongoing downtrend is losing steam. The price could remain range-bound or experience smaller movements until momentum returns.

Without a pickup in ADX, traders may see continued sideways or choppy price action in the short term.

Will Onyxcoin Reclaim $0.020 In March?

Despite being one of the most trending altcoins in 2025, Onyxcoin price has corrected by 42% over the past 30 days.

If this downtrend continues, XCN could retest the key support at $0.01. A breakdown below this level would mark the first time the token has fallen below $0.01 since January 17, before its major surge earlier this year.

However, as indicated by the weakening ADX, the current downtrend is losing strength, potentially opening the door for a rebound.

If Onyxcoin regains momentum, it could challenge the resistance at $0.0149, and a breakout could push the price toward $0.017. Should Onyxcoin recover its strong bullish trend from late January, it could rise as high as $0.022, breaking above $0.02 for the first time since March 3.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Tiago Amaral

https://beincrypto.com/onyxcoin-xcn-downtrend-fades-potential-rebound/

2025-03-18 03:00:00