Onyxcoin (XCN) has been trading in a tight range, causing concern among potential investors as the altcoin struggles to break out. Market uncertainty has led some traders to exit their positions.

However, a key group of long-term holders remains steadfast, preventing a catastrophic crash.

XCN Investors Are Spooked

XCN’s network growth has declined significantly, hitting a monthly low. This metric reflects the number of new addresses interacting with the network. A consistent drop in this figure signals waning investor interest, making it harder for the cryptocurrency to regain momentum.

A lack of new participants reduces overall liquidity and weakens buying pressure. Without fresh capital inflows, the asset risks extended stagnation or decline. This shift in sentiment suggests that the crypto asset is struggling to attract new investors, which could hinder its long-term growth prospects.

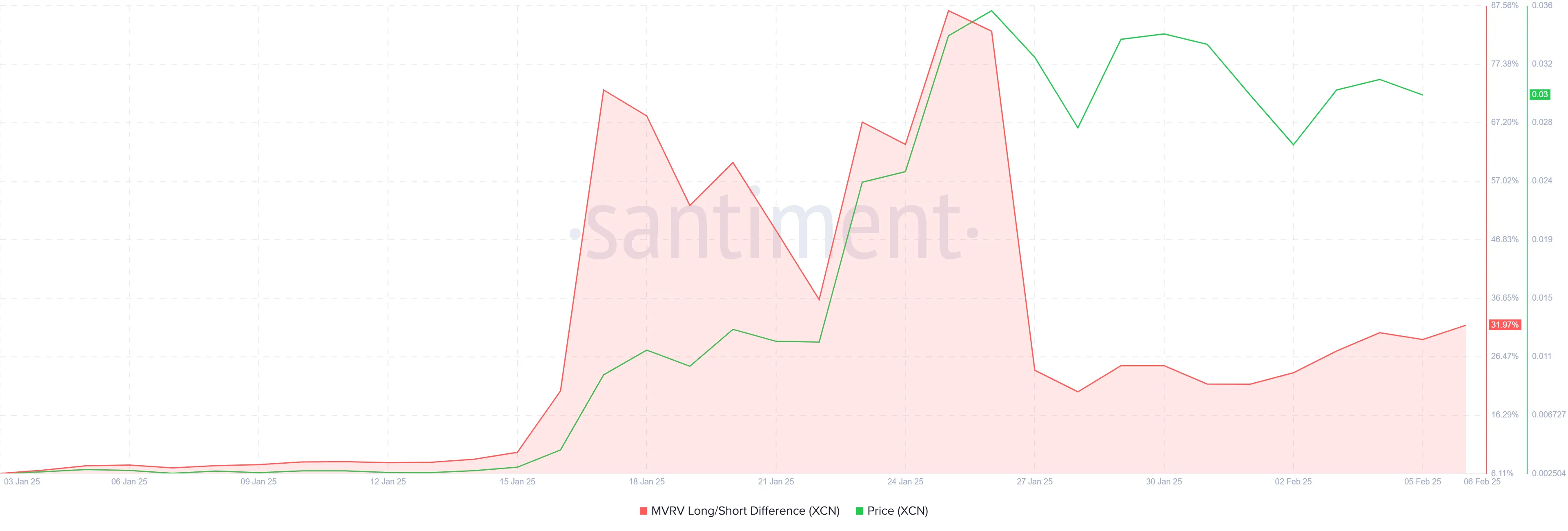

Despite weak network growth, XCN’s long-term holders (LTHs) remain in profit, as indicated by the MVRV Long/Short Difference. This metric highlights the profitability of various investor groups. With LTHs holding firm, the altcoin has managed to maintain key price levels, preventing a steep drop.

LTHs play a crucial role in maintaining market stability. Their reluctance to sell minimizes extreme volatility. By holding onto their investments, they are helping to prevent XCN from sliding into a bearish spiral, maintaining a level of confidence in the market.

XCN Price Prediction: Breaching The Barrier

XCN is currently trading at $0.0303, holding above the critical support of $0.0237 while facing resistance at $0.0358. For the asset to resume an uptrend, a breakout beyond this range is necessary. Without this movement, the altcoin risks prolonged consolidation.

The conflicting market signals could keep XCN in its current trading zone. If the asset fails to defend $0.0237, a downside break could trigger a sharp 66% decline, pushing the price down to $0.0100. The multiple tests of this support level indicate vulnerability, increasing the likelihood of such a scenario.

Conversely, if XCN breaches $0.0358, it could rally toward $0.0500. This move would invalidate the bearish outlook and open the door for further gains. A sustained uptrend beyond this threshold could restore investor confidence and attract new market participants, potentially reversing the current negative sentiment.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/xcn-price-struggles-as-new-investors-exit/

2025-02-06 08:00:00