HodlX Guest Post Submit Your Post

AI is one of the most powerful, disruptive industries since the internet.

But with increasing centralization and monopolistic control of companies like OpenAI, it’s moving in a dangerous direction away from the grassroots.

Per McKinsey’s study in early 2024, about 72% of businesses are using AI in at least some capacity. And 65% of them are using generative AI.

Source: McKinsey

Companies like OpenAI are at the forefront of this adoption, with their products like GPT-4o being used across businesses and industry verticals.

This raises the critical question is OpenAI too big to fail?

Given AI’s rapid expansion and increasing adoption in key industries, the scale and influence of for-profit corporations like OpenAI pose risks of excessive dependence, power concentration and system failure.

If this continues, extractive business models could become the norm in AI, as in Web 2.0 overall.

Building functional, user-centric frameworks to offset the rising power of legacy AI companies is the way out.

The stakes are high very high

It might seem far-fetched doom calling to the short-sighted. But the problematic implications of letting OpenAI or similar companies become unchallenged monopolies are visible in many other areas all around us.

The thing is that OpenAI’s influence or dominance isn’t merely because they built cutting-edge AI models like GPT-4o.

Widespread integration with critical industries from healthcare to education and finance also plays a huge role here.

As such, a large number of businesses rely on OpenAI’s tech for essential functions. Any disruption or failure on the company’s part could result in massive collateral damage.

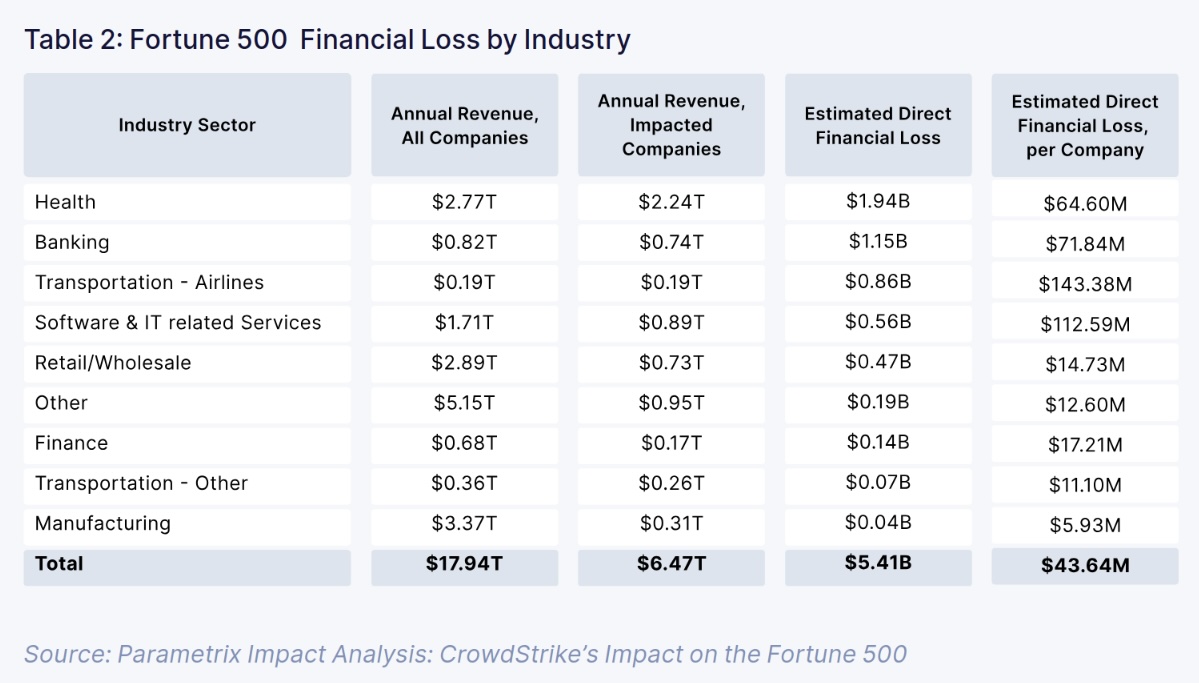

The recent Microsoft outage is a glaring example, where Fortune 500 companies suffered over $5 billion in direct losses across industries.

Source: Parametrix

Besides financial losses, the incident disrupted global aviation, with 2,217 flights delayed in the US alone, which affected over 3.7 million domestic and international passengers.

Nine-one-one was down in several states. Banks went offline.

The world came to a standstill for a considerable amount of time. That’s the danger of excessive dependence on one or a few centralized entities.

They become so big, that their collapse can bring down many others if not everything else.

The issue is even more pronounced with AI, as the impact of centralization extends beyond the possibility of operational disruptions.

For example, if attackers somehow poison GPT-4o or any other OpenAI model, over 200 million users could get biased or malicious responses to their queries.

Moreover, given the push to leverage AI for strategic decision-making, as well as the increasing popularity of election betting, etc., on AI-powered platforms, monopolization could have broad social impacts, albeit negative ones.

In the context of governance, influence over the regulatory landscape is the other concerning aspect with OpenAI’s unilateral dominance.

As a first mover and market leader, it can set the tone for competition and the standards for innovation.

Building the bottom-up AI paradigm

Centralization and top-down production/business models is the reason why ‘too big to fail’ is an issue.

Thus, to eliminate the crisis for good, it’s important to establish a bottom-up alternative.

Since no single entity or group can control or hijack these systems, companies and service providers can grow without putting the ecosystem at risk.

The idea is to build a decentralized dependence and resource network for AI, where all stakeholders depend on each other in some capacity.

Everyone gains, but no one rules that’s the power of Web 3.0-powered AI.

The use of blockchain and other decentralized ledger technologies, for instance, can democratize ownership of the AI stack at every level model, data and applications.

Communities, rather than this-or-that company, can own and control AI’s evolution in this setup.

Moreover, the immutability and verifiability of blockchain can help tackle bias and manipulation in AI, which are some of the main pain points with legacy, monopolistic AI.

Likewise, AI tools can help democratize access to Web 3.0 and significantly improve the user experience.

From personalized financial services to non-custodial query response, combining AI with Web 3.0 can pave the way to building full-fledged alternatives to traditional AI tools.

Functional, user-friendly tools are already helping non-native users onboard Web 3.0 and experience AI in a completely new light once here.

The non-extractive, community-led paradigm for AI is becoming a reality sooner than it seemed likely a year or two ago.

Although the AI industry owes its current popularity and recent growth to OpenAI, championing emerging alternatives is mission-critical o keep the corporation’s influence in check, if not anything else.

In the Web 2.0 era, internet users and communities didn’t have the tools to claim their stake either on the value generated or on the tech stack.

AI users, however, still have the opportunity to do so, thanks to Web 3.0 innovations.

It’s now or never in this sense, because once OpenAI or its peers become too big to fail, they’d be irreplaceable for all practical purposes.

This is the time to claim AI for the community and for grassroots users, not giant corporations.

Krystal Zhang is the co-founder of Owlto Finance, which is one of the fastest-growing bridges with over two million users in more than 200 countries/regions. Krystal graduated from the Chinese University of Hong Kong and previously worked in PwC and HTX.

Follow Us on Twitter Facebook Telegram

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

Krystal Zhang

https://dailyhodl.com/2024/09/10/openai-isnt-too-big-to-fail-yet-users-can-still-own-ai/

2024-09-10 17:59:20