In a dramatic turn of events, the Bitcoin price has breached the $64,000 threshold again after a 7.7% increase from a low of $59,400 in four days. This sudden price jump has sent shockwaves through the crypto market, with data from Coinglass revealing a significant wave of liquidations following the unexpected rally. Short sellers, who were anticipating a decline, found themselves in a tough spot as Bitcoin defied their expectations.

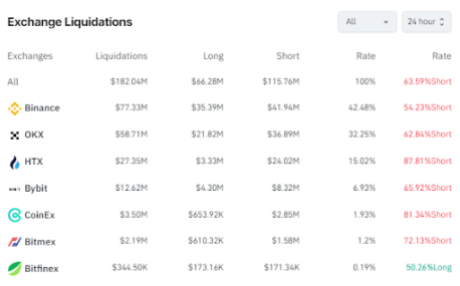

Notably, liquidation data from Coinglass shows that over $182 million worth of positions have been liquidated across various exchanges in the past 24 hours, with a majority being short positions.

Bitcoin Price Breaks Above $64,000 Again

Bitcoin rose above $64,000 in the early hours of Monday, October 14, after breaking above a tight range over the weekend and gaining 2.53% in the past 24 hours. Bitcoin reached as high as $64,500 in the past few hours, which is its highest point so far in October. As such, the Bitcoin price has now crossed above its open for the month, with the October monthly return finally turning green for the first time.

Related Reading

The price action, however, wasn’t as positive for everyone. According to the data shown in the picture below, the sudden rise has been costly for many traders holding short positions. Bears who bet on a continued decline were hit hard as Bitcoin’s continued rally triggered a wave of liquidations.

Of the $182 million worth of liquidations recorded across various exchanges, a staggering $115.76 million came from short positions, while $66.28 million were from long positions.

Binance has led the crypto exchange market in liquidations over the past 24 hours, accounting for 42.48% of the total liquidations. On Binance alone, approximately $77.33 million worth of positions were wiped out, with 54.23% being short positions. OKX follows closely, with $58.71 million in liquidations, where an even larger percentage of 62.84% were short positions.

HTX, Bybit, and CoinEx also saw significant liquidations, though on a smaller scale. HTX recorded $27.35 million in liquidations, a staggering 87.81% of which were short positions. Bybit came next with $12.62 million in liquidations and a short rate of 65.92%, while CoinEx rounded out the list with $3.50 million liquidated, 81.34% of which was from shorts.

Related Reading

More Liquidations Ahead?

Bitcoin’s recent uptick brings back the possibility of a declining Uptober sentiment. This interesting rally could set the stage for a surge in the second half of October, similar to what was witnessed in September.

If this rally were to continue for the rest of the month, we could see more short positions liquidated in the next few hours. Bears, who have been betting against Bitcoin’s rise, may rush to close their positions to minimize losses. The decrease in selling pressure from short sellers exiting the market could further fuel Bitcoin’s ascent.

Featured image created with Dall.E, chart from Tradingview.com

Source link

Scott Matherson

https://www.newsbtc.com/news/bitcoin/182-million-bitcoin-price-64000/

2024-10-14 14:00:13