Crypto markets will witness over $2.5 billion worth of Bitcoin (BTC) and Ethereum (ETH) options expire today.

Traders are particularly attentive to this event because it has the potential to influence short-term trends through the volume of contracts due for expiry and their notional value. Examining the put-to-call ratios and maximum pain points can provide insights into traders’ expectations and possible market directions.

Bitcoin and Ethereum Options Expiring Today

The notional value of today’s expiring BTC options is $2.23 billion. According to Deribit’s data, these 27,657 expiring Bitcoin options have a put-to-call ratio of 0.86. This ratio suggests a prevalence of purchase options (calls) over sales options (puts).

The data also reveals that the maximum pain point for these expiring options is $81,000. In crypto options trading, the maximum pain point is the price at which most contracts expire worthless. Here, the asset will cause the greatest number of holders’ financial losses.

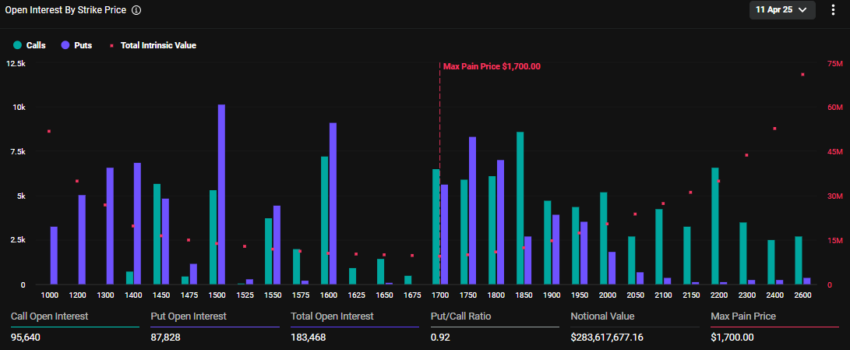

In addition to Bitcoin options, 183,468 Ethereum contracts are set to expire today. These expiring options have a notional value of $283.6 million and a put-to-call ratio of 0.92. The maximum pain point is $1,700.

The current market prices for Bitcoin and Ethereum are below their respective maximum pain points. BTC is trading at $80,622, while ETH sits at $1,543.

“With recent market volatility and ongoing tariff developments, how do you think these expiries will impact price action?” Deribit posed.

Deribit is a crypto options and futures exchange. Indeed, crypto markets are reeling from massive volatility induced by the trade war chaos following President Trump’s tariffs. Meanwhile, Cardano founder Charles Hoskinson says future tariffs will be ineffective on crypto.

He thinks that tariffs are already priced and that future announcements will be a ‘dud’ for the crypto market.

Traders Brace for Extended Weakness as Call Premium Fades Until September

Elsewhere, analysts at Deribit note a shift in crypto options, with short-term dips still bringing put demand. Meanwhile, the call premium is further out of the curve and fades.

“You now have to look all the way to September before calls retake the skew. Traders might be bracing for extended weakness,” Deribit noted.

This suggests traders might be bracing for extended weakness in the crypto market. A fading call premium, where the implied volatility (IV) of calls drops relative to puts, suggests that traders are less optimistic about price increases in the near to medium term.

A negative or reverse volatility skew, where OTM puts ((out-of-the-money puts) have higher IV than OTM calls ((out-of-the-money calls), is common in equity markets when investors fear price drops.

This pattern appears to play out in the crypto options market, reflecting heightened concerns about downside risks. Analysts at Greeks.live note that BTC’s IV has declined significantly and is now largely holding nearly 50% across all maturities.

On the other hand, ETH’s IV has maintained a higher level, with short to medium-term volatility holding near 80%. Selling ETH options in the short term would be a good trade for traders.

Global economic uncertainty, including the US-China tariff war, has dampened risk appetite. Crypto’s inherent volatility could also be fueling this cautious outlook.

“Sentiment was more panicky this week, with Trump’s frequent switching of tariff policies making the market extremely risk averse,” analysts at Greeks.live wrote.

The Greeks.live analysts agree with Deribit’s expectations of extended weakness. However, unlike Hoskinson, they expect continued uncertainty and volatility in the market for a long time.

For traders, this suggests a need for hedging strategies, like buying puts or diversifying into stablecoins.

“Cryptocurrencies are currently suffering from a lack of new incoming money, a lack of new narratives, and a more subdued investor sentiment. In this worse market of bulls to bears, the probability of a black swan will be significantly higher, and buying some deep vanilla puts would be a good choice,” Greeks.live analysts concluded.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Lockridge Okoth

https://beincrypto.com/bitcoin-ethereum-options-expiry-impact/

2025-04-11 06:41:14