PancakeSwap (CAKE) has increased 40% in the last 24 hours, and its revenues have climbed to $19 million over the past seven days, behind only Tether, Circle, and Jupiter.

The recent price surge comes as bullish technical signals continue to build. CAKE’s RSI has reached its highest level since 2023, while Ichimoku Cloud and EMA indicators point to further upside potential. Here’s what’s behind CAKE’s rally and the key levels to watch next.

PancakeSwap RSI Has Surged To Its Highest Levels Since 2023

CAKE’s RSI is currently at 89.6, up sharply from 25.1 just one week ago, marking its highest level since November 2023.

This significant increase suggests strong recent buying pressure, pushing the momentum indicator into extreme territory.

The Relative Strength Index (RSI) is a widely used momentum oscillator that measures the speed and magnitude of recent price changes.

It ranges from 0 to 100, with readings above 70 generally considered overbought and readings below 30 seen as oversold.

CAKE’s RSI of 89.6 signals that the token is deep in overbought territory. This could suggest that the price is at risk of a short-term correction as traders might start locking in profits.

However, during strong bullish trends, assets can remain overbought for extended periods before reversing.

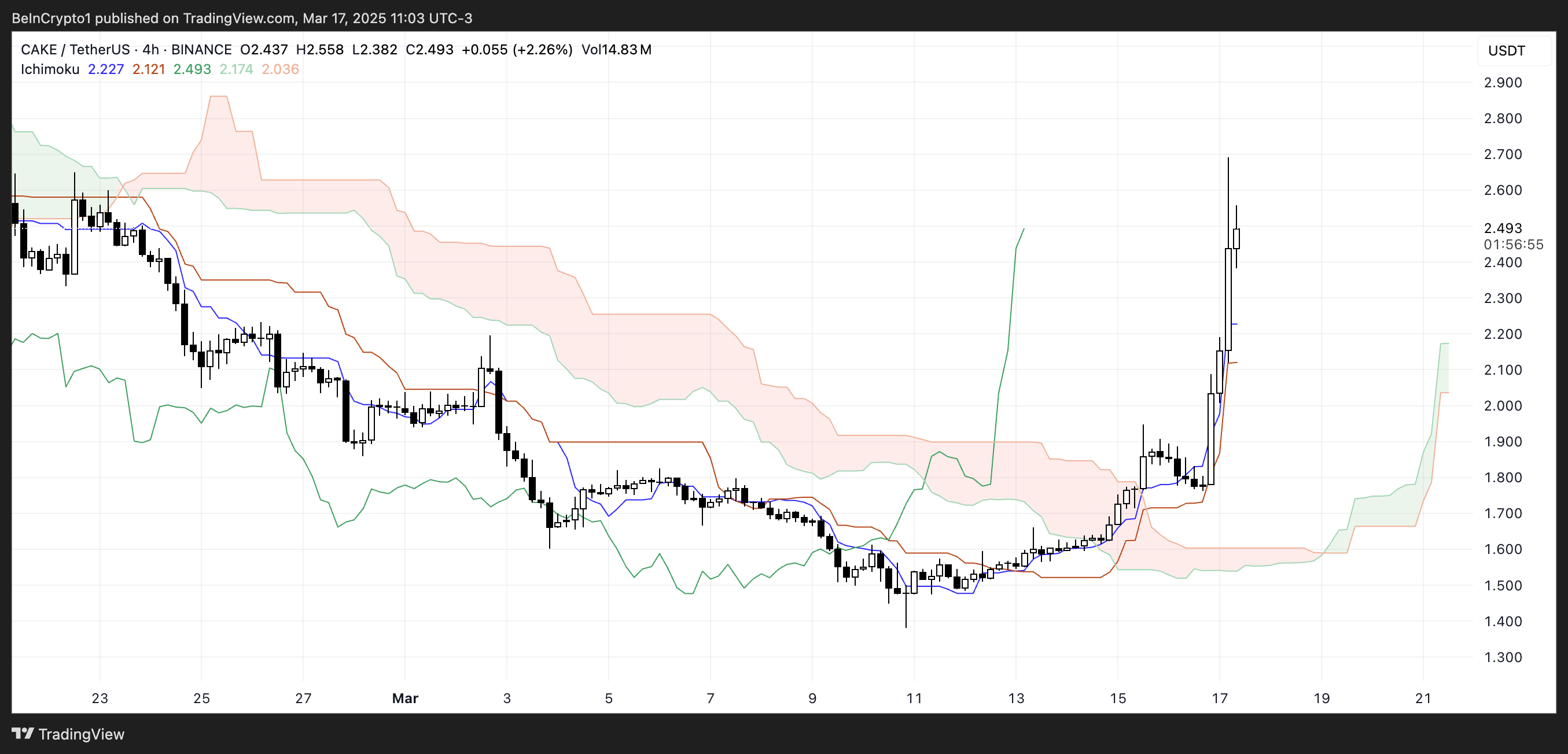

Ichimoku Cloud Shows A Strong Bullish Setup

CAKE has broken decisively above the Ichimoku Cloud on the chart, marking a strong shift to a bullish trend.

The Tenkan-sen (blue line) has crossed above the Kijun-sen (red line), a classic bullish signal, while the price remains well above both lines, confirming strong momentum.

The future cloud has turned green, indicating that bullish sentiment could extend in the coming sessions.

However, with the price now significantly distanced from the cloud and the support of the Tenkan-sen, a short-term correction or consolidation could occur before further upside.

CAKE Could Rise Above $3 Soon

CAKE’s EMA lines are showing signs that a golden cross could form soon, indicating a potential shift to a sustained bullish trend as the BNB ecosystem continues to attract attention.

If this crossover takes place, it could provide the momentum needed for CAKE to test the resistance at $2.65. A breakout above this level could open the door for further gains, with the next key targets at $2.95 and $3.41.

However, if the uptrend fails to hold and the momentum fades, despite PancakeSwap still being the most dominant DEX in the BNB chain, CAKE could retrace toward the support at $2.33.

A break below this level may accelerate the correction, with additional downside risk toward $1.85 and potentially $1.38.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Tiago Amaral

https://beincrypto.com/pancakeswap-cake-soars-weekly-revenue-jumps/

2025-03-17 22:30:00