PEPE has continued its downward trajectory, hitting a six-month low of $0.00000670. The meme coin’s sustained losses have significantly eroded investor confidence, leading even uncertain holders to pull back.

The extended drawdown has created a challenging environment, with sentiment remaining overwhelmingly bearish.

PEPE Investors Are Losing Hopes

Short-term holders (STHs) have exited the market over the past month. Their participation has dropped from 11.5% to 7%, a 4.5% decline that reflects the growing reluctance to engage with PEPE at current price levels.

The prolonged downtrend has discouraged traders, as any recent investments have resulted in losses.

Typically, a low STH presence can be seen as a stabilizing factor, reducing volatility. However, this case highlights rising pessimism among PEPE investors.

The absence of new inflows and the reluctance of holders to re-enter suggest that sentiment remains fragile, further delaying any potential recovery.

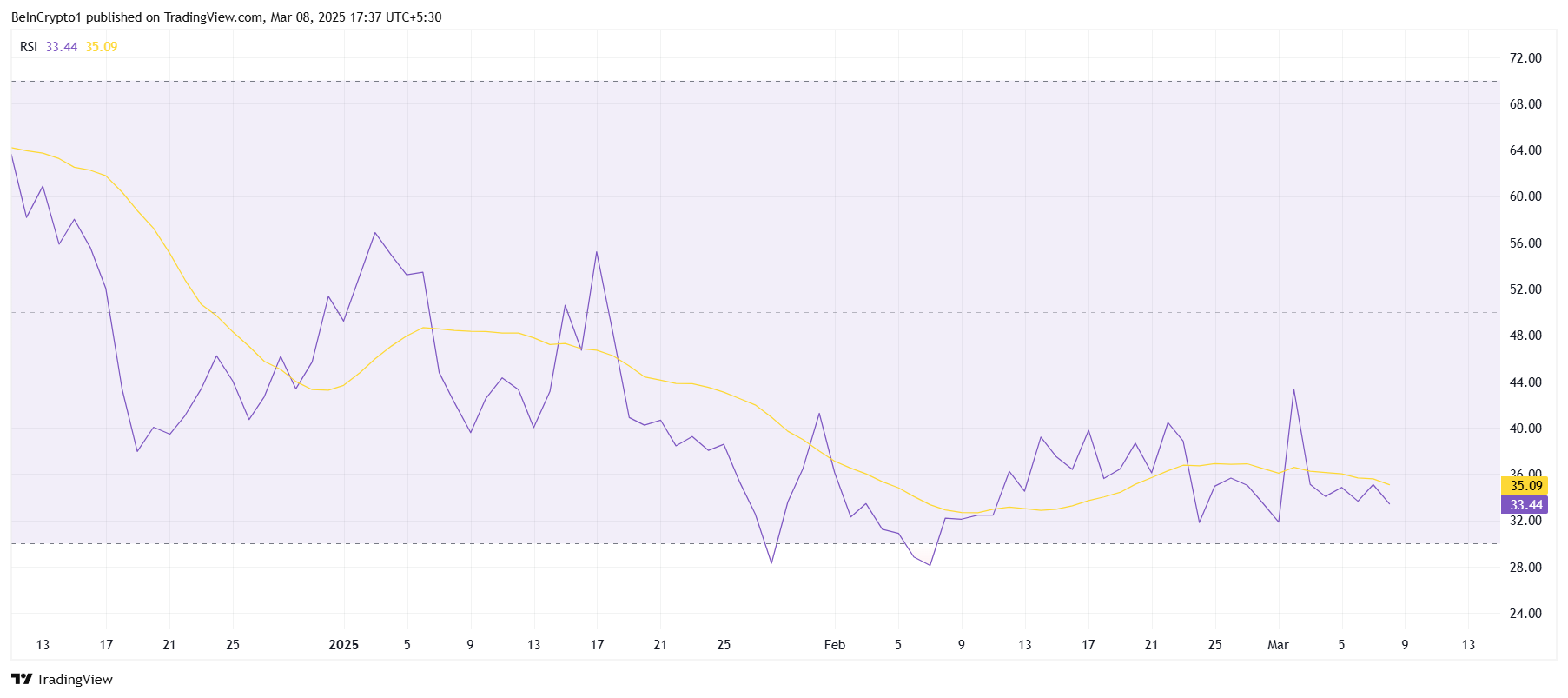

PEPE’s macro momentum remains weak, with technical indicators signaling persistent bearish conditions. The Relative Strength Index (RSI) has remained stuck in the bearish zone for over a month, indicating continued selling pressure.

The lack of upward momentum suggests that recovery remains unlikely in the near term.

Additionally, worsening broader market conditions have exacerbated PEPE’s decline. Without a shift in macroeconomic or crypto market trends, the meme coin could remain under pressure. Until key resistance levels are breached, bearish dominance is expected to persist.

The PEPE Downtrend Continues

PEPE’s price has fallen to $0.00000670, holding above the critical support of $0.00000632. Sitting at a six-month low, the meme coin’s four-month-long downtrend shows no signs of reversal. If bearish pressure continues, PEPE could lose its support and sink further.

A breach of $0.00000632 would likely result in PEPE falling below $0.00000600. This could extend losses further, pushing the price toward the next support at $0.00000587. Without a strong reversal, PEPE may continue its downward trajectory, deepening investor losses.

The only way to invalidate this bearish outlook is if PEPE reclaims the crucial resistance of $0.00000951 as support. A successful breakout above this level would increase the chances of the meme coin returning to $0.00001000.

However, before this can happen, PEPE must first breach $0.00000718 and $0.00000839, both acting as key resistance levels on the way to recovery.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/pepe-continues-multi-month-downtrend/

2025-03-08 14:30:00