Pepe (PEPE) may be vulnerable to further price declines, despite an increase in whale accumulation. This potential drop underscores the disconnect between large holders’ activity and broader market sentiment.

As the meme coin faces growing pressure, this on-chain analysis explores the sustainability of its current price levels and assesses its short-term outlook.

Whales Buy Pepe, Then Pause

Data from Glassnode reveals that PEPE’s large holders’ netflow has surged by 108% over the past seven days. Netflow measures the difference between tokens accumulated by crypto whales and those distributed.

A negative netflow signals more distribution than accumulation, while a rise suggests increased accumulation. However, in PEPE’s case, the situation is somewhat different.

Although whales initially bought a substantial amount of the meme coin, accumulation stalled around September 13. Since then, there has been little increase in tokens purchased by large holders. As a result, PEPE’s price may struggle to avoid a significant decline.

Read more: 5 Best Pepe (PEPE) Wallets for Beginners and Experienced Users

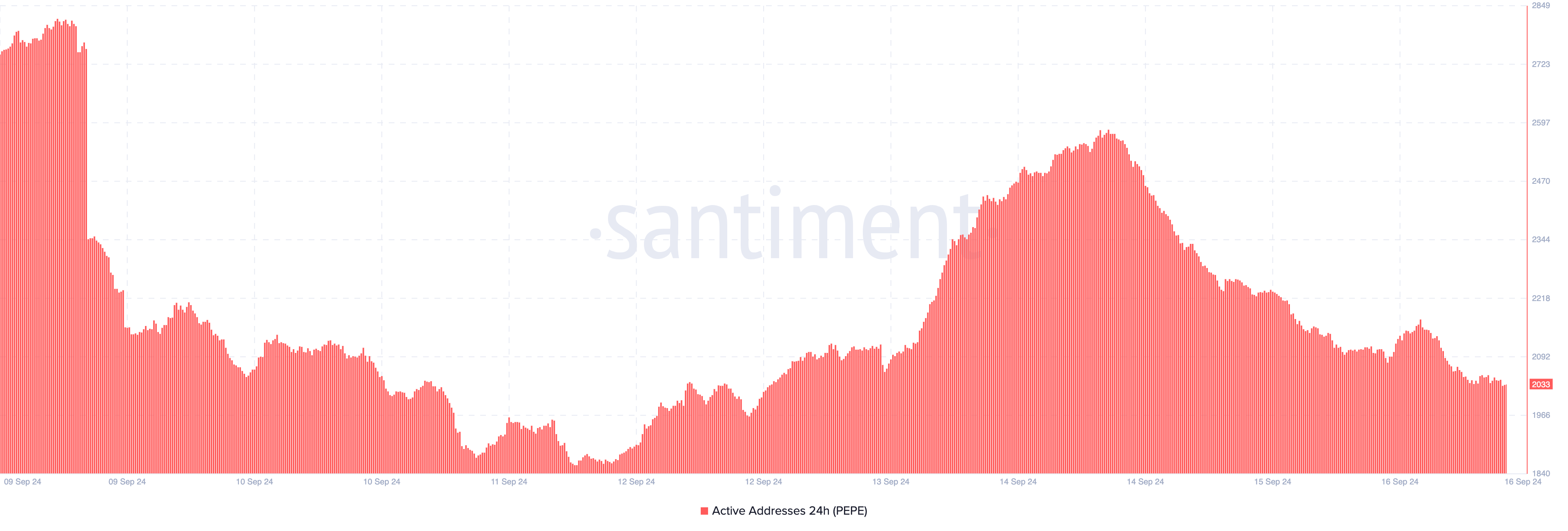

In addition to whale activity, Pepe’s active addresses also support the bearish outlook. Active addresses reflect user engagement with a cryptocurrency; an increase generally signals strong interaction and is typically bullish.

However, a decline in active addresses suggests reduced traction and lower demand. For PEPE, the number of active addresses has dropped significantly since peaking on September 14, further reinforcing the bearish sentiment.

PEPE Price Prediction: $0.0000060 Looms

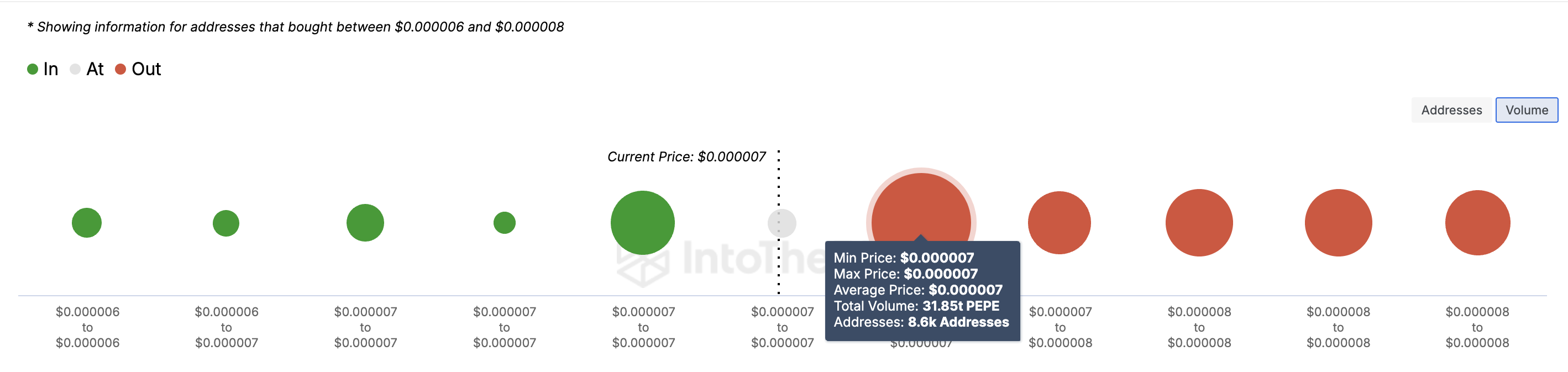

Currently, PEPE’s price sits at $0.0000071, down 31% over the last 90 days. From an on-chain perspective, the In/Out of Money Around Price (IOMAP) indicator reveals that the meme coin faces resistance near the current price, with 8,600 addresses holding over 31 trillion tokens.

The IOMAP helps identify key support and resistance levels by grouping addresses based on profitability. A higher volume of tokens in a profitable range typically acts as support. Conversely, when a large volume is “out of the money,” it becomes a resistance zone.

In PEPE’s case, the volume held below $0.0000069 is unlikely to offer strong support. If holders at the resistance zone sell, the price could face a further correction.

Read more: Pepe (PEPE) Price Prediction 2024/2025/2030

If PEPE faces a correction, the next level it could drop to is around $0.0000060. However, if demand surges enough to break through the current resistance, this bearish prediction might be invalidated. In that scenario, PEPE’s price could rally toward $0.000010.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/crypto-whales-cannot-prevent-pepe-price-crash/

2024-09-16 20:00:00