Pi Coin has faced a tumultuous period following its mainnet launch last week. After the launch, the altcoin suffered a massive crash, losing 99% of its value in just four days.

While it has shown signs of recovery, the damage remains significant, and the token still struggles to regain lost ground.

Pi Coin Has Some Challenges Ahead

The Chaikin Money Flow (CMF) indicator has shown a dramatic fluctuation in Pi Coin’s market sentiment over the past week. Investors sold heavily following the mainnet launch, causing the CMF to drop. However, others took advantage of the low prices, causing a sharp spike in inflows.

This is evident in the spike in the indicator. Despite these inflows, a true bullish confirmation will occur when the CMF crosses the zero line, signaling sustained positive momentum and investor confidence in Pi Coin’s recovery.

Pi Coin’s recovery is still in its early stages, with the market sentiment showing mixed signals. The volume of inflows indicates some investors believe in the altcoin’s potential, but the indicator’s failure to consistently stay above the zero line suggests that the bullish momentum is not yet fully established. The token will need to see consistent buying pressure for the price to build momentum and for investor confidence to stabilize.

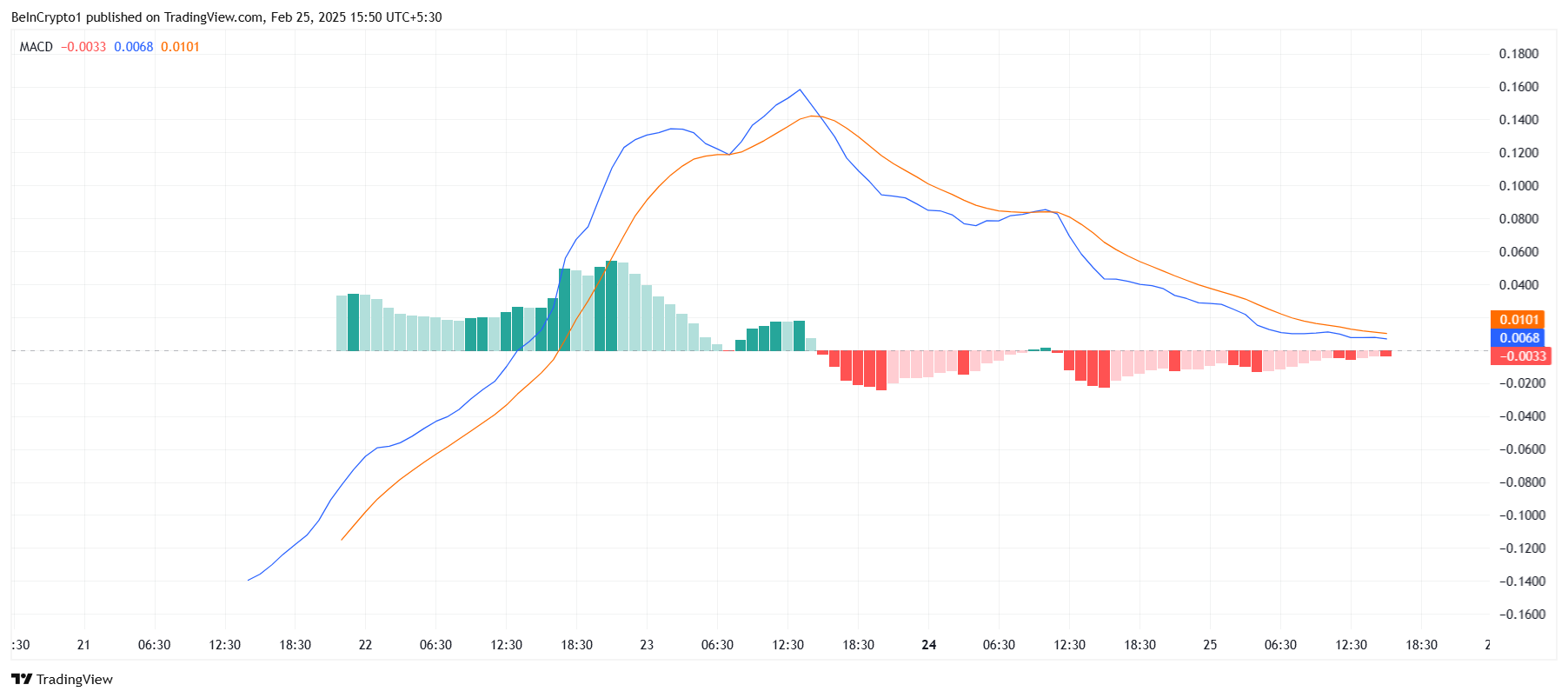

Pi Coin is also facing strong macro headwinds in the form of a bearish crossover. The Moving Average Convergence Divergence (MACD) has been observing a bearish crossover over the past 36 hours, which typically signals that further downward price action is likely.

The market is under pressure, and Pi Coin’s price action reflects these broader trends. However, if the gradual recovery remains persistent and Pi Coin manages to generate a stronger interest among investors to boost the inflows, the altcoin could witness a bullish crossover. This would signal potential recovery ahead, confirmed by the bars on the histogram flipping above the neutral line.

Pi Coin Price Recovery May Take A While

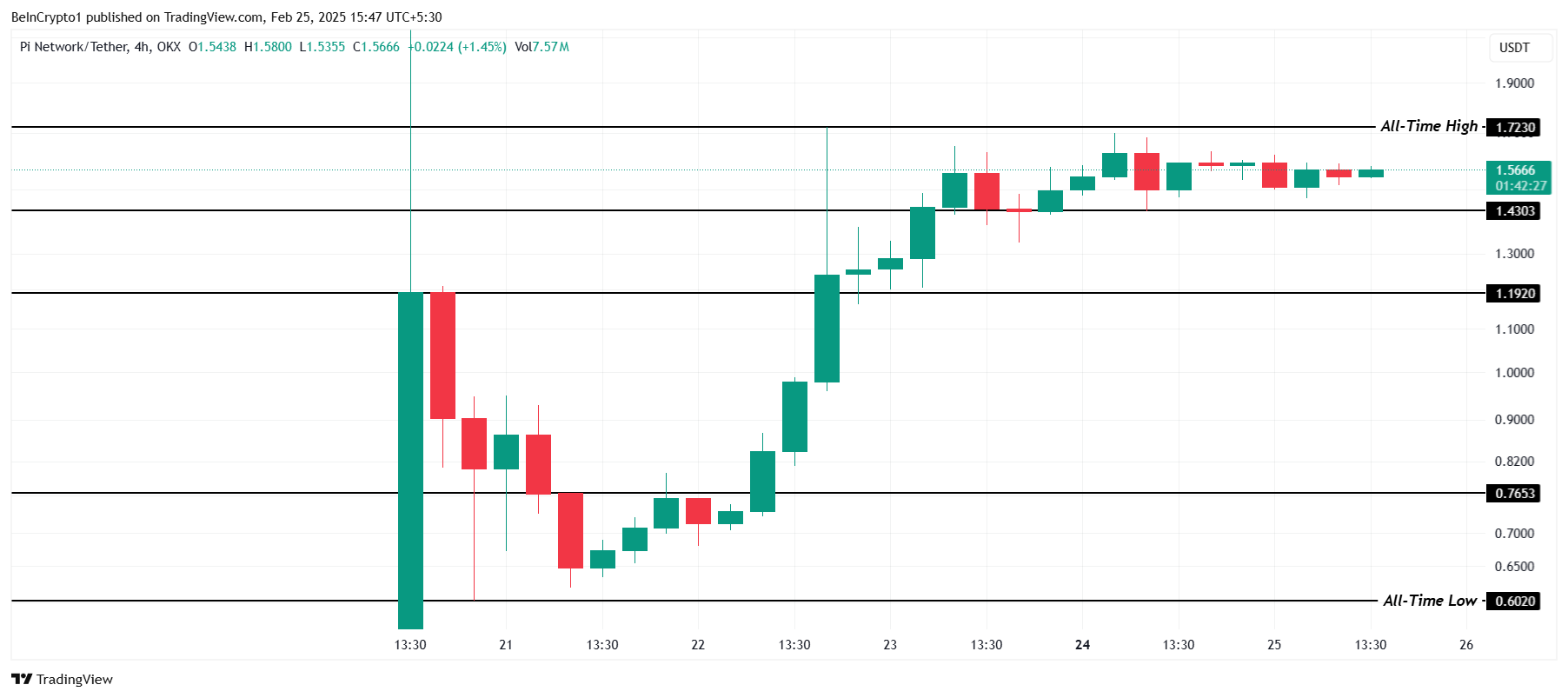

At the time of writing, Pi Coin is trading at $1.56 after a 116% bounce over the weekend. Despite this brief recovery, the prevailing bearish signals point to the possibility of further decline. While the altcoin did chart an all-time high (ATH) of $1.72, it is closer to the support of $1.43.

Given the current market outlook and the technical indicators, it is likely to fall through this support soon and slip towards the support of $1.19. If not, the altcoin could continue to consolidate under $1.72, facing persistent downward pressure from both the bearish crossover and broader market negativity.

For Pi Coin to actually break out, it would need stronger support from the investors, a breach of the $1.72 barrier, a move to $2.00 and higher, and continued formation of new ATHs. This would be a significant turnaround and invalidate the current bearish outlook.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/pi-coin-price-aims-new-all-time-high/

2025-02-25 14:30:00