Pi Network (PI) dropped by another 9% on Friday, adding to its recent bearish momentum. The decline comes after Justin Bons called the project a potential “scam,” fueling negative sentiment.

Technical indicators like BBTrend and RSI are also pointing to sustained downside pressure. As the price struggles below $1, traders are watching to see if PI can stabilize or if further losses are ahead.

Pi Network BBTrend Reached Its Lowest Levels Ever

Pi Network’s BBTrend is currently at -40.69, marking its lowest reading on record and staying negative for the past five days. T

The BBTrend, or Bollinger Band Trend, is an indicator that measures trend direction and strength based on price movement relative to Bollinger Bands.

Positive values typically indicate bullish momentum, while negative values suggest bearish momentum, with extreme values often signaling strong trends.

With Pi Network’s BBTrend sitting deeply in negative territory, it points to sustained bearish momentum.

This could suggest that sellers are firmly in control, and the asset may continue to face downward pressure unless a sharp reversal occurs.

A prolonged negative BBTrend like this often signals that the market is in a strong downtrend, and traders may remain cautious until signs of stabilization or a positive shift appear.

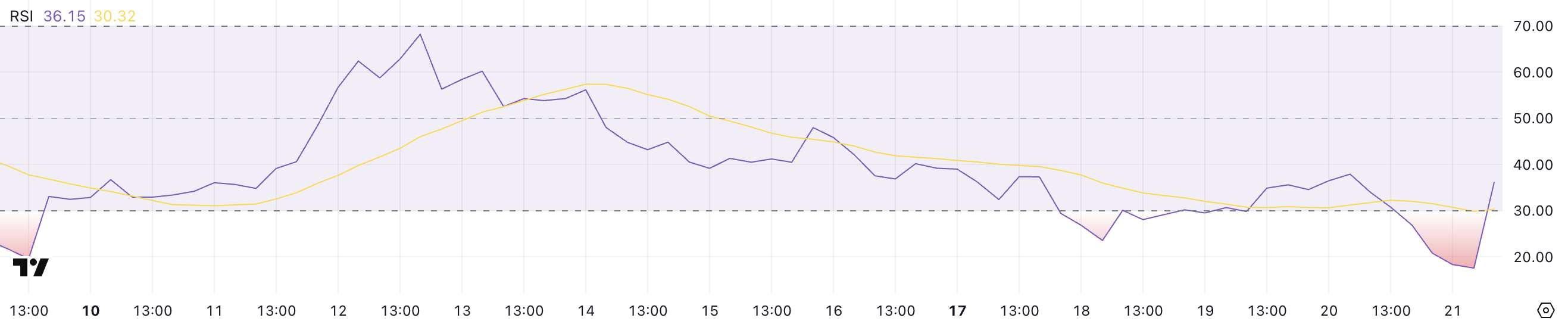

Pi Network RSI Is Recovering After Touching Oversold Levels

Pi Network’s RSI has rebounded to 36.15 after dropping as low as 17.5 just a few hours ago, showing a slight recovery in momentum.

The Relative Strength Index (RSI) is a momentum indicator that measures the speed and change of price movements. Values above 70 indicate overbought conditions, and values below 30 suggest an asset is oversold.

Pi Network’s RSI is now just above 36, moving out of the oversold zone but remaining in bearish territory.

This could imply that while some buying pressure has returned, the overall trend is still weak. Further upside will depend on whether the RSI continues to climb.

If the RSI fails to move higher, Pi Network may remain vulnerable to additional corrections.

Will PI Fall Below $0.90?

Pi Network has recently dropped below the $1 level for the first time since February 22 as bearish momentum builds. This decline comes as Justin Bons recently exposed Pi Network’s flaws, raising concerns and calling the project a potential “scam.”

If the correction deepens, PI price could test key support zones around $0.81 and possibly $0.62.

However, if Pi Network manages to regain strength despite the criticism, it could push toward resistance at $1.23.

A strong rebound could open the door for a move toward $1.79, but sentiment remains fragile following Bons’ claims and the recent price breakdown.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Tiago Amaral

https://beincrypto.com/pi-network-sentiment-worsens-amid-criticism/

2025-03-22 02:00:00