Pi Network’s price has faced a significant downturn recently, dropping 23% over the past week to $1.38. This decline highlights the weak market conditions that have continually eroded the altcoin’s gains.

As investor confidence dwindles, many are pulling out, leaving the future of Pi Network increasingly uncertain.

Pi Network Is Losing Investors’ Confidence

The Chaikin Money Flow (CMF) has remained firmly in the bearish zone for the past several days, signaling that outflows are dominating the market. More investors are pulling their funds out of Pi Network, likely driven by rising concerns over potential losses.

With inflows remaining low, there is little hope for a reversal, and the sentiment surrounding the token continues to weaken. The outflows signal that investor confidence is faltering, leading to a bleak outlook for the altcoin in the short term.

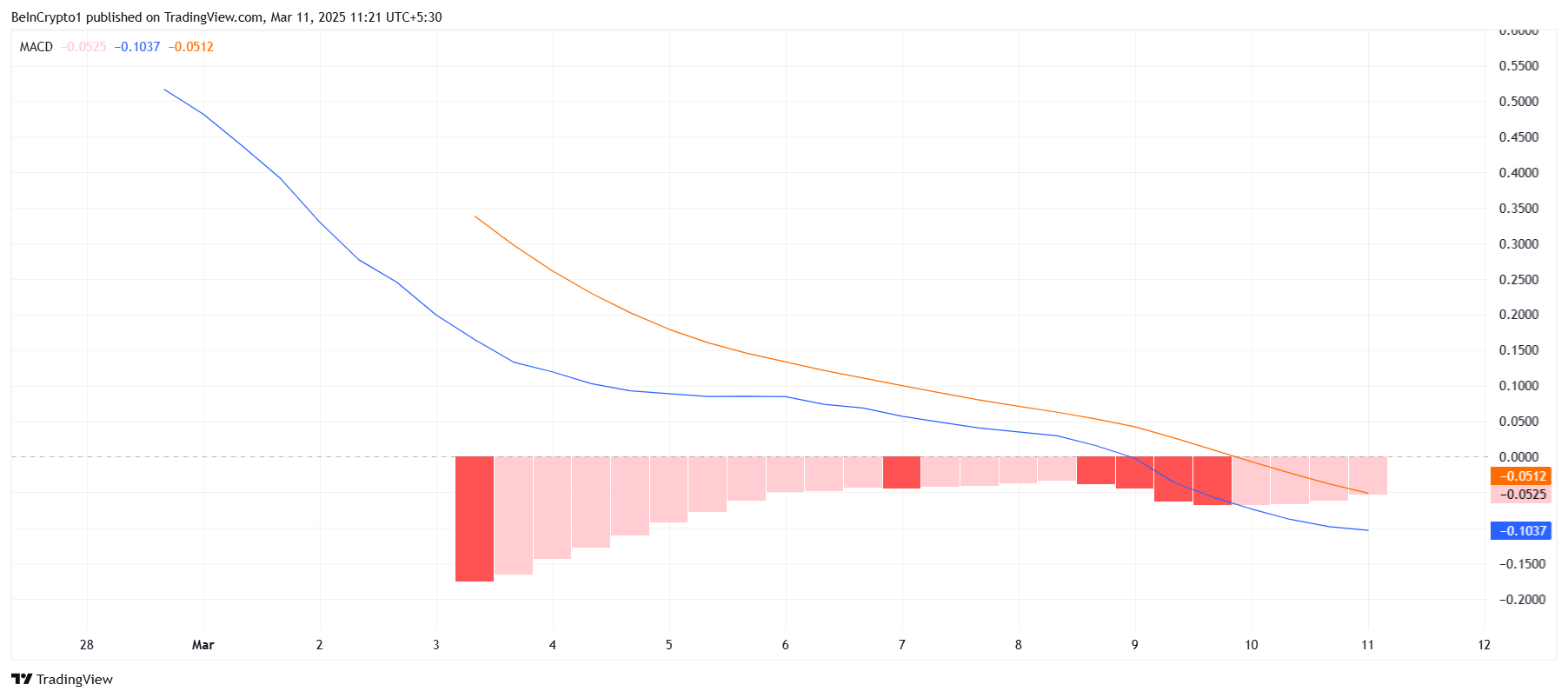

Pi Network’s overall macro momentum remains under pressure, largely due to the bearish trends in the broader cryptocurrency market. The Moving Average Convergence Divergence (MACD) indicator shows consistent red bars on its histogram, signaling bearish momentum.

The broader market’s negative cues are preventing Pi Network from gaining traction despite occasional hype around the token. The MACD’s continued bearish signal is a warning for investors, indicating that the altcoin may face more challenges ahead before any potential recovery.

PI Price Is Struggling

Pi Network’s price has been on a downward trajectory, falling by 23% over the past week and trading at $1.38. Currently stuck under the resistance level of $1.43, the chances of recovery appear low. Unless there is a major change in market conditions, the price is likely to remain under pressure.

With the current bearish outlook, Pi Network may struggle to hold onto the critical support level of $1.19. If this support breaks, the token could see further declines, potentially dropping below $1.00. This could lead to a dramatic fall toward the $0.76 mark, extending the ongoing losses for the token.

On the other hand, if Pi Network can capitalize on the attention it continues to receive, there is a possibility of reclaiming the $1.43 barrier. Flipping this resistance level into support could allow the altcoin to recover to $1.64, potentially invalidating the bearish outlook and signaling a trend reversal. However, this would require significant momentum and investor confidence to materialize.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/pi-network-suffers-weak-investors/

2025-03-11 07:30:00